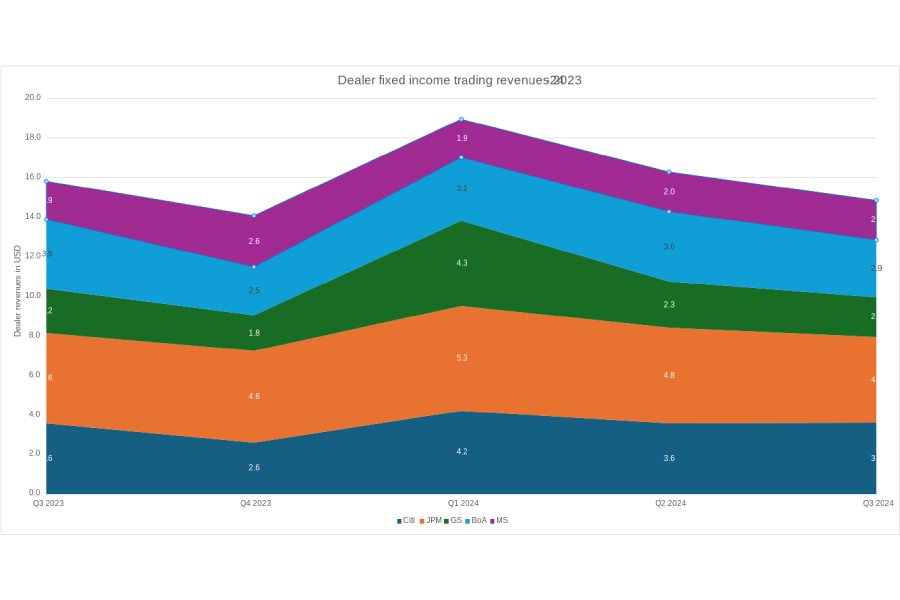

In the third quarter of 2024, of five major banks – Citi, JP Morgan, Goldman Sachs, Bank of America and Morgan Stanley – only one saw fixed income trading revenues increase year-over-year.

Morgan Stanley reported a 2.9% increase year-over-year in fixed income trading revenues for Q3 2024, up to US$2 billion against US$1.9 billion for Q323. The firm also noted a 0.7% increase quarter-over-quarter.

Morgan Stanley reported a 2.9% increase year-over-year in fixed income trading revenues for Q3 2024, up to US$2 billion against US$1.9 billion for Q323. The firm also noted a 0.7% increase quarter-over-quarter.

Citi saw a 0.4% year-over-year increase, reporting US$3.6 billion in fixed income trading revenues, with revenues remaining essentially flat year-over-year and quarter-over-quarter, despite a strong start to the year. The firm reported fixed income trading revenues of US$4.2 billion in Q1 2024.

JP Morgan, Goldman, and Bank of America all saw declines in revenues for their fixed income operations, both year-over-year and quarter-over-quarter.

Bank of America saw the biggest decline year-over-year, reporting US$2.9 billion in Q3 2024 against US$3.5 billion in Q3 2023, a 16.9% decline. The firm also saw revenues drop 18.5% quarter-over-quarter.

JP Morgan reported fixed income trading revenues for the third quarter of 2024 of US$4.4 billion, a 4.4% decline year-over-year, and a 9.6% drop against the previous quarter. It too had a strong start to the year, reporting fixed income trading revenues of US$5.3 billion.

Goldman’s fixed income trading revenues for Q3 2024 stood at US$2 billion, a 10.5% drop against Q3 2023, and a 13.9% drop against Q2 2024. Over the past year, its strongest quarter was Q1 2024, reporting US$4.3 billion in fixed income trading revenues.

©Markets Media Europe 2024

©Markets Media Europe 2025