Despite a broadly positive environment, ongoing geopolitical developments and economic uncertainties mean that financial market participants should be more vigilant than ever, according to a recent report from the European Supervisory Authorities (ESAs).

Collectively, the European Banking Authority (EBA), the European Insurance and Occupational Pensions Authority (EIOPA) and the European Securities and Markets Association (ESMA) have issued their Autumn 2024 report on risks and vulnerabilities in the EU financial system.

On a positive note, declining inflation between 2023 and 2024 has caused central banks to move towards looser monetary policies, the authorities said. In general, strong performances have been seen in financial markets in anticipation of rate cuts and improvements to the macroeconomic outlook.

However, this environment is not a stable one. Continued unrest, in the form of wars, aggressions and political elections, mean that the future of the global economy is unclear. This was highlighted by high market volatility in August, the authorities noted, proving that “there is potential for sudden shifts in the economic outlook and market expectations. The highly uncertain current environment continues to present material financial stability and operational risks that necessitate vigilance from all financial market participants.”

The ESAs have published a series of policy action recommendations to national competent authorities, financial institutions and market participants in light of their observations. Financial institutions and supervisors should be prepared to face continued high interest rates and their impact on the real economy, the authorities said, and the impact of inflation on product development should be monitored.

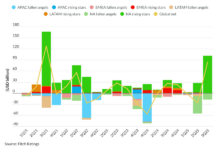

“Credit risk should continue to be monitored and carefully managed as its potential materialisation remains a concern,” the authorities continued. “This underlines the need for adequate provisioning levels and forward-looking provisioning policies, while maintaining prudent and up-to-date collateral valuation.”

In light of July’s Crowdstrike IT crisis, potential operational and financial stability risks resulting from cyber-risks should be taken note of, they added.

In all, financial institutions need to ensure that they are flexible and agile, with solid plans and processes in place to enact in the event of unexpected short-term, multi-fold challenges.

©Markets Media Europe 2024

©Markets Media Europe 2025