Borrowing costs for the German government spiked after an announcement of increased expenditure for its military, triggering a sell-off in German government bonds (bunds) on Wednesday, following into Thursday across the wider market.

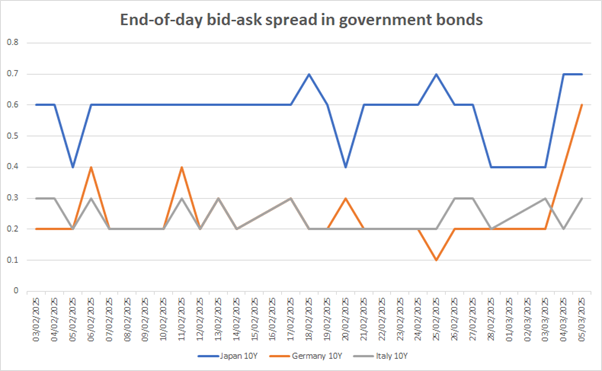

Bid-ask spreads in 10-year bunds blew out as a result of the sell-off, with the mid-point jumping from 0.2 basis points to 0.6 basis as dealers priced in the much harder risk of finding a buyer of positions they took on for clients, according to Tradeweb data. By comparison Italian 10-year government bonds (BTP) remained rangebound between 0.2-0.3 basis points, as they have done since February

Japanese 10-year government bonds (JGBs) have been more volatile since February with the mid-point bouncing between 0.4 – 0.7 basis points since mid-February, and jumping straight from 0.4 to 0.7 where it stuck for two days for the first time over the past month.

Traders reported the market was still orderly if volatile, during the sell-off. Automated quoting was still active across the street suggesting there were few issues despite the higher cost of liquidity.

ESTR swaps are pricing in a 97% expected interest rate cuts at the ECB March meeting, with a 54% chance of a cut in April and a 63% likelihood in June.

©Markets Media Europe 2025