The Federal Reserve Bank of New York’s market structure and macro analysts, Liberty Street economics, has examined how corporate bond market functioning has withstood rate rises monetary policy via the lens of its Corporate Bond Market Distress Index (CMDI).

While prices inform the CMDI, it measures market functioning and so change in the prospects for the economy may lower bond prices as default probabilities increase, but market functioning reflects bid-ask spreads, default-adjusted spreads, and conditions for bonds that do not trade.

As it characterises the ease of access to both primary credit market issuance and the ease with which that issuance can be re-traded in secondary markets, accounting for issuance volume, it is abel to correlate these with current activity.

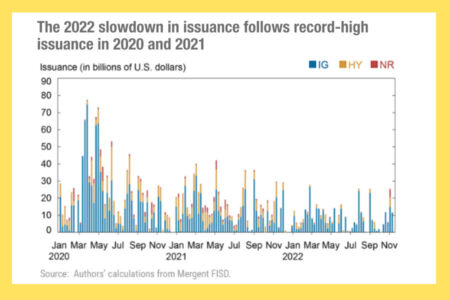

Based on the data it has seen, issuance measures have been particularly strained in the investment grade (IG) market due to record-high issuance in 2020 and 2021, which also reduced the amount of debt outstanding that would mature in the next year. Consequently, the current slowdown in issuance appears to be payback for market exuberance rather than a breakdown in primary market access for high-quality borrowers.

Tracking monetary policy tightening, it found that increases in the IG CMDI since the start of the current tightening cycle have been relatively modest, but the invasion of Ukraine by Russia in early 2022 had a far greater impact, with the IG CMDI deteriorating rapidly in that period, rising from the historical 5th to the historical 65th percentile in the space of eight weeks. In total it noted the overall CMDI has deteriorated but remains close to historical medians, while investment-grade CMDI index has deteriorated more than the high-yield, driven by low levels of primary market issuance.

©Markets Media Europe 2022

©Markets Media Europe 2025