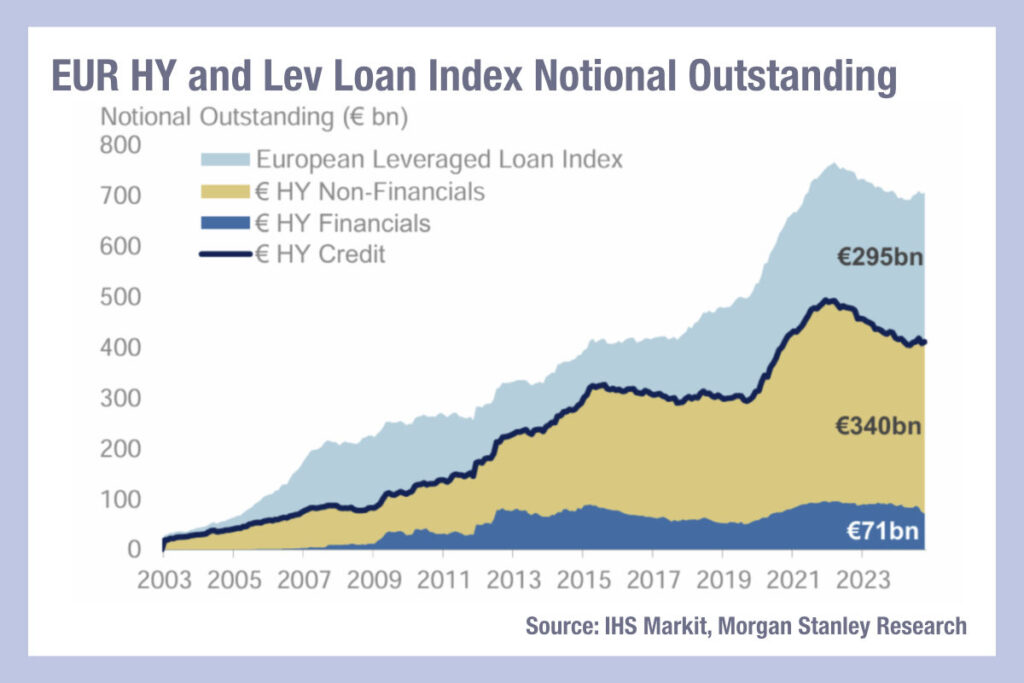

Europe has seen considerable growth in credit issuance this year relative to 2023, with last week finding a 116% year-on-year increase in non-financial high yield issuance and a 25% increase in investment grade (IG) non-financial issuance, according to data from Bond Radar, S&P and Morgan Stanley.

For Euro-denominated credit specifically, the numbers are 101% for non-financials HY and 25% for non-financials IG.

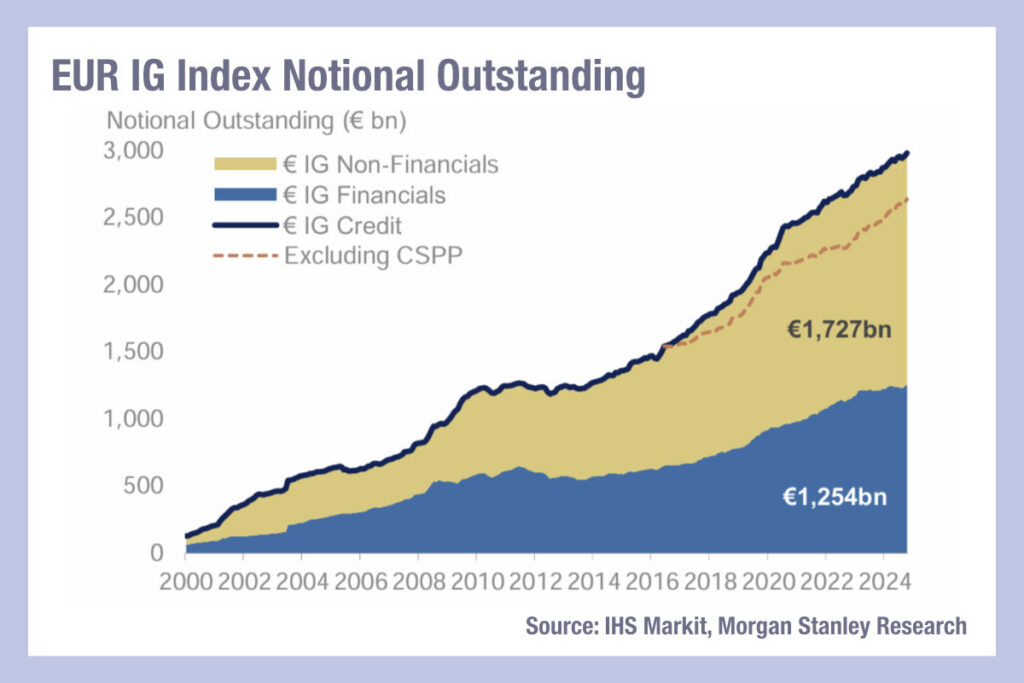

Looking at the notional outstanding for Euro-denominated indexed debt, based on IHS Markit and Morgan Stanley data, non-financials IG is still leading the charge, reaching €1.7 trillion with IG financials debt at €1.3 trillion, to reach a total of €3 trillion.

However, that debt level includes debt held by the corporate sector purchase programme (CSPP). The Eurosystem discontinued all CSPP reinvestments as of July 2023, with €298 billion still held under the programme as of 27 September 2024, nearly 10% of outstanding notional, it is suggesting that market appetite has faced a considerable drop off over the past year, and the notional that can be absorbed by the private market may well be lower.

By contrast HY debt outstanding has declined since 2022, with €340 billion outstanding in HY non-financials and €71 billion in HY financials.

Credit conditions seem relatively benign, with moderate interest rates to historical norms and no untoward concerns over credit events in the corporate sector. However, with 943 bonds of 1765 held by the CSPP set to mature in the next five years, and net issuance continuing to rise, corporates will be relying on a continued appetite for European IG credit into 2030, if this expansion is to be easily absorbed.

©Markets Media Europe 2024

©Markets Media Europe 2025