FILS 2022: Deferral times priority for consolidated tape plans – EC’s Lueder

Plans for a consolidated tape for fixed income markets in Europe hinge on the “urgent priority” of harmonising post-trade publication windows – keeping them...

Regulators to take tougher line on green bonds

Green bonds have become popular in recent years but the lack of transparency over how proceeds are invested has made some investors nervous. This...

CME Group: Expectation of rates rises for BoE in December 2021 and Fed in...

The CME Group’s central bank observations tools BoEWatch and FedWatch show that market expectations indicate increasing probability of a Bank of England rate rise...

Tradeweb sees credit default swap volume double in March

Tradeweb has reported total trading volume for March 2022 of US$28.2 trillion, with US$811 billion in credit default swaps, up from US$330 billion in...

US regulators battle to define bond market structure

US market regulator the Securities and Exchange Commission (SEC) has engaged in a series of initiatives that could collectively bring more structure and standardisation...

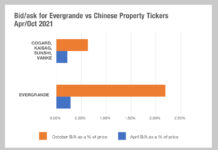

China Focus: The secondary effect of defaults

The bid-ask spread for bonds in China’ property market has expanded by 300% this year, although even more so for Evergrande which increased by...

The burgeoning portfolio trading business

Electronic portfolio trading offers an efficient execution channel for baskets of bonds, but Lynn Strongin Dodds finds there are several barriers to growth.

Portfolio trading...

Buy side wants new tools in primary market tsunami

Several buy-side traders report new primary bond market tools could come online this year in the US, with dealer consortium DirectBooks expected to step...

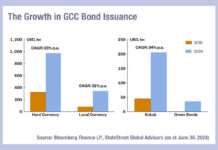

Key trends in emerging markets debt issuance in 2024

Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for...

Brian Hickey joins LedgerEdge as firm deepens bench

Brian Hickey, a veteran buy-side trader with a long tenure at State Street Global Advisors (SGGA), has joined bond market and distributed ledger specialist,...

Margin calls for bitcoin futures pose systemic threat

AIG failed in 2008, because the value it placed upon the mortgages underpinning the credit default swaps it had sold to Goldman Sachs was...

MeTheMoneyShow – Episode 25 (Brexit, Covid-19 and other challenges)

Dan Barnes and Lynn Strongin Dodds discuss the latest on the Brexit saga, the implications of a Biden victory in the US Presidential election,...