Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for investors.

Election shocks

Having been a big election year, 2024 saw surprises in emerging market economies with majority parties in India and South Africa losing their positions – by a little in the former case and a lot in the latter – leading to coalition rule for those markets. Markets have responded positively to stability having been asserted in both cases, although concern remains about political appointments in India leading to some caution.

By contrast, Mexico’s election delivered another surprise as the Moreno party won an unexpectedly large victory, which has raised investor concerns regarding expected reforms. These are summarised by analysts at investment firm Ninety One as:

- Reforms [of] the judiciary, essentially moving to a system where judges are elected. The judiciary has played a key role in preventing some of AMLO’s reforms from going ahead, so this would further weaken checks and balances.

- Reforms to the National Electoral Institute. This has been a target of AMLO, but so far he had been unsuccessful in weakening this independent institution.

- A pension reform, which could significantly raise the fiscal burden of providing much higher pensions.

- A minimum wage reform, ensuring that increases in minimum wages at least keep up with inflation. This would increase the persistence and stickiness of inflation.

Concerns have been raised over the peso, Mexican government debt and in the short term corporate bond market volatility.

This led to a sell-off, particularly in local markets and especially in the Mexican peso. We have moved to a more cautious view on the peso, which we expect to remain under pressure when AMLO’s reform plans get pushed through in September – as is now expected. We remain cautious on the outlook for Mexican sovereign bonds – we already had concerns over a deteriorating fiscal position this year, which will be difficult for the next administration to adjust, and sticky inflation is preventing the central bank (Banxico) from being more aggressive in its rate cuts.

While the election result may drive up volatility in Mexico’s corporate bond market, we maintain a positive long-term view given strong corporate fundamentals and structural tailwinds that benefit both exporters and domestic producers.

GCC debt dominates

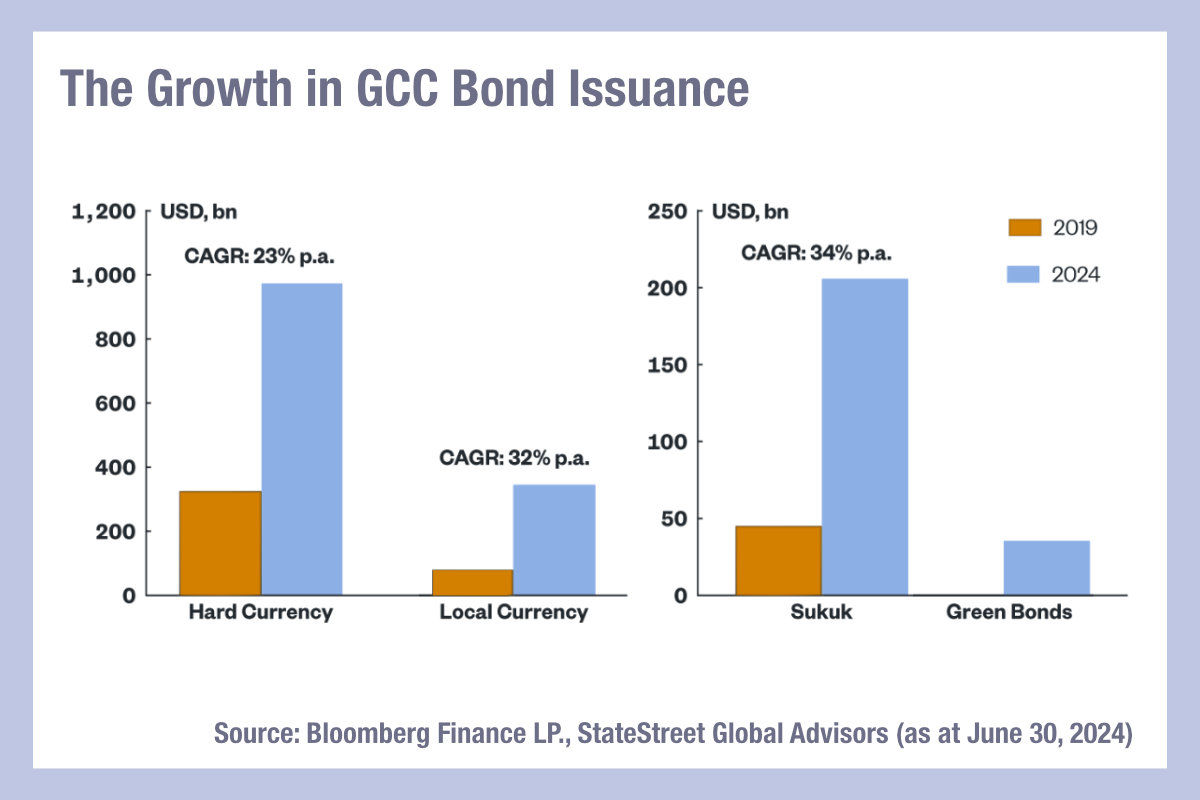

“GCC countries have been very active in the bond markets over the past five years in order to fund economic growth plans based on diversifying their economic bases”, writes Anand Datar, senior portfolio specialist in the Global Fixed Income Portfolio Strategists team at State Street Global Advisors (SSGA). “As of end-June 2024, the total amount of outstanding bonds issued by this group has more than tripled since 2019 to nearly US$1.28 trillion — this is across both sovereign and corporate issuers. Bond issuance in local currency has grown from a very low base, indicating an important deepening of the local bond markets and investor base. As a proportion of that total, hard currency debt accounts for approximately 75%, down from about 80% five years ago. This trend reflects ongoing policy efforts to deepen local bond markets. Sukuk issuance has also been on a significant rising trend, with Sukuk-labelled outstanding debt of US$205 billion — of which Saudi Arabia makes up about 50%.”

Fitch Ratings has observed that countries in the Gulf Cooperation Council (GCC), Malaysia, Indonesia, and Turkiye all accounted for 51% of all US dollar debt issued by EMs (excluding China) In the first five months of 2024 with an expectation that this growth will continue in the next year.

The firm reports “[This will be] driven by government initiatives to develop the debt capital markets (DCM), diversify funding, finance fiscal deficits, government projects, and maturing debts. Sukuk is also maturing as a key funding and policy tool, accounting for 12.4% of all EM dollar debt issued so far in 2024 (excluding China; 2023: 15%; 2017: 5%).”

Ex. China EM dollar debt issuance in that period was dominated by Saudi Arabia (19%), followed by Argentina (9%), the UAE (9%), Brazil (9%), Turkiye (8%), Indonesia (6%), Mexico (5%), and Chile (4%), Fitch Ratings says.

Saudi Arabia was added to the watchlist for inclusion in JP Morgan’s Government Bond Index – Emerging Markets in October 2023, and its inclusion would potentially yield considerably increased investor flows.

“The continued development of its local debt market, along with the potential inclusion in the GBI-EM index, signals a positive trajectory for the kingdom’s financial markets that would help attract more foreign portfolio investment,” wrote Sorin Pirau, portfolio manager at Janus Henderson in April 2024.

Fitch has upgraded the ratings of Saudi Arabia, Türkiye, Qatar and Oman over the past 18 months.

©Markets Media Europe 2024

©Markets Media Europe 2025