Traders are reported that liquidity across developed and emerging markets is being hit, with trades taking far longer to complete and price formation suffering as spreads blow-out.

Three direct effects of the war in Ukraine, which started on 24 February, have been the government and internationally-imposed sanctions on Russia, corporate self-imposed sanctions on trading in Russian assets and the effects of the war on economics and supply chains hitting Ukraine, Russia and many other countries as well.

The sanctions imposed can be summarised as blocking business with wealthy individuals who have political influence, including the president Vladimir Putin; barring trade with many companies in Russia – typically those associated with the state; and sanctions on the central bank and government organisations. While the European Unions, United States and other countries such as Japan, Switzerland and the United Kingdom are all drawing up their own lists of who is targeted these largely overlap.

In the meantime, Ukraine was able to raised funds this week via a bond issue.

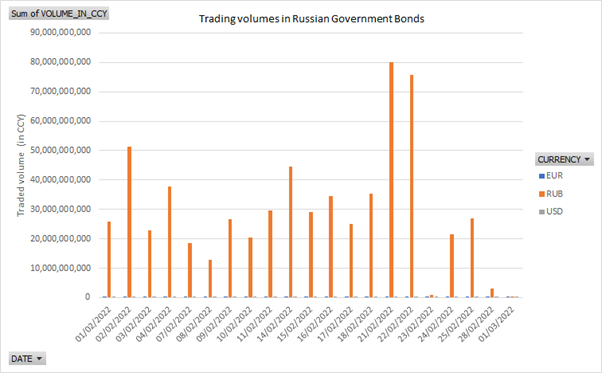

Data from MarketAxess shows an immediate effect in the trading of Russian government bonds, which was effectively dead by 1 March, five days after the invasion began.

It is now one week into the war and traders report that illiquidity has expanded to affect other Eastern European countries and securities that would be considered tangential to the countries directly involved in conflict.

“We are seeing is that it’s not just ‘Russian debt’ which is getting hammered, but already second or third degrees of separation – geographical or economical,” noted the head of one trading organisation. “Emerging markets and frontier markets may be extra volatile, but credit – cross-over, high yield, investment grade – are also being dragged into the mess.”

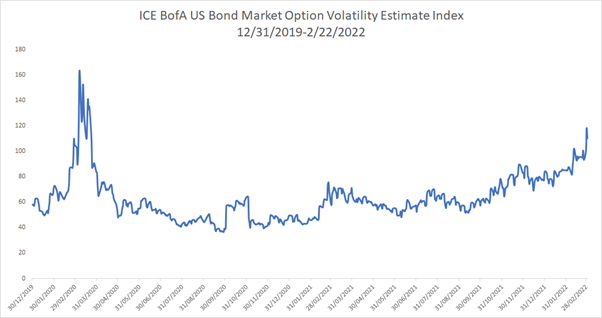

According to the ICE MOVE Index which tracks volatility in the bond market, the SMOVE1M is up 2.92% and is hovering around 115.56 at the time of going to press. This indicates a significant spike in market volatility and

While it is understood that there are no bids in Gazprom or other sanctioned firms, traders are questioning why firms like Austria’s Raiffeisen Bank, with debt rated Senior: A-/A2, would get tied in.

“Out of high risk, into low risk,” an experienced trader observed.

While this was largely manifesting itself in the time it took to manage trades at the start fo the disruption, bid/offer spreads are now being hit.

“Liquidity is getting tougher even in DM markets: spreads are 50 to 100% wider in EUR or GBP rates for example,” said another trader. “In other central eastern European, Middle East and African (CEEMEA) markets, like South African Rand or Hungarian Florint. same observation, spreads can be 100% wider or more for small size.”

One sell-side trader noted that holding risk was very uncomfortable for firms at present, while another cited concern about a lack of experience on trading desks, which could exaggerate risk aversion.

While primary and secondary markets in Russian securities have been directly affected by sanctions on participation, investors’ unwillingness to trade in those securities, and the inability to settle trades for Russian instruments, it also looks as though uncertainty around the war and its potential outcome has created a real liquidity drought, which is impacting the wider global market.

©Markets Media Europe 2025