In the first quarter of 2025, global debt capital markets (DCM) activity retreated while JP Morgan maintained its position at the top of the league tables.

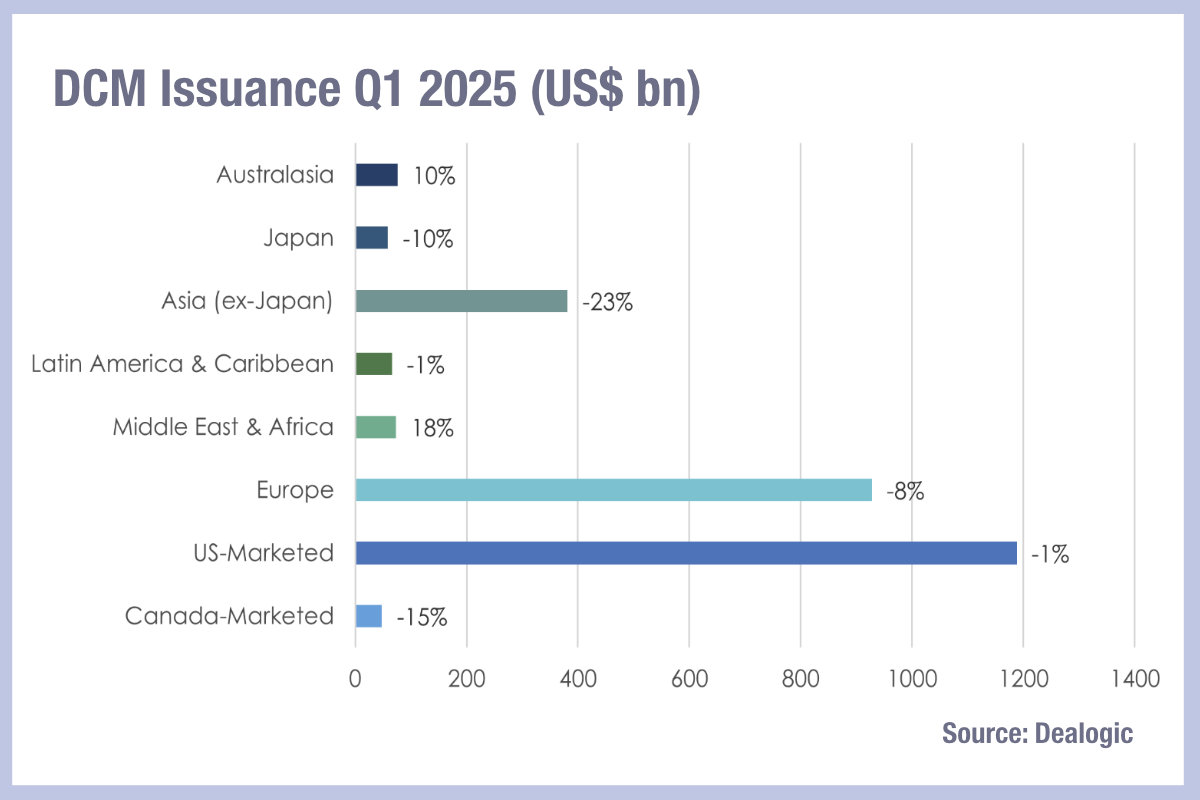

Primary markets activity varied significantly by region but was mostly down in Q1. While US-marketed deals fell just 1% to US$1.19 trillion, European issuance declined by 8% to US$927.5 billion. In contrast, the Middle East & Africa posted an 18% rise to US$73.1 billion, and Australasia recorded a 10% rise to US$75.8 billion. Asia ex-Japan contracted the most, with notional issuance declining 23% to US$380.9 billion.

According to Dealogic’s Q1 2025 rankings, global underwriting revenue reached US$7.7 billion, with contributions from American issuers (US$3.8 billion), EMEA (US$2.4 billion), and Asia (US$1.4 billion). Total corporate issuance amounted to US$849.8 billion. Notably, investment-grade bonds accounted for a substantial US$745.7 billion (approximately 88% of total), leaving high-yield – or non-investment-grade – issuers with US$104.2 billion.

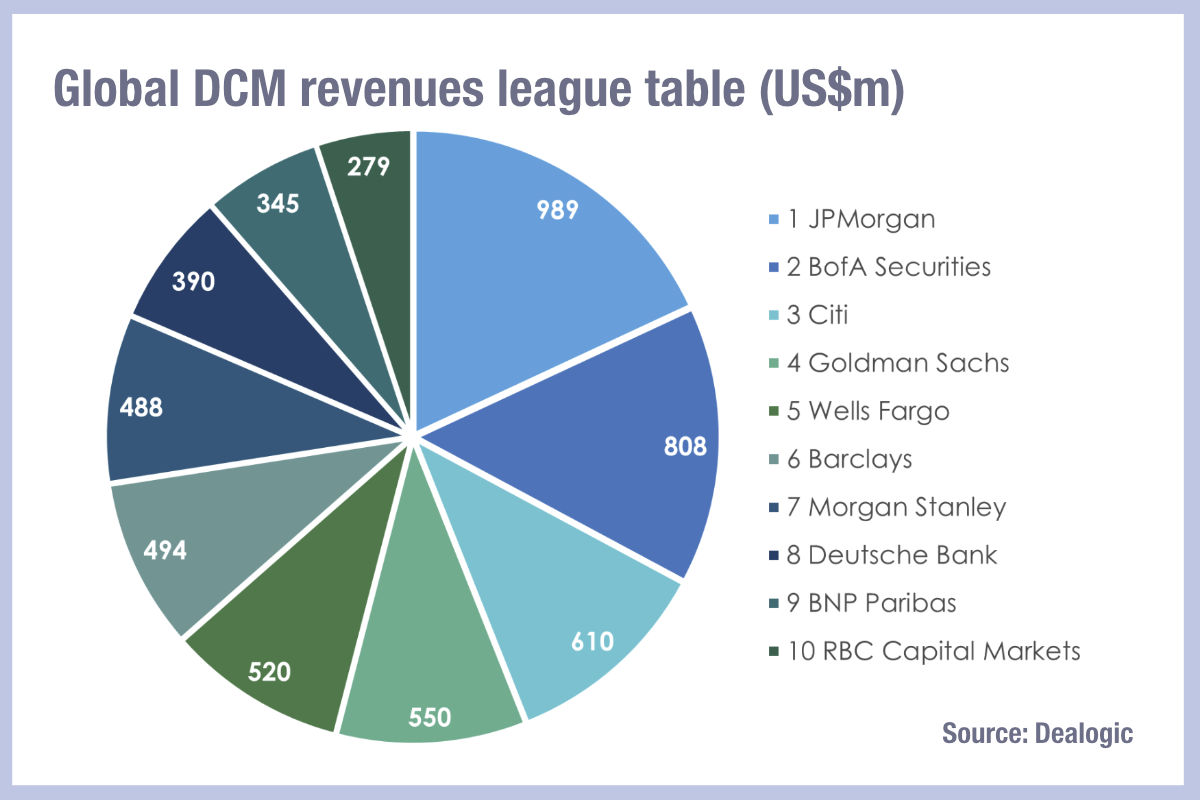

In the fixed income revenue rankings, JP Morgan led with US$989 million (8.9% market share), followed by BofA Securities with US$808 million (7.3%), Citi with US$610 million (5.5%), and Goldman Sachs with US$550 million (5.0%).

©Markets Media Europe 2025