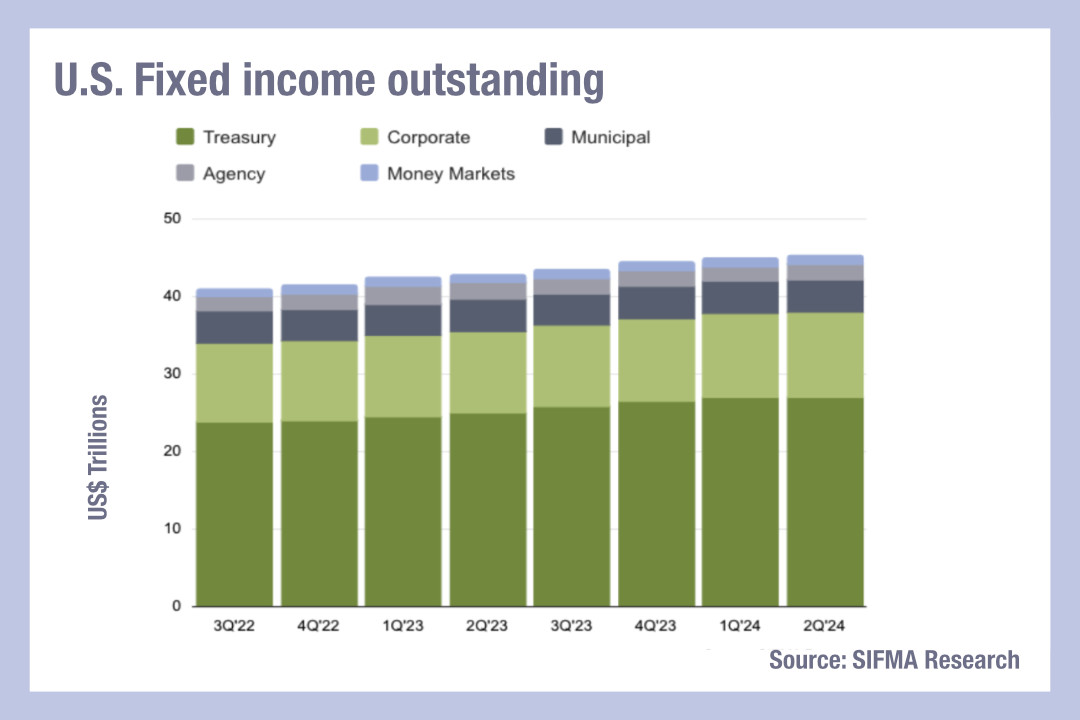

Reviewing the second quarter activity in primary markets and fund flows, we see the total notional outstanding in US fixed income totalled US$45.3 trillion, an increase of 0.5% quarter on quarter (QoQ) and 5.8% year on year (YoY), with four out of five asset classes analysed by the Securities in Financial Markets association (SIFMA) recording quarterly growth.

US Treasuries (UST) took the lead in growth, with an increase to US$27 trillion, up 0.4% QoQ and 8.7% YoY.

Corporate bonds outstanding increased 0.7% QoQ and 3.4% YoY to hit a notional outstanding of US$11 trillion. The highest quarterly growth was made by agency securities, with 1.3% QoQ but these fell -7.8% YoY, following four consecutive quarterly decreases, and bringing the total to US$2 trillion.

The only asset class SIFMA found to have decreased in Q2 was money markets, which dropped -1.4% QoQ although year on year increased by 4.4% to US$1.2 trillion in this quarter.

The European Fund and Asset Management Association (EFAMA) has published its latest International Quarterly Statistical Release for Q2 2024, which noted a slight decrease into money market funds, but a rise in bond fund sales.

Worldwide money market funds (MMFs) recorded net inflows of €244 billion, down from €255 billion in Q1 2024, largely led by MMFs in the Asia-Pacific region. They saw €98 billion in Q2 2024, compared to €169 billion in Q1.

MMFs in the United States reported net inflows of €97 billion, up from €53 billion in Q1 2024 and European MMFs saw net inflows of €29 billion in Q2 2024, slightly up from €21 billion in Q1 2024.

This may reflect a switch into longer term assets, as sales of worldwide long-term funds recorded net inflows of €518 billion, up from €501 bn in Q1 2024, with APAC recording the highest net inflows, at €242 billion, compared to €133 billion and €98 billion in Europe and the United States, respectively.

Hailin Yang, data analyst at EFAMA, commented on the Q2 2024 figures: “Net sales of global bond funds reached a new record of EUR 399 billion in Q2 2024, driven by investor anticipation of interest rate cuts by global central banks. China, in particular, recorded an all-time high in net sales.”

©Markets Media Europe 2024

©Markets Media Europe 2025