MarketAxess, the operator of an electronic trading platform for fixed-income securities, has seen a rise in volumes of local currency bond trading in emerging markets since releasing its local market automation solution to all 28 EM countries at the end of last year.

Natalie Lowenstein, global EM product manager at MarketAxess, told Markets Media that clients are using automation solutions particularly when there are significant inflows or outflows as it makes a significant difference to workflows from an efficiency standpoint.

“Getting clients comfortable and showing the benefits of automation is one of the things we are looking at more broadly, as that can be more challenging in EM,” she said. “While adoption has been rising, there is still a lot of room for additional growth.”

Lowenstein continued that hard currency trading typically makes up 65% to 70% of EM volume but in June the split was almost 50/50. In the second quarter local currency trading was 44%, which Lowenstein said speaks to the fact that many emerging market central banks were early movers last year in starting their rate hike cycles to combat inflation.

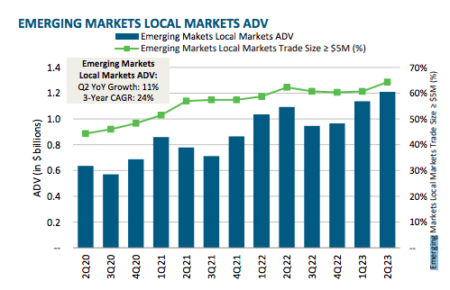

For July MarketAxess reported a 13.8% increase in emerging markets average daily volume to $2.9bn, driven by a 26.7% increase in local markets trading activity.

Chris Concannon, chief executive of MarketAxess, said in a statement: “Estimated market share trends in our international product areas, emerging markets and Eurobonds, are encouraging and we are starting to see a rebound in emerging market volumes on strong local currency activity.”

For the second quarter of this year MarketAxess reported record emerging markets estimated market share. There was a 10.7% increase in emerging markets local markets trading volume in the quarter driven by a record $31.2bn in the month of June.

“Local markets are a bigger proportion in the overall EM market, so that is a big opportunity,” said Lowenstein. “We are trying to solve for different client bases on the platform and the goal is to build bespoke but scalable solutions.”

Analytics

MarketAxess has also spent a lot of time building out CP+, its artificial intelligence-generated pricing feed, and it is available in all the core currencies in emerging markets. The intention is to continue to build out CP+ across all local currency bond markets.

“As we move forward there will be increased coverage for CP+ in local markets as our clients often highlight to us the lack of transparency in emerging markets,” added Lowenstein.

Another item that MarketAxess is working on is helping clients create alpha with high-touch workflows that use all of the firm’s data inputs to highlight specific trading tools or parameters that are more suitable for more sensitive trades. There are new analytics on the emerging markets platform such as Smart Dealer Select, which offers a data-driven approach to dealer selection.

“It is unique in terms of uncovering liquidity, especially from the many regional dealers who may be strong in particular names,” said Lowenstein.

In addition, MarketAxess has a successful high-touch trading workflow in emerging markets in Request-for-Market, where clients request a two-way market according to Lowenstein. Clients can now trade their initial risk and then negotiate directly for additional size behind an inquiry.

Open Trading

Lowenstein said Open Trading, MarketAxess’ all-to-all model, is widely used in emerging markets and has been pivotal to the firm’s offering in hard currency due to the fragmentation of liquidity. Many clients did not have access to all the regional players and Open Trading has stepped in as a key avenue for liquidity.

“We want to implement Open Trading across local markets as many of our clients have been asking for it for a long time,” she added. “Solving Open Trading in local markets will benefit international clients but will also give local clients an opportunity to access liquidity from more international dealers.”

In addition, MarketAxess has a dealer-to-dealer offering in hard currency and would like to open that up in local markets as well.

MarketAxess is also spending time building onshore trading solutions with protocols to suit clients within the region, such as in Brazil and South Africa, as their workflows are often slightly different from the international client base.

Latin America

There has been increased adoption of electronic trading in Brazil, Mexico and other major Latin American markets due to more demand for the region’s debt securities by both local and international investors, coupled with new technology solutions according to a report from consultancy Coalition Greenwich, The Growth of Electronic Trading in Latin American Bond Markets.

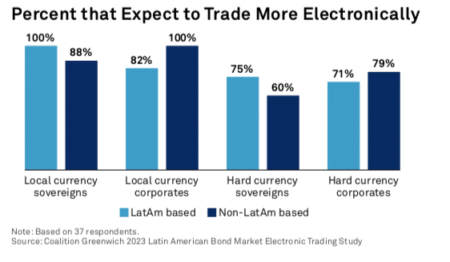

Kevin McPartland, head of research for market structure & technology at Coalition Greenwich, said in the report that nearly half, 46%, of participants traded hard currency corporate bonds electronically in the past year, with three quarters, 76%, expecting to trade more electronically going forward.

Local currency bonds are most likely to increase volumes of electronic trading. Those based in LatAm are most bullish on the growth in e-trading for government bonds, whereas international investors see more growth in trading corporate bonds according to the survey.

The research was based on responses from 45 investors and traders of Latin American bonds in Latin America, Europe and U.S.

“The continued development of a robust secondary market for trading Latin American debt securities—ideally one that is highly electronic—is a key piece of the path forward,” added McPartland. “For years, closed local markets, regulations that discourage international investments and a lack of standard trading mechanisms left trading largely manual, while major markets in the U.S., Europe and Asia pushed forward with their adoption of electronic trading.”

Access to all-to-all trading was cited by more than half of the participants in the survey as a key factor impacting their platform selection. McPartland said that MarketAxess’s Open Trading is, so far, the only all-to-all offering available for Latin American bonds.

“While there are many caveats, including bond type, liquidity profile, order size, and trader needs (e.g., fast execution at the expense of best price, etc.), all-to-all trading has proven to be a successful tool for both the buy and sell sides,” he added, “Global bond dealers can not commit capital to buy bonds from clients as they once used to, so both clients and the dealers themselves have sought liquidity through all-to-all channels to fill the gap.”

This article was first published on MarketsMedia.com

©Markets Media Europe 2023