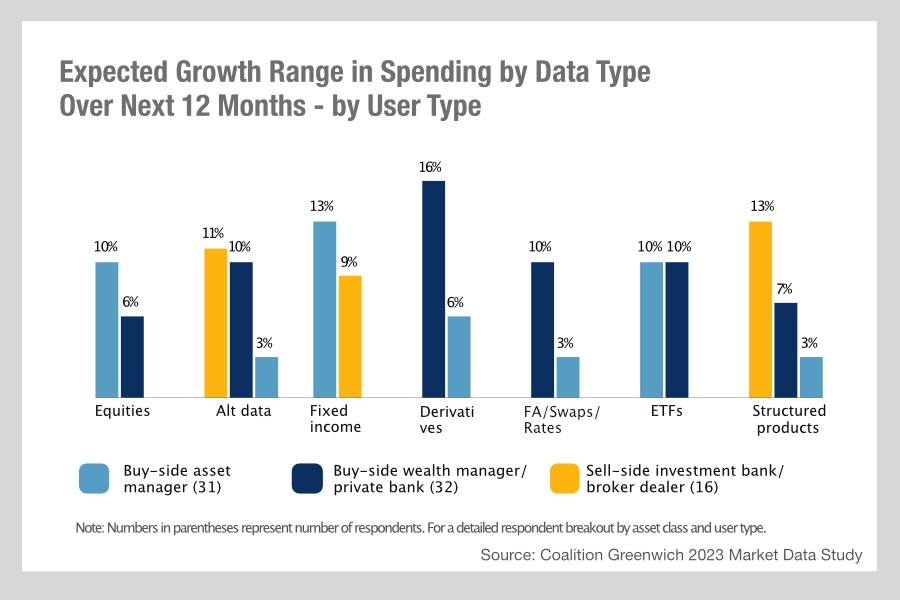

Spending is up across all categories of market data, with equities, fixed income and derivatives all expected to see a rise of more than 5% over the next 12 months, with some categories up more than 10%, according to a report from Coalition Greenwich (CG).

Over April and May of this year, CG and SIX spoke to 79 global buy-side and sell-side market participants about their choice of market data vendor, what types and frequency of data these firms are buying and consuming, and their views on future use cases, sources and delivery.

Thanks to the maturation of electronic trading in equities markets and the rise of algos and data analytics, the demand for low latency, high quality market data is on the up. The report found that both the buy side and the sell side are investing in technology and infrastructure to meet this demand and to maintain pace with evolving data capture and reporting regulations in the space.

Buy-side asset managers expect spending on equities data to increase 10% over the next 12 months, while buy-side wealth managers/private banks expect spending on equities data to increase 6% over the next 12 months.

Fixed income spending on data is expected to rise, the report suggests, as new and more accurate data is collected and sold. Trading venues, which possess some of the richest data sets, are starting to recognise the value of these assets, the report found. Buy-side asset

managers expect spending on fixed income data to rise by 13% while sell-side investment bank/ broker dealers expect spending to rise over the same period by 9%.

Among buy-side market participants, 80% believe data budgets will rise over the next 12 months, and more than 25% anticipate a rise of at least 5%. Some categories of market data, such as alternative data, fixed income and derivatives, are growing by 10% or more.

The report also found that market data purchasing and licensing is driven largely by region for sell-side firms and business units for buy-side firms. Data accuracy is the top determining factor for firms looking to switch providers, with 88% of firms considering it a driver. The cost of data licenses and the technical cost of data was a ‘very big driver’ for only around a third of firms.

Alt data spending is on a multi-year growth trend, the report said, with 44% of institutional asset managers and hedge funds in 2022 reportedly using alt data as part of their portfolio construction process, and 19% planning to do so in the next 12 months. In addition, 73% of investors said their use of alt data had increased over the last two years.

The majority of respondents worked in either asset management or wealth management, with nearly half of asset management firms reporting assets under management (AUM) of at least US$1 billion and one quarter reporting at least US$5 billion. More than half of wealth management firms in the survey reported AUM of more than US$1 billion.

The majority of respondents conducted business in the US (38%), closely followed by Europe (28%), the UK (21%) and APAC (13%).

©Markets Media Europe 2023

©Markets Media Europe 2025