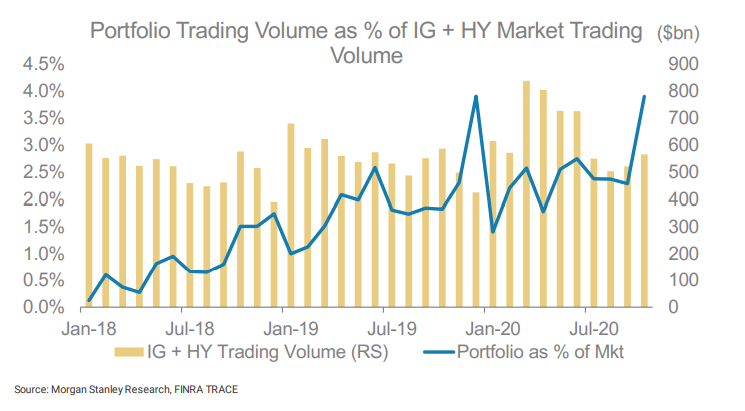

Research by Morgan Stanley’s market strategist team has found that use of portfolio trading in the US corporate bond market has increased by 56% in the past year, with portfolio trades now account for around 2.4% of corporate bond trading more broadly, from 0.8% in 2018 and under 2% in 2019.

Total volumes are estimated at US$155 billion for the year through October, by our estimate. That already eclipses the $127bn for all of 2019 and represents an increase of 56% over the same period last year

The team also found that portfolio trading was able to provide liquidity during the height of the COVID-19 crisis in March, when liquidity disappeared through other electronic and traditional trading protocols.

The average trade size has been stable but trades are now including more securities, with the average count of CUSIP codes – the Committee on Uniform Security Identification Procedures tags for securities – in a trade having grown from 89 to 109.

That average reflects a high number of smaller-sized trades being weighed against many larger-sized trades of US$200 million or more. While a quarter of trades involve both buying and selling of securities the majority of portfolio trades are outright buys or sells.

The bank’s team assessed market size using Trade Reporting and Compliance Engine (TRACE) data, which it noted was challenging as TRACE caps reported trade sizes at US$5 million for investment grade (IG) and US$1 million for high yield (HY) which will lead its data to understate the true volume. The bank looked at all trades with capped amounts and scaled them up using a methodology that Bloomberg uses to estimate trading volumes.

“Using this methodology, we estimate 2020 portfolio trading volumes of US$218 billion through October, compared to US$135 billion over the same period last year (+61% y/y),and compared to US$177 billion for the full-year 2019,” they wrote. “This estimation also shows October was a record month in terms of portfolio trading volume, as markets participants likely sought to position ahead of the election.”

This puts the size of portfolio trading at roughly 2.4% of monthly trading volumes in 2020, compared to just less than 2% in 2019, while the analysts note electronic trading more broadly has also increased.

“MarketAxess alone has accounted for 21% of IG trading volumes this year, up from 18% in 2018 and 19% in 2019. The rise in electronic trading has been even more pronounced in the HY space recently, with MarketAxess volumes representing 14% of HY volumes in 2020, up from 9% in 2018 and 10% in 2019,” they wrote. “While trading volumes have increased, turnover has remained relatively steady in 2020. Portfolio trading has increasingly become an important way for investors to manage fund flows and minimize tracking errors vs benchmark indices, with the ability to customize diverse lists of CUSIPs for a trade and get guaranteed execution on the whole lot.”

©Markets Media Europe 2025