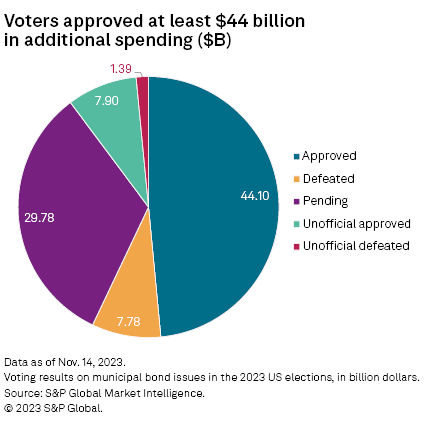

Voters across the US greenlit more than US$44 billion in new muni bonds at November’s elections, with 55% of all mooted bond measures approved and nearly a quarter voted down.

The data, compiled by S&P Global Market Intelligence, a division of S&P Global, signals a willingness from US citizens to fund local infrastructure and other projects such as schools, during the 7 November elections. The off-year elections included gubernatorial and state legislative elections in a few states, as well as numerous citizen initiatives and mayoral races.

An additional US$29.8 billion is in the pipeline as of 14 November, despite ‘higher for longer’ interest rates.

Most of the largest municipal bond issues were approved in Texas, with nine out of the top 10 originating from the Lone Star State. Barring pending and unofficial bond election results, Texas recorded the highest number of ballot measures, with 199 approved and 61 denied across the state.

Texas was also represented among the largest defeated bond measures, though the largest defeated proposal originated from Mesa, Arizona. The bond of US$500 million was designated for capital improvements and issued by Mesa’s public school district.

At US$2.5 billion, the two largest bond measures were authorised by Houston voters for local hospitals and by Charlotte, North Carolina, voters for school-related projects.

Voters in Minnesota, Michigan and Iowa were more divided on spending going toward proposed municipal bonds. Minnesota voters approved 25 proposals but denied 22, while Michigan voters approved 25 and denied 23.

© Markets Media Europe 2023

©Markets Media Europe 2025