The 2020 pandemic marked a critical turning point for electronic trading in the corporate bond markets according to Tradeweb in the firm’s 2021 letter to clients.

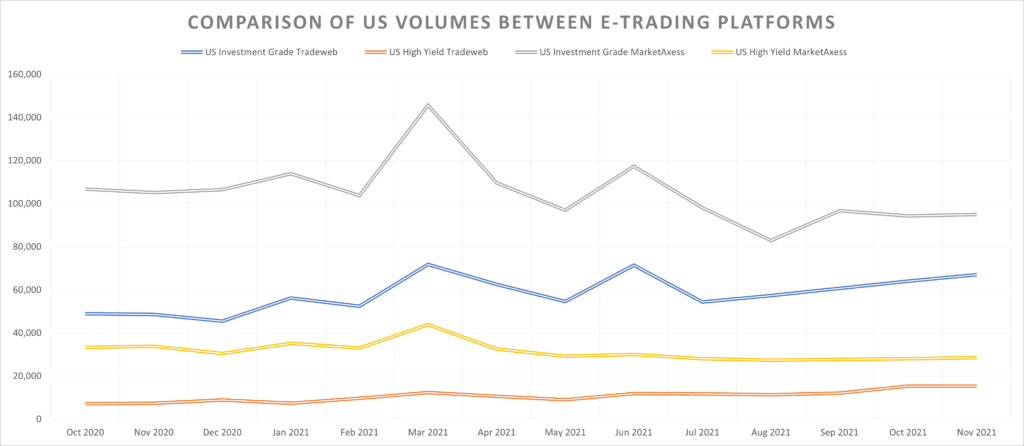

Lee Olesky, CEO of Tradeweb and Billy Hult, President of Tradeweb, said in the letter that electronic credit trading has evolved from new kid on the block to the norm. The letter noted that average daily volumes for electronic trading in US credit climbed to $11.5 billion by March 2021.

“What’s most exciting to us is the sheer breadth of this evolution,” added the letter. “Whether our clients are using automated trading for their US High Grade volume from their desks in New York, or opting to exchange bespoke baskets of high yield and emerging market debt in Paris, the race is on towards a more electronic corporate bond market.”

Tradeweb reported that total trading volume for November 2021 was US$24.1 trillion. The firm said November was its second-busiest month ever, extending its run of more than 12 consecutive months reporting year-over-year ADV growth.

Olesky said in a statement, “What is so encouraging about this momentum is the fact that much of our growth is coming from tools and protocols that did not exist five years ago. With innovations like portfolio trading for credit, direct streams for US Treasuries, and request for market (RFM) trading for swaps, we are building the future of electronic markets in collaboration with our clients.”

US investment grade (IG) credit was US$67 billion with high yield at US$15.4 billion. European credit ADV was up 1.6% over the same timeframe to US$1.8bn. Total credit across cash and derivatives was US$408 billion for the month. Growth in US and European credit was driven by record activity in portfolio trading as well as continued client adoption of the request-for-quote protocol and session-based trading according to Tradeweb.

Gross issuance of nominal Treasury bonds and notes hit an all-time high of $414bn in February this year according to the Tradeweb letter. As a result trading activity on the platform broke records throughout this year, hitting a record US$148.9bn in average daily volume in October. The Federal Reserve has announced that it will start tapering the pace of its asset purchases.

For November, Tradeweb reported that US government bond average daily volume was up 44.3% year-on-year to US$144.5 billion.

Tradeweb said: “Growth in US government bonds was driven by strong activity across institutional and wholesale markets, continued momentum in streaming protocols and the addition of the Nasdaq Fixed Income business.”

MarketAxess reported total monthly trading volume for November 2021 of US$653.4 billion, up 30% on November 2020. It also saw US$212.4 billion in credit volume and US$440.9 billion in rates. Wider credit spreads and higher volatility in the second half of November led to increased trading activity on the platform according to the firm with an estimated US high grade market share of 20.9%, up from 19.6% in October.

MarketAxess reported that US Treasury bond volume was US$432.7 billion in November, up 55% year-over-year as further adoption of the all-to-all Click-to-Trade protocol drove record investor client volume.

Emerging markets trading volume for MarketAxess in November was up 14% from a year ago. Year-to-date emerging market trading volume to the end of November is already 7% higher than full year 2020.

MarketAxess also reported record monthly portfolio trading volume in November as quarter-to-date portfolio trading reached US$10.3 billion, exceeding the full third quarter of US$8.9 billion.