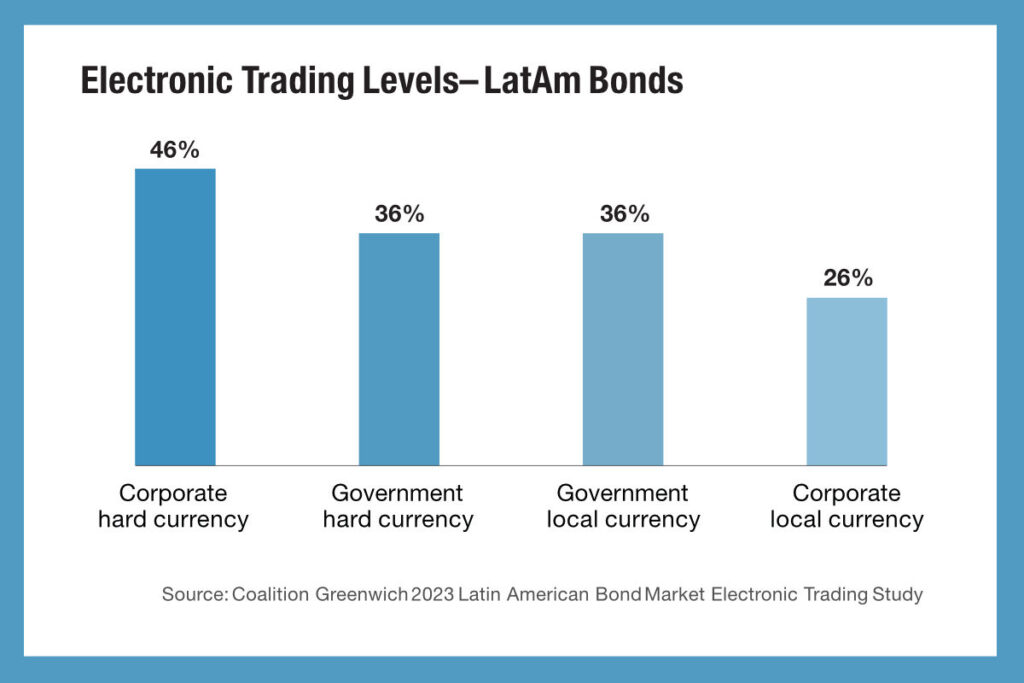

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to 26% for local currency credit and 36% of government bonds in either local or hard currency.

Analysis shows that over the past ten years, the US$3.3 trillion bond market in LatAm has grown considerably, thanks to appetite from both local and global investors. The split, with global investors typically taking hard currency assets and local investors absorbing local currency debt, has most recently been invigorated by the hard response to inflation by central banks in the region, driving up the returns for investors and in turn seeing trading volumes sustained longer and later this year than in the US or Europe.

Analysis shows that over the past ten years, the US$3.3 trillion bond market in LatAm has grown considerably, thanks to appetite from both local and global investors. The split, with global investors typically taking hard currency assets and local investors absorbing local currency debt, has most recently been invigorated by the hard response to inflation by central banks in the region, driving up the returns for investors and in turn seeing trading volumes sustained longer and later this year than in the US or Europe.

“Brazil, Mexico, Chile, and Argentina are the largest markets by value of bonds outstanding, with government bonds accounting for 60% of the market [vs credit] as of April 2023,” noted the report. “While the global run-up in interest rates in 2022–23 continues to hurt new issuance in the region, global and local demand for Latin American debt securities will continue to drive the market forward.”

The momentum of growth in LatAm debt trading is even more marked, with between 80-100% of investors in local currency bonds expecting to increase the level of electronic trading they are conducting, depending upon whether they are based inside the country or internationally, and between 60-79% of hard currency bond investors taking the same stance.

“Thankfully for investors and traders of LatAm bonds, the breadth and depth of e-trading offerings continue to grow,” wrote report author Kevin McPartland, head of research for market structure & technology at Coalition Greenwich. “Not surprisingly, liquidity and the cost to trade were the top two criteria when choosing among LatAm bond e-trading platforms.

Ultimately, liquidity is what these platforms are designed to provide and improve upon, so offering that service at a fair price is ultimately what will attract the most users. The quality of brokers on the platform ranked highly, which ties in closely with the desire for deep liquidity.” When selecting an e-trading platform, 59% of respondents noted liquidity depth and cost of trading as a key factor, while 51% cited all-to-all trading as a factor, as this increase the capacity to trade with a broader range of counterparties.

“The positive sentiment toward all-to-all was expressed by investors in Europe, the US and LatAm, and equally by traders and portfolio managers – all a sign of its growing role in global bond markets,” wrote McPartland. “All-to-all trading is a relative newcomer to the institutional bond market. MarketAxess led the way in 2012 when it launched Open Trading, allowing all-to-tall trading of US corporate bonds.

Bloomberg, Tradeweb, Trumid, and others have since followed suit with varying degrees of success in the US, Europe and Asia. To date, MarketAxess’s Open Trading is the only all-to-all offering available for LatAm bonds. While there are many caveats, including bond type, liquidity profile, order size, and trader needs, e.g. fast execution at the expense of best price, etc. all-to-all trading has proven to be a successful tool for both the buy and sell sides.

Global bond dealers can not commit capital to buy bonds from clients as they once used to, so both clients and the dealers themselves have sought liquidity through all-to-all channels to fill the gap.”

©Markets Media Europe 2023

©Markets Media Europe 2025