The use of private versus public borrowing by corporations has changed during 2024, based on falling funding costs in public and the capacity to fund complex capital structures in private. This has effects on both costs of debt and covenants needed.

A recent report by Morgan Stanley strategists Joyce Jiang, Vishwanath Tirupattur, Vishwas Patkar and Anlin Zhang found, “Among the largest direct lending deals taken out by public loans, many names had public market presence – either at the time of refi or in the past, e.g. they opted for private financing during the hiking cycle. Many refinanced the privately placed second lien loans. Among the broadly syndicated loan deals refinanced in private, a number of them were lowly rated and pushed out maturities by tapping into private credit.”

At the same time spreads on newly originated direct lending deals continued to decline to 529 basis points as of third quarter 2024 down from 585 basis points at the start of the year.

“The spread pickup vs public loans got squeezed due to the heightened competition between the two markets,” the analysts noted. “Direct lending loans offered 140bp on top of the prevailing spreads for single B public loans in Q1 2024, but the premium had come down to 90bp as of Q3.”

The spread compression in the third quarter was led by lower middle market deals; while the first half of 20204 had the most pronounced spread decline in “upper middle-market segment” which faced greater competition with the public market.

“In 3Q, the competition spilled over to the lower middle-market segment as well. Spreads compressed the most within the sub-$20m EBITDA bucket, with demand outstripping supply.”

Switching from public to private has an impact on covenants, as S&P Global’s analyst team recently reported.

“For 22 entities that moved from BSL to private credit, we reviewed select provisions from their respective credit agreements from the two markets,” wrote credit analysts Ramki Muthukrishnan, Omkar Athalekar and Evangelos Savaides. “These loans are now held in middle market CLOs that private credit managers issue and we rate. In addition to the financial maintenance covenants, the other provisions we reviewed included EBITDA definitions and guardrails around asset transfer. We noted that of the 17 syndicated loan market credit agreements, which were covenant-lite previously, eight required a financial maintenance covenant on moving to the private credit market, indicating the relative negotiating strength of private lenders. The covenant was for the most part leverage – debt to EBITDA – and, in the remaining cases, fixed-charge coverage.”

EBITDA definition in these credit agreements can include restructuring charges, acquisition costs, transaction expenses, stock compensation expenses, severance costs, earn-outs, losses from discontinued operations, and often also allow for cost savings and synergies that an issuer can expect to realise in the event of mergers and acquisitions, or buyouts.

“More aggressive credit agreements don’t cap the addbacks, providing borrowers with unbounded flexibility to add back anticipated synergies and cost savings,” they wrote. “Over and above calculation for financial maintenance purposes, EBITDA is also used in the calculation of incurrence ratios and to set capacities under various other negative covenants.”

Having reviewed the majority of credit agreements for which S&P Global provided credit estimates in 2023, the team found more than 90% had some form of financial maintenance covenant, the most common being leverage-based.

“When a second financial maintenance covenant was present, it was a fixed-charge coverage ratio,” they wrote. “Lenders likely want to keep a pulse on a company’s ability to service fixed costs, especially when benchmark rates are at a 15-year high. For many distressed issuers, lenders also want to keep track of cash balances and ensure issuers proactively address liquidity concerns. Consequently, liquidity covenants were tested monthly or bi-weekly. These lenders typically require the submission of 13-week cash flow projections.”

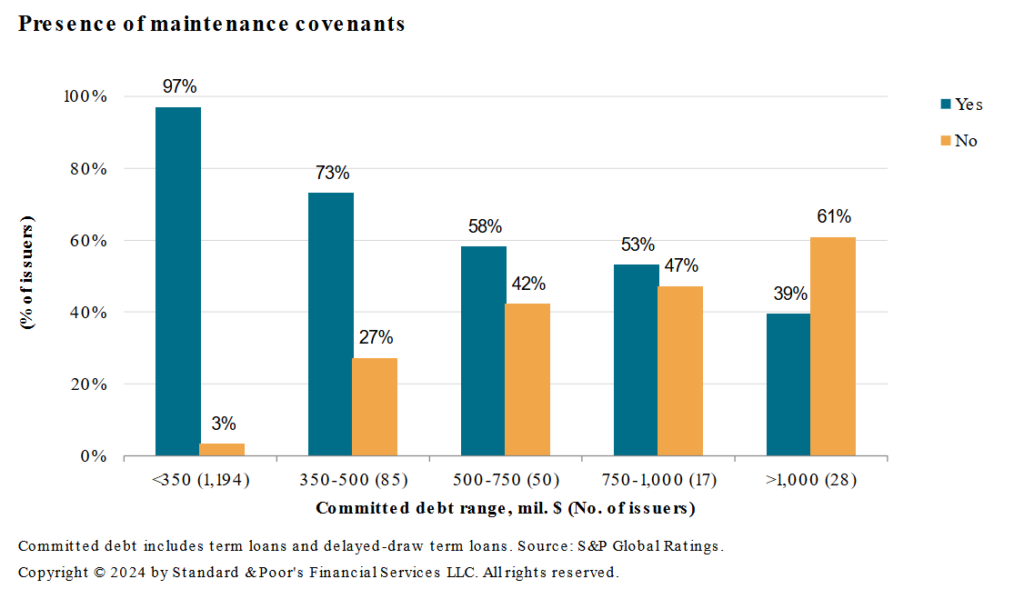

The inclusion of maintenance covenants is found in 95% of cases up to US$350 million at which point they decline gradually, with deals over US$1 billion only having covenants in 39% of cases, less than 10% across all deals.

While private credit dovetails with some parts of public markets, supporting liquidity when banks withdraw from the broadly syndicated loan market for example, it also offers a competitive alternative for issuers and investors, the Morgan Stanley team note by offering speed and certainty in execution; term flexibility; a close working relationship with borrowers; and limited ratings requirement.