While long-term equities allocations continue to rise, Noel Dixon, senior macro strategist at State Street Global Markets, noted that: “weakness among fixed income is broad-based.”

According to State Street Holdings Indicators, long-term investor allocations to equities were up slightly since December – maintaining their highest level for the past 16 and a half years.

Inflows rose by 5 basis points (bps), prompting a 3bps decline in cash equities and a 1.3bps fixed income outflow into cash.

Dixon, senior macro strategist at State Street Global Markets, commented: “The lion share of equity allocation was in the US. Long term investors re-allocated some of their exposure to Europe including the UK. That said, equity allocation towards Asia and Japan actually declined as of January. Fundamental concerns and prospects of tariffs on China likely drove this activity in the region.”

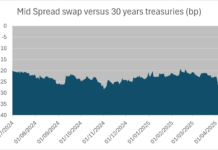

In bond markets, APAC saw significant selling over the month. Dixon noted: “Long term investors’ pessimism surrounding Asia Pacific Bonds persisted. 20d flows continue to show meaningful selling. Indonesia selling stands out with 20d flows in the bottom decile. To be fair, weakness among fixed income is broad-based, not just evident in APAC.”

The State Street Risk Appetite Index rose to 0.36 in January, despite unease around US tariffs. The index remained positive in the second half of 2024 following the US election.

©Markets Media Europe 2025