With the introduction of MiFID II and MiFIR on 3 January 2018, the European financial markets will face the biggest regulatory change they have ever seen. Market participants have spent a long time debating and analysing the real effects of the new regulatory landscape on secondary market liquidity and the new market microstructure. The financial sector is now tirelessly working to be fully compliant with the new obligations but most of the market participants do not yet know where all of this is going to end up.

Some issues still remain unresolved and need further analysis, but we are expecting new consultations and questionnaires from ESMA soon. Cross border and local deferrals may prevent the creation of a single, level playing field. The foreseen risk here is creating regulatory arbitrage by privileging some players/countries and allowing different domestic market structures, which restrict total integration into a single European marketplace and may cause activity to move from one country to another.

As of today, no more delays are foreseen to implementing the new regulations, meaning that those who have completed their projects and can provide solutions globally will gain a competitive advantage. Those who are still chasing delivery deadlines, which are fast closing, will find themselves further and further behind when it all kicks off. The implementation phase is very heavy and is stressing the value chain as well as straining budgeting and resources in an environment where trading revenues are shrinking. The risk lies in not participating and not meeting requirements because the entry barrier to the new financial arena will be costly.

Even if there are still substantive sources of risk – structural problems in many EU member states, increasing concerns over public and private debt, prevailing geo-political and political uncertainties and of course, Brexit – there is some good news coming from the European economic and risk environment: ESMA issued recently the second TRV – ESMA Report on Trends, Risks and Vulnerabilities. Market performance reflected increasing confidence and improved expectations on the future economic outlook in EU and globally. This is echoed in increased capital flows into strategies yielding higher returns.

The ESMA report also highlights a future increase of market liquidity. This opinion is not shared by most market participants, who highlight the risk of new transparency obligations over market liquidity, with particular reference to European secondary corporate bond markets.

New paths, new models

Over the last several years, financial market infrastructure became globally more and more complex and the traditional business models based on dealer-centric trading protocols came under siege. For example, bonds and swaps trading venues are becoming increasingly competitive in their structures as volumes shift away from historically utilised forms of an investment bank or pure voice broker-run intermediation and their request-for-quote (RFQ) centric multi-dealer counterparts. Great expectations are growing for a shift from European secondary markets trading volumes towards Regulated Markets, Multilateral Trading Facilities and Organised Trading Facilities, helped by new regulations. Fixed income electronic platforms are offering different types of services and protocols, together with the traditional dealer-to-client (D2C) protocol in which different types of price-makers can face off against buy-side client orders simultaneously. This leads to competition amongst these liquidity providers whereby new protocols are capturing buy-side interest.

The all-to-all (A2A) bond trading venue model may be representative of the eventual end-point of the marketplace’s experimentation with variants of the historical venue-based trading model. Trading for liquid, easily-priced instruments could eventually move entirely to exchange-like central limit order books (CLOBs). The result of this change would be the possible introduction of new price formation protocols for less liquid, hard-to-price issuances to support broker-dealer intermediation.

Next year, the top sell-side players will request Systematic Internaliser (SI) authorisation from ESMA, with the aim to keep client relationships closer, in particular on Large-in-Scale orders and more value-add products. This is aided by the automation of the sales-trader workflow. The industry also witnessed changes across business strategies. For example: this year we saw the growing involvement of Tier 1 and Tier 2 investment banks in the exchange-traded fund (ETF) manufacturing and distribution process.

Adaptation and evolution

The financial industry foresees participants like institutional investors, asset management firms and hedge funds acting as liquidity providers rather than solely price-takers. This is due to the fact that they have better access to inventory and more appetite for taking risk, so the market landscape has evolved.

The financial industry foresees participants like institutional investors, asset management firms and hedge funds acting as liquidity providers rather than solely price-takers. This is due to the fact that they have better access to inventory and more appetite for taking risk, so the market landscape has evolved.

Multi-asset buy-side execution desks are becoming more sophisticated, with the adoption of new tools providing ways to aggregate and analyse market data, the ability to provide ad-hoc analysis, such as TCA, price discovery, market intelligence and inventory reporting, and reducing the costs for their clients.

All these issues may lead to an important reshuffle of the financial market as we know it. These revolutionary structural changes are currently ongoing at an increasing pace. The possible opportunity for the sell-side to cope both with regulatory boundaries and revenue generation pressures will be the mix of high touch services (via voice), limited to the highly-profitable clients only, and agency low touch electronic services (via platforms) for all the others.

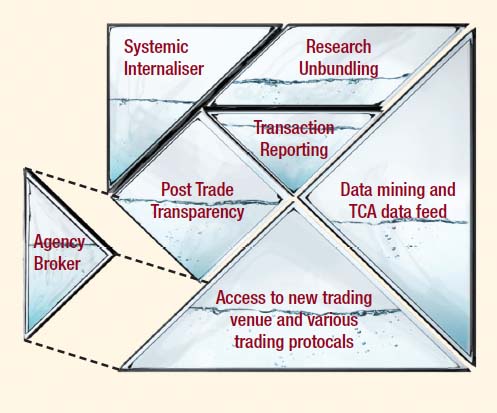

Technological innovation, data mining, pre- and post-trade transparency, transaction reporting, access to new trading venues, various trading protocols, SIs and financial research unbundling will be the ‘mantra’ for next year as all of them will play a crucial role in business development, and we wait to see who will gain a significant edge in respect to their competitors.

©TheDESK 2017

©Markets Media Europe 2025