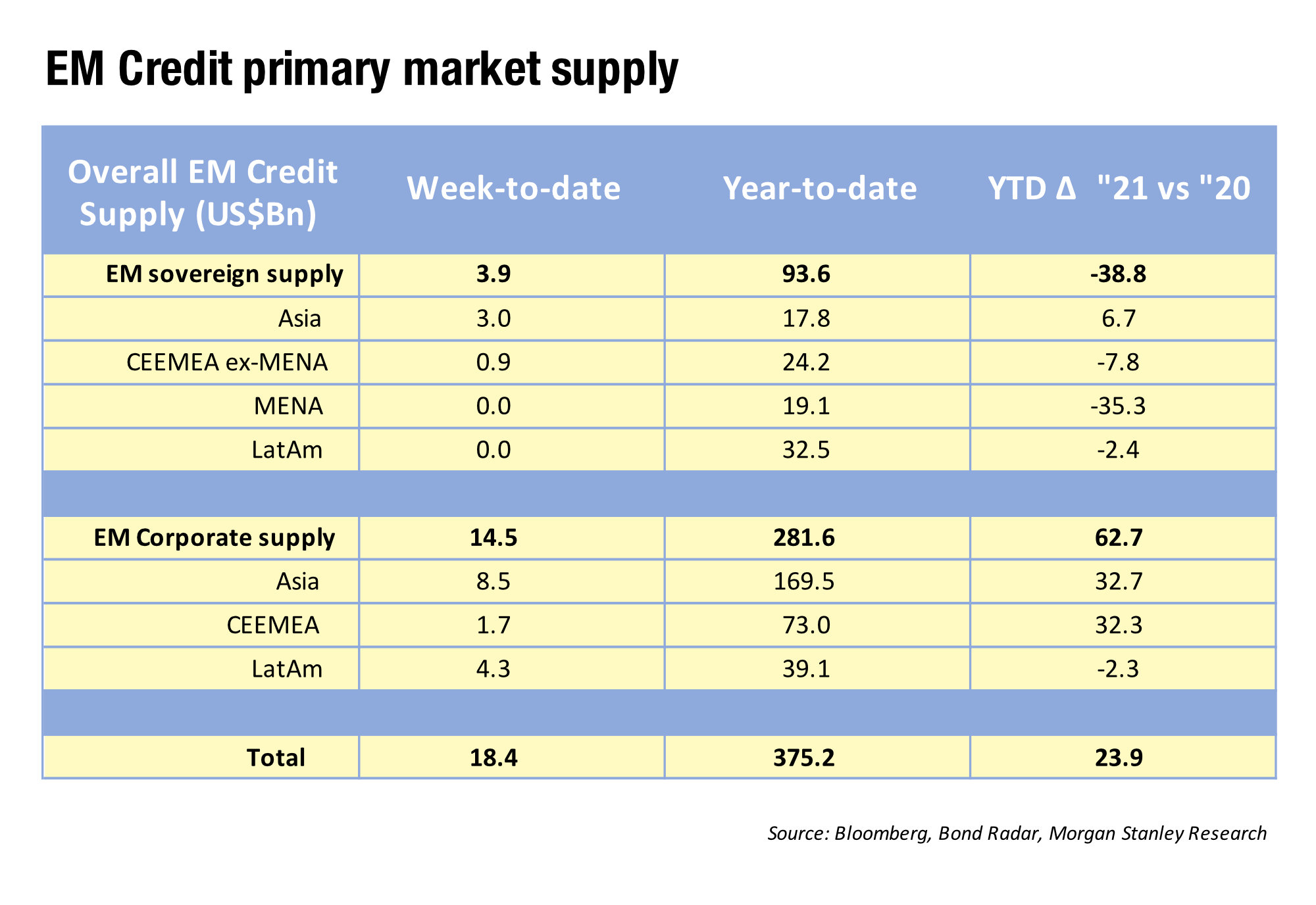

Buy-side emerging markets (EM) traders will be bonding well with their banks and brokers this year to make sure they are getting a slice of new issues. According to data from Morgan Stanley, the market has seen significantly higher EM corporate bond issuance levels in 2021 year to date, against 2020, led by firms in Asia (up US$33 billion) and Central, Eastern Europe, Middle East and Africa (CEEMEA) which are up by US$34 billion. That is nearly double the level seen in CEEMEA last year.

At the same time, we are seeing a lower level of sovereign supply, most notably in CEEMEA which is down US$44 billion on 2020 year-to-date.

Looking at bare numbers, a level of issuance like this is net positive for EM credit traders; access to more liquidity via the primary markets not only supports price formation but good access to new paper for portfolio managers. Getting bigger order filled can often be easier in primary markets where secondary supply can struggle.

Nevertheless, the breadth of markets that constitute EM primary markets is enormous and each has a set of local dealers – as well as international players – that are needed to engage with to support access to new issues.

As a result, the primary markets demand a lot of work to access, keeping traders busy but mostly in the relationship part of the business. It also tends to support secondary activity, creating opportunities via relative value trades or secondary trading in on-the-run bonds.

One trader observed that the increased activity with sell-side desks builds up colour on the market more widely, as greater numbers of interactions are necessary with bank capital markets teams. This also helps to prove early feedback and even creates reverse enquiries.

Given the challenges that typically exist in accessing EM secondary market liquidity, this is a good reason to build bridges with EM dealers in the last part of Q2.

©Markets Media Europe 2025