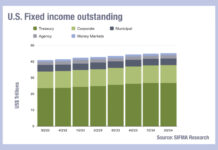

Money markets begin to tail off as rates fall

Reviewing the second quarter activity in primary markets and fund flows, we see the total notional outstanding in US fixed income totalled US$45.3 trillion,...

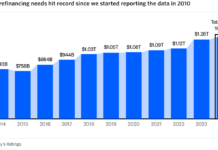

Moody’s: Short-term refinancing to grow in 2025

A report from rating agency Moody’s, has found that the proportion of US non-financial investment-grade corporate bonds needing refinancing within five years has grown...

Schleifer: “Explosive growth” for desktop interoperability as Finsemble goes solo

Cosaic is spinning off its desktop interoperability platform, Finsemble, following the sale of its Chart IQ to S&P Global, as a new company. The...

Buy side issues framework to standardise bond issuance

The Credit Roundtable, a buy-side lobby group for bondholder protection has issued an ‘Investment Grade Primary Best Practices Framework’ designed to improve bond issuance.

The...

Reviewing 2022: European credit trading costs have doubled

There have been an enormous number of factors shaking up bond trading this year. From fixed income fundamentals like rapidly rising interest rates from...

IHS Markit publishing new CRITR US dollar funding rate

Information, analytics and solution provider, IHS Markit, is now publishing a series of forward-looking dynamic term rates that measure the daily US Dollar (USD)...

Overbond launches buy-side model for spotting mispriced bonds

Overbond has added a ‘rich-cheap’ model to its suite of AI fixed income analytics, designed to help buy-side desks generate systematic returns. Combining both...

Science vs. art: Where TCA adds value in fixed income

Picking the right transaction cost analysis methodology might improve best execution, but qualitative assessment must balance the quantitative, writes Flora McFarlane.

MiFID II obliges buy-side...

A third of US buy-side bond traders see dealer connectivity as priority

Research published by data, analytics and trading systems provider, IHS Markit, has found that 33% of buy-side fixed income traders are assessing direct connecting...

Greenwich: Nearly half of bond trading desk budgets now spent on technology

New research by Coalition Greenwich has found that the proportion of budget for fixed income trading desks spent on technology grew to 46% in...

Re-designing the fixed income landscape

Benjamin Bécar, Fixed Income Product Manager at smartTrade Technologies believes that growing access to data is enabling buy-side firms to transform their trading workflow...

LSEG integrates CanDeal pricing into Canadian fixed income indexes

CanDeal Data & Analytics (CanDeal DNA), the provider of Canadian data and information services, has expanded its relationship with LSEG businesses, FTSE Russell and...