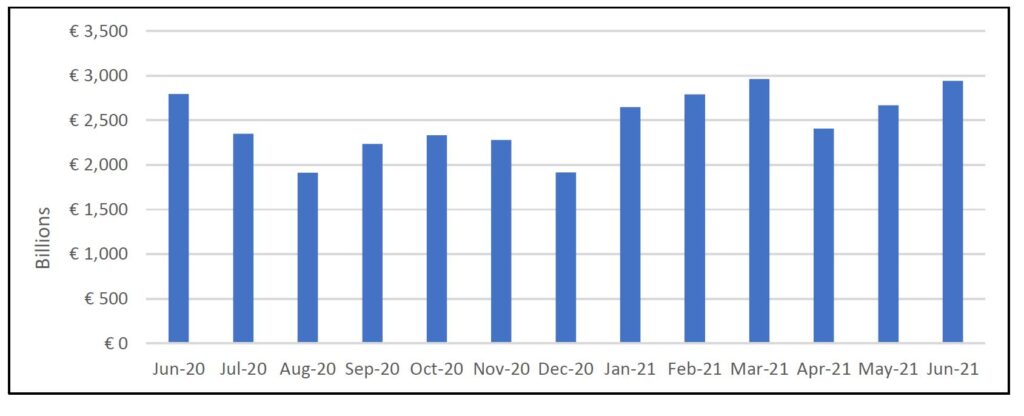

European volumes in sovereign bonds traded in the secondary market continued to bounce back to its near 18-month peak, according to MarketAxess data, with a total volume of €2.94 trillion, against previous total volume record highs in the previous 18 months of €2.96 trillion during the March 2021 sell-off, and €2.84 trillion in March 2020.

In Eurozone government issuers, total volume traded in June remained at over €1.4 trillion, with a slight decline in monthly average daily volume (ADV), down from €75 billion to €64 billion.

Total volume traded in Italian government bonds remained high, at €430 billion, reportedly the second highest monthly total volume in the past 18 months.

Secondary trading volumes in German debt also remained high, at €287 billion, the third highest it has been in 18 months after a peak of €311bn in March 2021.

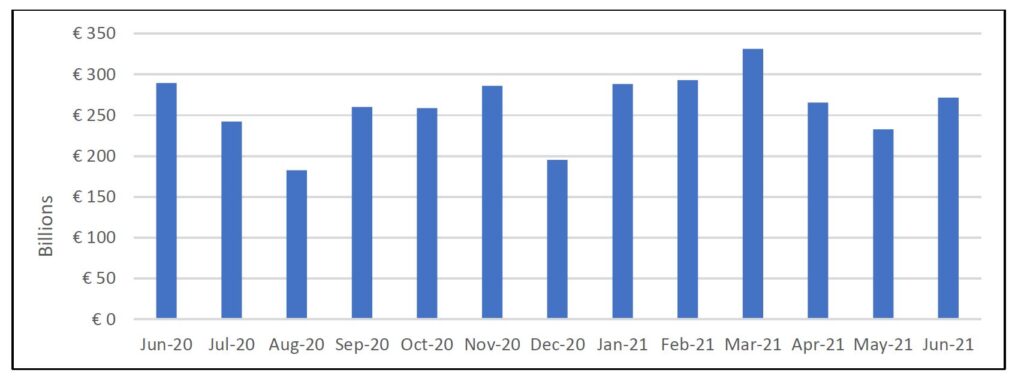

European secondary corporate bond market volumes bounced back from their dip in May, with a total volume traded of €271 billion, up from €232 billion in May.

MarketAxess’s analysis via Trax Emerging Markets and Trax Eurobonds processed volume represents approximately 60% and 75% of the total European market, respectively.

©Markets Media Europe 2025