Erik Tumasz and Josh Grodin of Wellington Management on honing trillion-dollar Wellington Management’s technology-driven edge in trading.

How do you structure your trading desks?

Josh Grodin: We are regionalised, with a US, European and an Asian desk. Specifically in the US we have four trading lines: high touch equities, high touch macro trading which includes cash bonds, EM debt, currencies and rates, a credit desk which includes high yield and investment grade in addition to structured products, and the fourth is the cross-asset electronic desk which I manage, where we are seeking to optimise flow across all instruments and all asset classes

Why is electronic flow cross-asset?

Josh Grodin: We are trying to leverage technology across the board. We think that flow trading and the concept of “low touch” which has been prevalent in equities for many years is consistent and transferable across rates, FX, and credit. From a high level, if we can segment the flow correctly, then we can introduce data-driven decision-making to optimally route orders, and then measure how we did from a cost standpoint. Then the lifecycle of a trade comes into play, where from a pre-trade standpoint we have an idea of how we should route a trade, we dynamically watch and measure how we are trading the security during the trade, and then post trade we can measure how we did and feed the findings back into the pre-trade model

What are the operational pressures on the trading desk today?

Josh Grodin: Our pressures are to grow the business in scale and scope, to focus on more asset classes, increasing volumes and managing a larger set of assets under management. That makes scalability an important factor.

We are working on segmenting order flow correctly, as part of the discussion around capacity. We need to know how to quickly and efficiently realise which flow should be living with which desk; the electronification desk or the high touch, more alpha-producing desk? We are looking at things like liquidity scores, characteristics in the market place such as volatility and percentile volume, and historic bid-offer spreads. Then we are trying to also incorporate what the PM’s profile is; do they have an urgency level? Do they have a lot of short term alpha in their flow, meaning should the traders go quickly or should they go more slowly?

So, the information that might be expected to be included within notes from a portfolio manager are included in the platform?

Josh Grodin: Yes, we are trying to put tools on the traders’ desks that allow them to make better decisions with lots of data, eventually helping in the potential automation across asset classes.

How is automation coming into play?

Erik Tumasz: Take the new issue process as an example. We are one of a very few firms that have a syndicated trading desk. Even today, across the buy side and the sell side, the workflow process is manually intensive. Some of the deals might come in and within two hours we need to get them out to the investors and analysts, then come back to the sell side with request for an allocation. That’s a big manual process. It takes away from the traders adding to the investment process.

From a technology standpoint we have been partnering with a number of dealers on the street, and building pipes to connect directly to them so we can take data quickly into our in-house tools, feed the deal information out to our analysts and investors, and get back a response on whether or not they will participate on the deal.

It gives us a real advantage, because we are able to turn around the data very quickly and get back to the syndicate desks on the sell side in a much faster fashion, giving us a greater opportunity to participate in deals than some of our peers.

So, creating solutions on your own is a real advantage in speed to market?

Erik Tumasz: Yes, and we have been patiently working with dealers and vendors on vendor solutions, but they have been a little slower than we would like to move, and they are focusing mainly on products that are semi-automated today, like investment grade (IG) credit. We are focused on products that are probably lower down on the vendors’ roadmap, like structured products, mortgages, and municipal bonds so we have found it helpful to develop our own proprietary solutions.

How do those dynamics impact the investment process?

Josh Grodin: From a PM standpoint – and it relates to traders too – we are constantly asking ourselves if we are consuming the absolute best price for the security that we want to invest in. That means pulling the right quotes from the right bank; assessing if there is a bank where we are not seeing their tightest quote, pulling that quote or consuming that quote electronically. If we can solve for this, knowing that when we pull up a specific security or CUSIP that we have the best price possible, data gives us important information. Our PMs can take that data and run analysis on how they want to manage their portfolios.

How do you approach your technology framework?

Erik Tumasz: We have three buckets in our technology stack. One is pre-trade data, transparency, and insight which includes contributions to the investment process. The second bucket is the trading execution, looking at expansion and efficiencies; that includes our order management, our desktop real-estate utilisation, access to different liquidity channels, and electronic trading platforms. The third bucket is our post-trade transparency, best execution and transaction cost analytics. These three buckets do not represent a linear equation, but do need to be supported together as part of a multi-dimensional tool. When we think about the technology framework we think about how to support these three buckets with scale and a seamless user experience.

The one common factor across all these buckets is data. We have invested heavily in the ability to source, store and digest the data. We built a data management system that allows us to systematically digest or aggregate data from pre-trade, at-trade and post-trade data and then display it to the trader to aid with their decision-making process.

What was the strategy when that data management system was conceived?

Erik Tumasz: Six to eight years ago the common question we would get from the trading desk, was ‘how do I get quote data into our screens and into our database; can we access straight through processing for rates products?’ We have evolved to real time measuring of axe data for consistency and macro themes. Our traders really understand the power of the data, finding ways to harvest and derive decisions from it.

Erik Tumasz: Six to eight years ago the common question we would get from the trading desk, was ‘how do I get quote data into our screens and into our database; can we access straight through processing for rates products?’ We have evolved to real time measuring of axe data for consistency and macro themes. Our traders really understand the power of the data, finding ways to harvest and derive decisions from it.

So, six to eight years ago when we started looking at the data, the quality was pretty poor and we couldn’t make decisions based upon that. Over the years we built much better data sets. Historically fixed income data was assessed on a CUSIP-by-CUSIP level, or issuer-by-issuer level. Now we take a macro approach. We have harvested all this data and we are looking at it at a market level. We ask, ‘what is the entire financial sector doing today? Are people buyers, or sellers? What is the imbalance in the market?’

Josh Grodin: There is data that everyone can see, which represents what is happening publicly in the market. Then there is data that is unique to an asset manager that only they know about. We are a trillion dollar firm that’s trading in every different asset class, and we might be doing something in equities that could potentially affect other risk markets such as rates. Only we know about that, so we can leverage that to our advantage.

As we continue to grow, we believe that we can leverage technology and data to scale our ability to handle increased volumes with our current desk.

How would you characterise the difference in technology that traders have now compared to five years ago?

Erik Tumasz: Technology is a lot easier for us to deploy and build. It is easier to use. As we are a proprietary build shop, we do not rely heavily on vendors. We are able to handle large amounts of data, to deploy technology a lot faster using tools such as Apache Kafka, Amazon Web Services (AWS). We are able to leverage open source tools and fintech companies.

Josh Grodin: Ten years ago to today equities moved from 95 per cent electronified to 99 per cent today. In FX it was maybe 90 per cent 10 years ago, and it’s 99 per cent today. Fixed income, and specific esoteric asset classes within fixed income, were 10 per cent 10 years ago, and they are between 30 and 70 per cent today. That number is only going to exponentially increase in the next 10 years. We are preparing for a world where all asset classes are more or less 100 per cent electronic in some sense.

How have traders’ roles changed?

Josh Grodin: There is a focus more on alpha generation as a trader. It’s not enough anymore just to be able to route 100 lots of ten-year Treasury futures, you need to have an opinion, you need to be able to handle real sizeable order flow.

What are the biggest challenges in deploying technology for traders?

Erik Tumasz: We invested early on, and invested heavily in data management tools like AWS. We are able to drive a lot of the development needs in vendors so we can scale accordingly, because we are early adopters. We work very closely with Josh and the other trading managers on connecting our system into broker execution platforms and vendor execution platforms.

Because we are a proprietary shop we are able to connect to them in a way that is very generic to Wellington Management and it’s not a one-off custom build. These vendors and these brokers want us on their platform, they value our business and, they are able to customise their specs to meet our needs.

Josh Grodin: I would say from a trader’s perspective, we are constantly adapting how we trade and PMs are adapting how they run their portfolios. Our system today is a hundred times better than it was five years ago, but the ‘asks’ are way more complex and will never stop. Striving for perfection is almost not achievable, but it’s our job to make sure we are thinking of what the world is going to look like in the future.

Josh Grodin: I would say from a trader’s perspective, we are constantly adapting how we trade and PMs are adapting how they run their portfolios. Our system today is a hundred times better than it was five years ago, but the ‘asks’ are way more complex and will never stop. Striving for perfection is almost not achievable, but it’s our job to make sure we are thinking of what the world is going to look like in the future.

Erik Tumasz: We are partnered up directly with our trading team so we work as one integrated team.

Josh Grodin: We are consistently drawing from Erik’s team and other data analysis teams to find the next generation of traders. We want coders, we want quants, we want ‘data ninjas’ who can look at big data sets and read through the noise and find out what’s relevant.

What measure of return on investment do you use for technology?

Erik Tumasz: Data is key – we are looking at the analytics, how we trade, and where we can make alpha. And we are applying more technology to that. We also have a pretty stringent way to prioritise projects across the trading desks. My team and Josh’s team meet formally every week, but informally we are always talking, some of our technologists are co-located on the desk with Josh’s team. Integrating quantitative people and technology people with the trading desk is going to be very prevalent going forward.

With off-the-shelf order management systems, or even building in-house, there is typically a cycle firms have to go through with ‘X’ amount of releases and updates per year.

Because we are partnered up and co-located with the desk, we are starting to push more enhancements and coding into the system. That might not be 100% complete, but now we can iterate that through the workflow. It is better than delivering something we think is complete, and then going back and getting feedback. We can put it in a beta mode, and test it in a real-world scenario.

Do you use machine learning-based systems to try and manage the volume of data down and make sense of it?

Erik Tumasz: We use a handful of technologies including Amazon Web Services. For example, if I wanted to look at trend analysis for a particular bond over the last 30 days and see how many times it’s been quoted by the dealers, and how many times they have been offering it, we can leverage AWS in to come up with fairly simplistic graphical pictures to show us what the trends have been. If you really wanted to be clever you can actually create alerts, so if a bond that is coming in every single day being offered 30 times, and suddenly is offered more than 50 times we can generate an alert to the traders or to the investors.

We are also part of the OpenFin community. We are using it pretty heavily right now. For example, it enables Josh’s team. They trade all products and we built an equity trading system, an FX trading system, and a fixed income system but they are segregated for failure capabilities. We don’t want the trader to log in at three different systems to trade. Using OpenFin you can take pieces of each system and make it appear to users as if it’s one system.

Where do you guys sit on assessing best execution for fixed income using technology today?

Erik Tumasz: The OTC and non-transparent nature of fixed income has made it difficult to prove best execution historically – depending on how you define it. Over the last few years now, we have dealers streaming prices to us, it gives us a lot more confidence that if we do not trade on an electronic platform for one reason or another, that we have the numerical data that can actually provide us with the confidence that we have done the trade with the best possible level on the market.

How do you find the struggle for talent?

Josh Grodin: On the trading side it’s extremely competitive and everyone is looking for the same skill set. People want quants and strats. We need to make ourselves attractive to the younger generation. It’s a constant struggle to differentiate ourselves from sell side firms and other buy side firms.

Erik Tumasz: In technology we have been fighting this battle for years. Every graduate wants to go to Google or Facebook. We put a programme in place to recruit directly out of college, and with headquarters in Boston we have a lot of strong technology universities. So we are able to leverage some local talent, and creating a programme here will bring them in for a couple of years, train them very heavily on the technology, and often they become full time employees within our technology group.

Are you looking to commercialise technology?

Erik Tumasz: No, we are not looking to distribute our trading technology commercially although we have been asked this question by some of our clients. We are a build shop, and we like having the early mover advantage. We also like being able to customise our platform to 100 per cent of what our trader needs.

We have a lot of client mandates for custom products for custom workflows, and we are able to do those pretty quickly. We had a number of mandates where we have been asked to do something for a particular client, it was not part of our normal workflow and it’s helped us attract newer clients. Our highest priority is doing what is best for our clients.

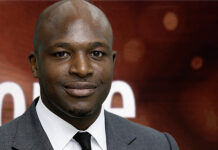

Biographies:

• Erik Tumasz is managing director and manager of the Fixed Income Trading Technology team, which ensures that products, specifically the Global Trading System Fixed Income products, are developed at Wellington Management and enhanced in line with trading objectives and industry best practices. Prior to joining Wellington Management in 2006, Tumasz worked at Charles River Development (CRD) overseeing the implementation of portfolio management, trading, and compliance systems. He received his BS in finance from Bentley College.

• Josh Grodin is managing director and director of Cross-Asset Electronic Trading, overseeing the execution of Wellington Management’s electronic trading in equity, fixed income, currency, and commodity securities. Before leading Cross-Asset Electronic Trading, Grodin was a trader in the Global Derivatives and Program Trading Group, specialising in equity derivative and commodity execution. He has a BS in business administration from Boston University.

©TheDESK 2019

©Markets Media Europe 2025