By Flora McFarlane.

MarketAxess, electronic trading platform for fixed income securities, has reported that January was a record month for daily and monthly trading volumes, which it artttributes in part to MiFID II trade reporting.

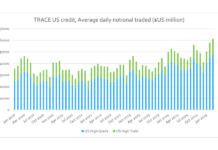

The trading platform, which also provides market data and post-trade services for fixed income markets, saw a total trading volume of US$14.9 billion on January 31.

Average daily trading volume in January was up to US$7.3 billion, an increase of 22% on the previous year and beating March 2017’s record of US$6.7 billion.

In addition to the record total trading volume posted on January 31st, the last day of January also posted records in high grade, high yield, emerging market and open trading.

US$7.8 billion was traded in high grade, while high yield and emerging markets recorded trading volumes of US$1.3 billion and US$3.5 billion, respectively, while open trading volume hit US$1.9 billion.

MarketAxess has attributed the record-breaking volumes to the changes that have come about under MiFID II. MiFID II’s post-trade transparency requirements have seen firms looking to third-party providers to facilitate meeting requirements.

Kevin McPherson, global head of sales, said: “Our growing global client network and the initial effects of MiFID II trade reporting rules were among the drivers of the high level of electronic trading activity in the month.”

©TheDESK 2018

©Markets Media Europe 2025