Significant changes in counterparties and market structure have transformed US Treasury market activity.

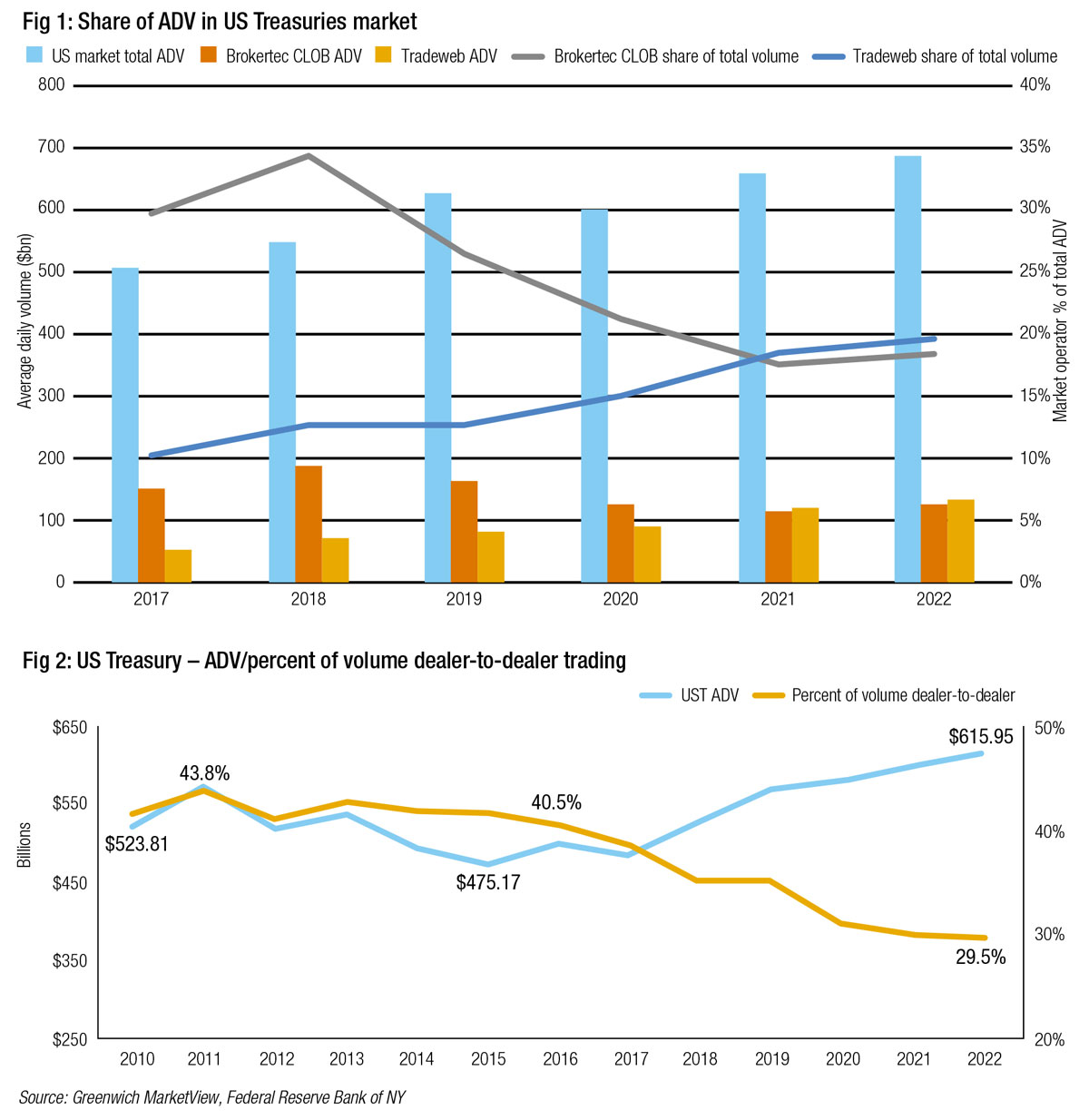

Dealer-to-client trading has overtaken interdealer markets in volume traded according to analyst firm Coalition Greenwich, with Tradeweb and Bloomberg now rivalling the once dominant Brokertec, owned by CME Group, for electronic trading market share.

The change began in 2011 following a drop in overall average daily volume for the US Treasuries market, but when market-wide volumes rebounded in 2017, proportional interdealer volume decline accelerated.

Liz Kirby, head of market structure at Tradeweb, says, “We’re seeing the continued growth in electronification of the institutional dealer to client market and within that, Tradeweb continuing to gain market share in the D2C space. That electronic portion of the pie is growing and Tradeweb’s piece of the pie continues to grow. In the interdealer market, we see continued emergence of streaming technology and a migration of that interdealer market onto streaming protocols, with a de-emphasis of the traditional central limit order book (CLOB) style of trading, and Tradeweb and Dealerweb are very strong in the streaming protocol space.”

This point-to-point streaming in Dealerweb for example, would typically be either a dealer or a proprietary trading firm (PTF) to another dealer.

“Those streams can be different to CLOB prices, they can be very bespoke to the participants who are involved,“ Kirby explains.

Although Brokertec began offer direct streaming in 2019 it still only publishes CLOB trading volume data, where the Tradeweb figures are inclusive.

However, Coalition Greenwich estimates that 9-10% of volume is now direct streaming, from 8% in 2019.

“It’s possible that the overlap between request for quote (RFQ) and streaming volume is starting to lean more to the latter,” says Kevin McPartland, head of market structure at Coalition Greenwich. “It’s also important to note that the 9-10% market volume from streaming is of a much higher base, given how much market volumes have surged post-pandemic.”

As point-to-point prices and trades are bespoke, they provide a very different liquidity profile to CLOB liquidity, suggesting market activity is now quite different to the profile seen ten years ago.

In a rising rate environment, with concern about the market’s capacity to absorb US Government bond debt next year and growing leveraged hedge fund positions the market, and banks’ capacity to intermediate liquidity, it is worth considering how we got to the current market structure and whether the current structure will hold up in a large directional movement.

The risks

Several worrying events in the largely unsupervised US Treasury market raised concerns. In October 2014 there was a ‘flash crash’, which saw the 10-year Treasury rate fall 34 basis points over a 10-minute period from 2.2% to 1.86%, a 52-week low, before rebounding for the end of day. Treasury futures volume reached nearly 1.6 million trades, an all-time record, having only broken the 800,000 trades a day barrier three times before.

At that point US Treasury trading activity was not reported to any independent supervisor and oversight was so light that the investigation by government agencies into the flash crash sought only to track exactly what happened. Even in that, the report was inconclusive as to causal links between events.

Historically, all government bond markets have low levels of regulation and supervision, because any limitations on raising debt for a government can become a political issue.

In the US, market politics were also in play. The reason for the tension was that banks – once the lifeblood of the interdealer markets – were having their lunch stolen high frequency trading (HFT) firms on the central limit order books (CLOBs) of Brokertec and eSpeed, while those same HFTs were making prices to buy-side firms in swaps and cash instruments and big buy-side firms like BlackRock were also said to have access to the D2D CLOBs.

Banks were the main customers of the interdealer markets and both platforms and interdealer brokers (IDBs) studiously avoided annoying them. Yet Brokertec already had around 55% of volume being provided by HFT firms in 2012, according the ICAP’s then chairman Michael Spencer.

There was no defined regulatory responsibility or oversight of the market by either the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

The greatest level of independent supervision came from the Federal Reserve itself, whose Treasury Markets Practice Group can provide advice on best practice, however it had no regulatory role regarding secondary market trading.

When the 2014 flash crash happened, there was almost no capacity to respond. Self-trading was shown to be highly elevated to 10-20% of market activity, yet no investigation was mounted to check if these were deliberate – which would make them illegal as ‘wash trades’ and manipulative spoofing.

Then in March 2020 the intermediation of the market by banks dried up and bidless markets were seen at points. This was perceived to be because banks did not have the capacity to intermediate the market in the event of large scale selling. A contributor to the selling were reportedly hedge funds unwinding the cash-futures basis trade, according to Federal Reserve research.

“The cash-futures basis trade is an arbitrage trade that involves a short Treasury futures position, a long Treasury cash position, and borrowing in the repo market to finance the trade and provide leverage,” wrote Fed economists Daniel Barth, R. Jay Kahn and Robert Mann in August 2023. “This trade presents a financial stability vulnerability because the trade is generally highly leveraged and is exposed to both changes in futures margins and changes in repo spreads.”

These events together have triggered regulatory reviews of the market structure.

The need to impose supervision was realised. In 2017 The US Treasury recommended that HFT firms be identified in TRACE data, and in 2022 US market regulator, the Securities and Exchange Commission (SEC), proposed regulation of high-frequency trading (HFT) firms, also referred to as proprietary trading firms (PTFs), in order to “more consistently” apply to firms engaged in similar activities the “important protections to investors and the markets that result from registration and regulation under the Exchange Act, including those obligations that promote market stability.” The proposal drew upon the SEC’s original ’34 Act authorities, including the authority added in the 1986 statute.

In a statement at the time, SEC chair Gary Gensler, said, “We’ve seen a number of high-profile events in markets with significant participation by PTFs. Tremors in the Treasuries markets in 2014, 2019, and at the beginning of the Covid crisis in 2020 demonstrate the importance of the SEC’s oversight of dealers, consistent with the statute.”

As market dynamics have changed considerably, the risks created by market structure and supervision nine years ago are also likely to have shifted.

Current pressure

A paper published by Darrell Duffie, professor of Management and of Finance at Stanford Graduate School of Business, on 25 August entitled ‘Resilience redux in the US Treasury market’ found “empirical evidence, with supporting theory, that the current intermediation capacity of the US Treasury market impairs its resilience” with identified risks including losses of market efficiency, higher costs for financing US deficits, potential losses of financial stability, and reduced safe-haven services to investors.

His suggested improvements echo previous calls for broader central clearing, all-to-all trade, post-trade transaction reporting, substituting the Supplementary Leverage Ratio (SLR) rule with higher risk-based capital requirements, and official-sector market-function purchase programmes.

The recent Fed economist paper, ‘Recent Developments in Hedge Funds’ Treasury Futures and Repo Positions: is the “Basis Trade” Back?’ concludes that hedge fund futures and repo positions in May 2023 when it was drafted were consistent with increased trading in the cash-futures basis.

“We emphasise these developments are not enough to conclusively determine the scale of hedge fund basis trade activity,” they wrote. “However, we note that conditions are similar to those that prevailed in 2018 and 2019, when hedge fund basis trades grew rapidly. Specifically, increases in interest rates away from the zero lower bound may have contributed to hedging demand by asset managers. If the basis trade is reemerging, it would suggest that this hedging demand indeed plays a large role in driving the volumes in the trade.”

With positions between 9 May 2023, and 13 June 2023 of hedge fund 2-year short Treasury futures rising by US$94 billion, they reached a level only US$65 billion lower than their all-time high.

“Should these positions represent basis trades, sustained large exposures by hedge funds present a financial stability vulnerability,” the paper noted. “While the contribution of sales from the basis trade to March 2020 Treasury market liquidity remains debated, several papers suggest that absent prompt intervention by the Federal Reserve, the situation may have been far worse. At present, measures suggest the Treasury market remains volatile, with the MOVE index still at levels comparable to the peak of March 2020. Consequently, cash-futures basis positions could again be exposed to stress during broader market corrections. With these risks in mind, the trade warrants continued and diligent monitoring.”

Through the increased reporting and potentially tightened market structure authorities may be able to prevent another damaging event, but only if they are able to impose changes in a timely manner.

©Markets Media Europe 2023

©Markets Media Europe 2025