According to Troy Rohrbaugh, head of global markets at J.P. Morgan, the bank will be investing in electronification of credit trading where it has made less progress than in other asset classes.

Rohrburgh said at JP Morgan Chase’s investor day on 23 May that the firm has been investing in electronic trading for a long time as market structure has continued to evolve rapidly.

The investments have been in infrastructure to provide common technology platforms which helps the bank scale faster than peers; workflow automation which improves algos through structured datasets; organisational agility which allows more effective coverage of clients with data-driven decision making; and to drive market structure evolution with participation on third-party venues and the use of standard APIs for direct connectivity.

He added: “These investments have paid off across our products in cash equities as low-touch revenues have seen double digit growth.”

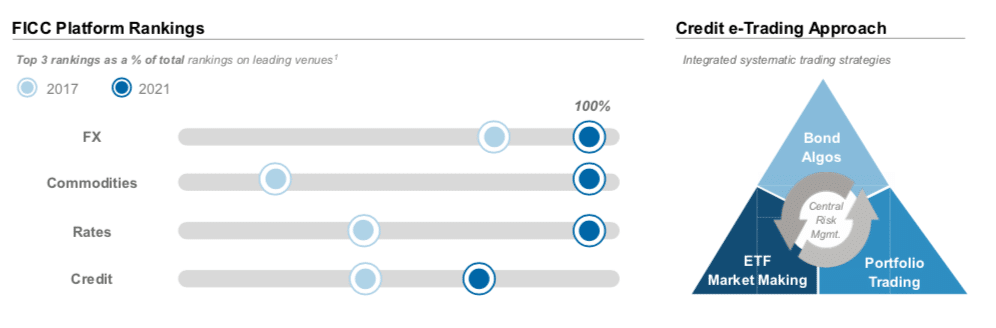

In fixed income one of the metrics tracked by the bank is rankings on key fixed income, commodities and currency platforms and it has increased top three rankings across all products.

The bank is particularly pleased with progress in commodities and rates, and Rohrburgh said that despite being number one in foreign exchange there is still real scope for upside. The size and scale of the FX electronic trading franchise has allowed the bank to grow volumes and share in CLS, the global FX market infrastructure, according to Rohrburgh.

“We plan to replicate the FX strategy at size and scale across the rest of FICC,” he added. “In credit specifically, which is behind other asset classes, the electronification journey is rapidly evolving and we see lots of opportunity.”

The bank is systematically investing in credit trading capabilities such as pricing individual bonds, but also entire portfolios and exchange-traded funds. “We are committed to being a top-tier player in this space,” said Rohrburgh.

Rohrburgh added that the bank feels that areas where it has made investments will continue to pay off, such as central risk management, migration to the cloud, data and analytics, artificial intelligence and machine learning.

“Our strategy remains the same, which is to remain the leading markets franchise regardless of the macro environment,” he added. “We achieved this by doubling down on our already strong client relationships, capturing secular growth, such as large clients getting larger concentration in the wallet, and investing in new asset classes such as private alternatives.”

Marc Badrichani, head of global sales and research in the corporate and investment bank, said at the investor day that growth in fixed income market share has been the same as in equities.

Badrichani said: “The million dollar question is what is going to be the wallet going forward and that is very hard to predict.”

He believes that in a normal market the bank’s breadth and diversity will provide growth. However, if high volatility continues and the bank demonstrates the same risk discipline, the business benefits from widening bid-offer spreads and a flight to quality.

“Our business generates a tonne of data but you can be data rich and information poor unless you invest in AI and machine learning,” Badrichani added. “This is what we’re doing to provide real-time alerts for the sales force in trading.”

The business will also be focussing on private/alternative assets, which are expected to continue to grow at double digits over the next couple of years.

“Our asset manager clients are getting more organized, our private equity clients are getting larger and despite headwinds with the rise in interest rates we still believe that this asset class will perform very well,” said Badrichani.

Daniel Pinto, president and COO of JPMorgan Chase and chief executive of the corporate & investment bank at J.P. Morgan, said at the investor day that total investment spend in 2022 is $3.8bn, with $3.1bn of spending on technology.

Pinto said investment banking will be focusing on four strategic pillars – middle market financial sponsors, private capital, Asia Pacific and ESG.

“Private capital is a huge area of growth so we are launching Capital Connect by J.P. Morgan, a digital platform that will allow us to connect early-stage companies with potential investors in a very efficient way,” he added.

He highlighted the launch of Fusion by J.P. Morgan, a platform which provides data management, reporting and analytics solutions across the investment lifecycle for institutional clients.

“Fusion is about solving the data problem for our clients,” Pinto said. “They can ingest data in a standardized way and use it more effectively to generate investment and operational alpha.”

Pinto said this year has been a very tight environment for banking with a substantial reduction of market share of wallet, so the firm expects core banking fees to fall year-on-year from the second quarter of 2021by around 45%.

In contrast, markets had very good momentum in the first quarter which is continuing into the second quarter.

“We think markets will be up between 18% to 20% as compared with the second quarter of last year,” said Pinto.

This article was first published on Markets Media’s Global Trading, May 23, 2022.

©Markets Media Europe 2025