The overall pace of bond market electronification is slowing, but trading evolution is not linear.

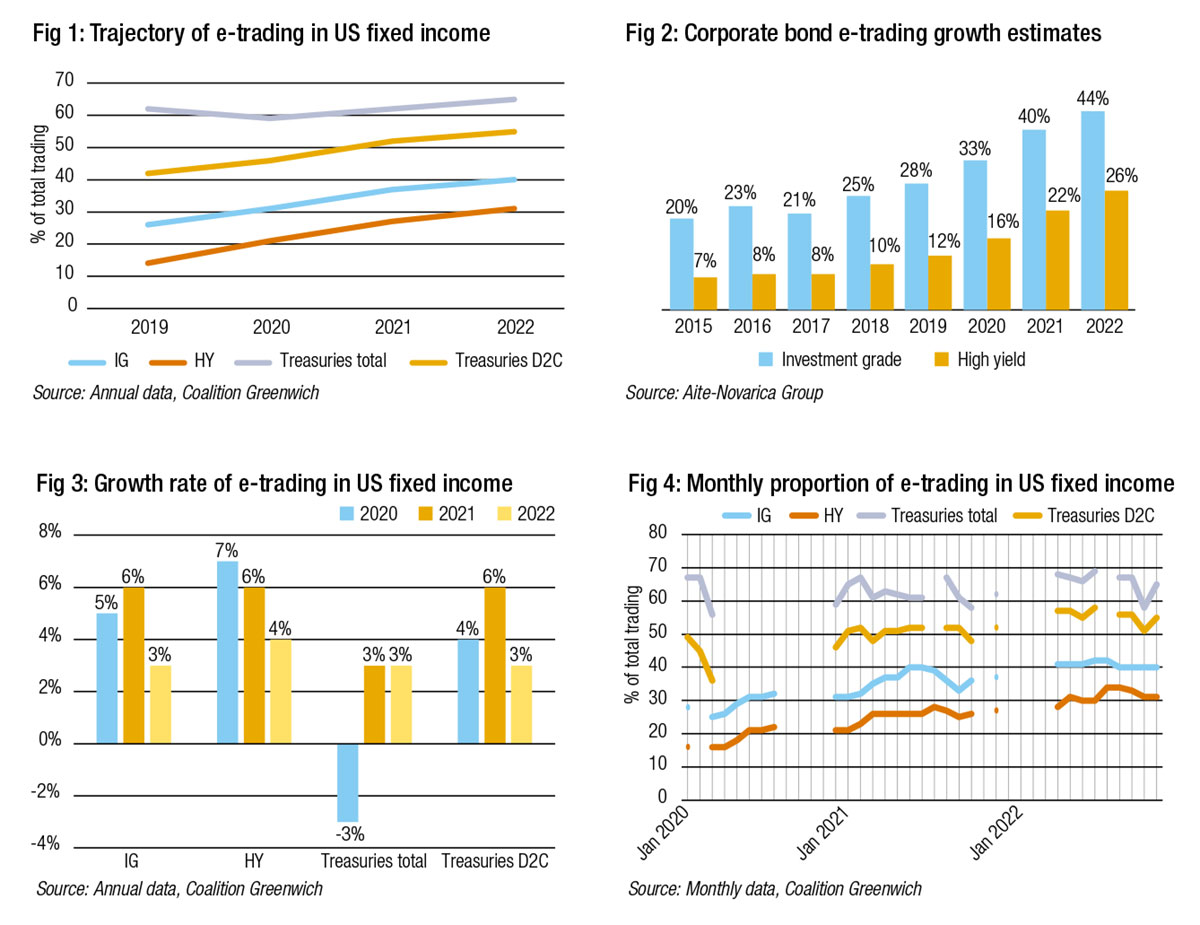

Electronic trading has grown as a proportion of total trading, year on year, in both government and corporate bond markets in the US since 2019, according to data from analyst firms Coalition Greenwich (Fig 1) and Aité-Novarica (Fig 2).

However, the pace of growth has slowed (Fig 3), leading to questions around the maximum level of electronification that can be supported, the drivers for growth – or reduction – and the detail around dynamics which will support electronification.

Analysis by The DESK of Coalition Greenwich data on a month-by-month basis (Fig 4), shows that the level of e-trading versus total trading is highly variable and the growth represented by year-on-year data masks many positive and negative impacts on e-trading use.

“A number of macro factors can contribute to the pace of electronification in any given year,” says Tom Pluta, president of Tradeweb. “For example 2022, having been an especially volatile year, I think trading desks were mostly focused on just managing through rather than trying out new trading protocols. The pace of change for electronification varies year to year, depending on the idiosyncrasies of US markets, but for all the products that are not electronified yet, we’re bullish. We have a plan to work with our clients and dealers to keep moving that needle.”

Derek Kleinbauer, global head of fixed income & equity e-Trading, and president of Bloomberg’s Swap Execution Facility (SEF), says, “Short term we’ve seen a slight increase so far starting this year versus last year on e-trading. Typically short end products lend themselves to electronic trading. We’ve seen a pretty significant rise in portfolio trading, particularly within US and European credit. People are trading more line items which is certainly showing itself within the number of trades being put through. Repos, structured products, those are still primarily done over the phone but over time markets will move to electronic trading, whether by regulatory mandate or innovation.”

Looking at monthly proportion of e-trading activity, as assessed by Coalition Greenwich, we can map the withdrawal of dealer market-making in US treasuries in March 2020 with a significant decline for dealer-to-dealer (D2D) and dealer-to-client (D2C) US treasury e-trading of around 15 percentage points. In 2021 US Treasury e-trading was again characterised by peaks and troughs. Credit meanwhile appears to follow a more benign upward path, absent of drama. Yet last year, which saw wider losses to investment portfolios as alluded to by Pluta, growth flattened.

Trigger for a Tigger

A more exciting ‘Tigger’ bounce in credit e-trading activity would potentially require a change in adoption, an aggregation of liquidity through trading venue M&A, or a trading protocol that makes a material difference to dealers’ ability to execute electronically.

The first effect was seen in 2020 when the work from home (WFH) environment under Covid led to the proportion of trading conducted electronically to jump at a high single figure rate – between six and seven percentage points according to coalition Greenwich/Aité-Novarica.

“Changing behaviour is the number one obstacle,” says Rich Schiffman, head of open trading at MarketAxess. “We’ve proven that we have a compelling offering and why traders should change how they execute. And while it has taken longer than we would all hope, that’s the history of electronic trading.”

Justine Robertson, head of client strategy at Trumid says, “There’s definitely a desire to trade more electronically, you just have to guide users to the ways they can do it. We hear there are some clients that are less than 10% electronic, and others that are 70% electronic. So, there’s room to grow when you think about the disparity between clients who look and feel similar but are at different levels.”

New trading protocols are one driver for increased engagement, as these allow the very disparate and different elements of the fixed income markets to be traded electronically, reflecting the highly varied liquidity, counterparty and risk profiles that make up the markets.

“Time will tell which protocols capture how much share,” says Schiffman. “We have several different protocols because we don’t believe there is only one solution. It will take a combination of these protocols, with actionable data layered on top of them, to create efficiency for traders. It is critical that we make all of these options and advantages easier for the traders to use, particularly the buy side traders, but sell side traders as well. We are heavily invested in doing this via our new Adaptive Auto-X offering, which wraps protocols together and allows traders to take advantage of them automatically.”

This can create ways of trading electronically that shift activity away from manual processes, expanding the level of e-trading for all participants.

“The tools we’ve provided in new issue have made us a leading venue for new issues,” says Robertson. “We’ve been able to provide trading and pricing transparency to the grey market which didn’t really exist. Once that focus is on Trumid users start using us for other trades – perhaps less liquid orders – without having to create a bigger footprint on the market.”

Tectonic market structural shifts

Other game-changing developments can happen in the wider market. A pre-requisite for the use of rules- or algorithmic-based decision making, which can facilitate low-touch electronic trading, is improved data.

Europe is making slow but sure progress towards developing a post-trade tape of bond pricing data, in a similar vein to that put in place in the US markets 20 years ago. While there are limits to the value of public pricing information, it can create a common benchmark to support data-led decision making engines.

“The consolidated tape project is certainly a positive factor,” says Pluta. “With the types of market participants expanding from banks to dealers to highly sophisticated principal trading firms being huge market makers, and a lot of these products, they’re very data driven – they’re almost exclusively electronic traders – data is a big factor in allowing electronic markets to continue to grow. Having more price discovery, pre trade data and post trade data is a positive factor. I wouldn’t say the consolidated tapes could be some big ‘hockey stick’ move in market activity in the near term, but these are positive factors.”

Robertson notes that these electronic trading firms are in turn impacting the type of liquidity available – in terms of the size and frequency of orders and prices – which helps to reduce pressure on block trading.

“Algorithmic liquidity providers in the market are increasing in number, as also reflected in the continued expansion of our dealer-to-client protocol, Attributed Trading,” she notes. “Forty four dealers and algorithmic liquidity providers are now streaming into the platform with over 13,000 bonds priced every day for clients to trade. The average trade size is going down in the market, so I think people are less sensitive to getting multiple partial fills, that increased activity creates more liquidity in the market, by definition.”

Traditional liquidity takers are also able to become liquidity and price makers through e-trading creating additional support for liquidity in stressed circumstances.

“The attractiveness of liquidity available electronically versus traditionally is where our all-to-all offering, Open Trading, comes into play,” Schiffman says. “Electronic trading is the only way to take advantage of the open market. Electronic trading gains further traction when firms want to be more opportunistic, cross bid-ask spread, and capture that as a price maker or liquidity provider. We’ve described the effect as price improvement and alpha generation. That is a primary driver of Open Trading and electronic trading because you simply cannot do that on the phone.”

As more data becomes available, advances in technology will further help to reduce the workload on trading desks.

“The functionality we have in automated trading is able to take multiple data points and arrive at a trading decision,” says Kleinbauer. “That’s certainly early days, but this space will no doubt evolve in ways that will help to accelerate the adoption of e-trading.”

Differing liquidity profiles

Buy-side traders note that their use of electronic trading differs substantially between different bonds, with shorter-dated bonds and smaller trade sizes being traded more easily than larger orders and longer dated bonds.

A more granular analysis of trading would potentially indicate that e-trading is accelerating in some areas, even as it struggles in others. E-trading platform providers are working to support less liquid parts of the market in order to raise the total level of electronic engagement.

“Where there’s ample liquidity, price transparency, and access to multiple points of liquidity that will certainly lend itself more to electronic trading,” Kleinbauer acknowledges. “Getting to illiquid instruments, we’ll see a slower trajectory of adoption. This is where we see offerings such as intermediation helping to advance adoption. The recent launch of Bloomberg Bridge has helped our participants tap into pockets of liquidity that previously were not available to them.”

Over time, the drive to innovate could allow the whole market to become electronic, although that will not be entirely platform based says Schiffman.

“I’m going to make a bold statement and say that there is no ceiling and that virtually 100% can be electronic,” he says. “I will qualify that by saying there are different ways that you can trade electronically. There will always be a segment of the market that continues to be bilateral between a buy-side firm and a dealer, but that trade will still be done in an electronic manner.

©Markets Media Europe 2023

©Markets Media Europe 2025