Evaluating the quality of a bond trade is made complex by the multiple dynamics which impact quality, and the frequent absence of data to measure many of those dynamics, either for the trade itself, or for a benchmark against which to measure the trade.

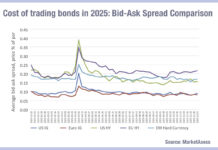

The cost of a trade, and the explicit costs are more straightforward. If both sides of the bid-ask spread are known, that gives a sense of price and the risk being priced into a trade, for a given bond. To know that, a trader needs to have asked a counterparty for a price.

In a simple transaction, let us say Investor A asks Dealer X for a price by making a request for quote (RFQ). To know if that price is good, Investor A needs to benchmark it.

To do that it can use its own data, and/or a consolidated price feed for the relevant bond, and/or the axes from market makers indicating where they are happy to buy/sell, and/or by getting firm prices from other dealers, and comparing them.

During this price discovery process, Investor A needs to limit information leakage; the more information leaks in the market revealing its trading intentions, the more market participants will move to maximise their return/minimise their risk in trading this bond. As that ultimately increases the cost of trading for Investor A, information leakage can be considered an implicit factor affecting the costs of trading.

When Investor A executes the trade with Dealer X, it can measure the difference in expected explicit costs at the outset with the realised explicit costs of the trade, any loss being the ‘implementation shortfall’ of the trade, an implicit cost of trading, and potential reflection of information leakage.

The market impact – assessing how much a market moves after a bond has traded – is typically far harder to calculate.

One model proposed in a 2021 academic paper, ‘Transaction Cost Analytics for Corporate Bonds’ to measure the price impact of each single trade for corporate bonds that are liquid enough, by Professors Xin Guo of UC Berkeley, Charles-Albert Lehalle of Imperial College London, and Renyuan Xu of NYU, found two characteristics of the price impact of corporate bonds:

- There is an asymmetry between buying and selling trades. The mid-price moves triggered by a trade on a corporate bond are larger for buying transactions than those for selling ones. In terms of transaction cost analysis (TCA), it means that the asset manager has to respect such an asymmetry and take it into consideration during the evaluation of the counterparty dealers.

- There is decay in price impact curves, similar to the one identified in equity markets. The price impact curve consists of a jump corresponding to the adverse selection suffered by the dealer, followed by a decay stabilising the price at the level of the permanent market impact.

This study suggested the following approach for TCA for US bonds:

- For all corporate bonds of interest, asset managers first compute an expected bid-ask spread given the characteristics of the bond and market conditions using one of the regression approaches proposed [in the paper], and using either the Standard TRACE or the Enhanced TRACE datasets for bid-ask spread approximation.

- This reference bid-ask spread can be used to benchmark the bid-ask spread obtained while requesting for quotes from counterparties. It can also be used to score all the obtained trades during the week.

- Worst trades can be qualitatively evaluated using the average price impact curves obtained [see Fig 1]. More specifically, if a trade has price impact larger than the curve showed, then it can be identified as a worst trade and the asset manager can conduct further analysis on the counterparty.

What is particularly useful about this study is the curve it generates to indicate market impact for multiple trades after the initial trade.

Where buy-side traders are frequently executing multiple small trades in a liquid bond for efficiency, understanding the effect on future pricing after each trade is key,

Although the study did not look at the effect of time since issue – investors are more likely to being buyers at point of issue, and potential sellers later in a bond’s existence – this nevertheless offers one path to practically assessing the implicit costs of trading a bond.

©Markets Media Europe 2024

©Markets Media Europe 2025