Making the team.

Nicholas Greenland is managing director for APAC and EMEA, head of broker/dealer relationships for BNY Mellon Investment Management based in London. In his role he represents the trading desks for the 12 boutique asset managers that are part of BNY Mellon Investment Management, which have a total of US$1.7 trillion assets under management. Nick joined BNY Mellon in December 2013.

Nicholas Greenland is managing director for APAC and EMEA, head of broker/dealer relationships for BNY Mellon Investment Management based in London. In his role he represents the trading desks for the 12 boutique asset managers that are part of BNY Mellon Investment Management, which have a total of US$1.7 trillion assets under management. Nick joined BNY Mellon in December 2013.

How does your role challenge you?

I have to work to gain consensus across different geographies, different time zones and different boutiques. Trying to strip out what really matters is always a challenge. Having a multi-boutique approach is the right model for our clients through the focused expertise of autonomous asset managers with different styles and strategies. Bringing that all together though to get a group view or consensus on an issue and bring that to the industry is understandably more challenging than in a centralised model.

The flipside of that is we can represent a co-operative of independent boutiques under one umbrella to the broker dealer community. Using that scale we can maximise the value we can get for our clients’ and their trading dollar. Where our dealing desks have had historical relationships with the sell side, trying to create a united front and be viewed by the sell side as a ‘co-operative’ can be a challenge. Some broker dealers understand that concept, and by employing technology effectively, they can deal with us both independently and holistically. On the other hand, there are other broker dealers who struggle to do this. My role is to bridge that gap.

What has been your approach to manage that?

The first thing we did was to try and optimise communication internally across the heads of trading at all the boutiques and one example of this was to bring them together in one place for the first time, and establish a ‘heads of trading’ group across all the boutiques and their different trading desks and trading regions. We are developing a group identity, and a belief that “together we are stronger” and as such information exchange is getting more frequent.

Heads of trading need to be heads-up rugby players. They need know where they are placed and not just focus on the day-to-day, but try to listen and understand what’s going on around the place, be it regulatory change in the industry and how that will impact their business, or dealing with the sell side. A lot of our heads of trading are very experienced and share their experience and views with other asset managers at industry fora. In the past, due to the fact that they sit in different offices, geographies and legal entities, we haven’t always interacted that closely together. We are now seeking to internalise that resource, expertise and information, and build the trust necessary to succeed as a collective group.

Are trading desks changing the way they operate?

We probably don’t feel the same pressures as the smaller firms in the market as typically we are one of the top 10 clients of our larger broker dealers. By this I mean, as the cost of business for the sell side increases (e.g. cost of balance sheet), they are having to focus their resources on a smaller group of key clients who we tend to be part of.

As an aside, we have also noticed, for smaller asset managers, waves of conversations in the industry around the rise of firms providing outsourced trading. That said one big investment management company had an outsourced trading business which they offered out to third parties, which I understand is currently being wound down. I think some of these ideas are good, some need scale to get real traction and others are just ideas.

There is a place for using agency execution services, think of this as an additional tool kit in the traders’ armoury, but even then we will want to ensure our relationship brokers know that we are trading with them. We value the direct relationship for a range of reasons and I cannot foresee that changing.

So, tools like disclosed agency trading can be helpful and additive dependent upon their technological edge and potentially market conditions, the assets and the size of the trade. But if you think about it, an agency is to an extent aggregating liquidity not adding to it. You still need principal price makers and those with the ability to warehouse risk in order to manage non-matched client positions. The question will always be: ‘What are you giving up by going agency versus principal?’ That is one example of where the skill of the senior trader comes into play.

Overall, there has been innovation and progress in the electronic trading space that have sought to increase transparency and aid workflow. However, in some markets this is offset by fragmentation. We will continue to watch this space.

What do you think of the interpretation that there is a liquidity repricing, not a liquidity shortage?

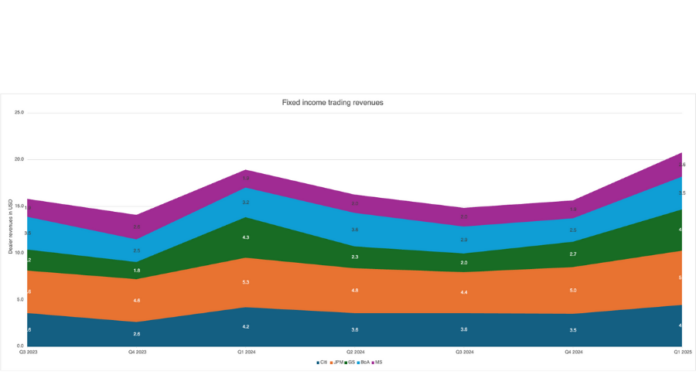

I would agree with that. I think that many banks don’t have a balance sheet problem per se; historically they have been allocating their balance sheet to clients who they now deem not to be profitable. Many of the big broker-dealers who are on top of how they allocate balance sheet, and have various different metrics which they derive from that allocation, have balance sheets to put to use with us. To support what Nick Cox (J.P. Morgan Asset Management – see The DESK, Summer 2015: www.fi-desk.com/?p=348) said, we feel we are one of those firms in a rock pool. However, we monitor this closely as who knows when the next exogenous event will come along.

From what we see, broker dealers are clearly partnership oriented and their balance sheet utilisation is heavily driven by the overall strength of the relationship between the firms.

In short, we are also very cognisant that things are changing, we need to be very aware of what the future could bring and believe that the moves toward electronification, standardisation, benchmarking and some of these initiatives around all-to-all have their place in some parts of the market.

Is there a model or approach for trading that you see gaining favour?

I think increasing our efforts to improve pre-trade information to the buy-side community enables our traders to be at the forefront of their game, making decisions about how to execute client business and then that feeds back into the risk management process. Moreover, buy-side traders will be better equipped to demonstrate best execution to regulators and for their clients.

Some buy-side traders are keener on buy-side to buy-side than all-to-all, can you sympathise with that view?

I believe in partners. On balance I think there is definitely a place for the sell-side community, they do add value to our business on many different levels and we are keenly focussed on maintaining those partnerships. There are some elements in the community who are perhaps more focussed on buy side to buy side being the panacea. We value our sell-side partners and feel that they have a real and meaningful place in the value chain.

How do you see the market structure changing as a result of these initiatives?

The optimal model is using technology to let people who want to buy something interact with someone who wants to sell something. The goal is to connect natural buyers to natural sellers with the least amount of friction. You need to be able to pay for value that is created and value that’s added. All-to-all trading is growing but I think to an extent it is over-hyped. For all-to-all to really exist with the buy side being a big part of that community, you need the buy side to be price makers as well as price takers. That will be a change for many buy-side firms in terms of a) their mandate from their clients b) their skill set and c) their technology and ability to do so.

There is evolution in the market but I can’t see the role of the broker dealer disappearing and nor do I think it’s appropriate. There will be a place for professional market makers. There are different skills and technologies and the barriers to entry are substantial enough that we, the markets and our clients need a strong and active broker-dealer community.

How do alternative liquidity providers such as electronic market makers fit into that picture?

We tend to focus our trading relationships with our relationship broker dealers. And I would argue that those firms are not relationship broker dealers.

MiFID II and MiFIR are going to be impacting the desks you represent next year, what parts do you think are most concerning?

There is a lot to be fully clarified. Unbundling of research payments has become much more focussed on the fixed income space and there are questions around what that means. Do we need to have research payment accounts (RPAs), or are commission sharing agreements (CSAs) good enough? What will be the mechanism for funding an RPA as opposed to a CSA, given there is no commission model in the fixed income world and how will this impact our clients? People are focussed on the different interpretations and the potential for it to create an uneven playing field between UK, Europe, North America, and the rest of the world.

There are other points; the European Securities and Markets Authority (ESMA) has proposed that there will be 81 transaction reporting fields some of which are new. Some people in the industry are scratching their heads about that; it’s something the buy and sell side are looking at carefully and closely. Robust transaction cost analysis (TCA) is good at the end of the day. We have to prove to our clients that we are meeting the highest standards of best execution.

And looking ahead do you see the potential for centralising technology and metrics like TCA to support your traders?

Given the multi-boutique model I am not sure that’s something that we can look at. Each boutique is different, separate and ring fenced.

Overall, while you can source TCA in fixed income, whether it’s valuable is another matter as it depends on the quality of the underlying data which is much more difficult in an OTC market than an exchange traded. You need to have a benchmark to compare the transaction costs against and if there is not a good benchmark then you are just creating a whole industry of work with limited value. However, there are a range of industry initiatives in place and we seem to be moving in the right direction. As with FX, this is a journey, and for FI more generally, we have a way to go.

However technology has a useful place. In rugby you don’t move, you get the ball to do the work. In trading, you can get technology to do the work. When you need to integrate ideas, trading platforms and human beings you can use technology to do a lot of that.

Biography:

Prior to joining BNY Mellon Investment Management, Nick was a managing director of Credit Suisse in the Investment Banking division based in London. He was also a member of the Global Currencies and Emerging Markets management team and was founder of and responsible for the Client Risk Advisory Group globally for four years. Before that, he spent seven years at The Royal Bank of Scotland where he was a Managing Director and Head of the GFI Risk Advisory team and held a variety of roles across Treasury, eCommerce and FX. Nick qualified as a CF21 (Investment Adviser) and CF27 (Investment Manager). He started his career working in the technology sector at IBM, then later Staffware which is now part of TIBCO. He holds a M.A. degree from the University of Oxford (Mansfield College).

©TheDESK 2015

©Markets Media Europe 2025