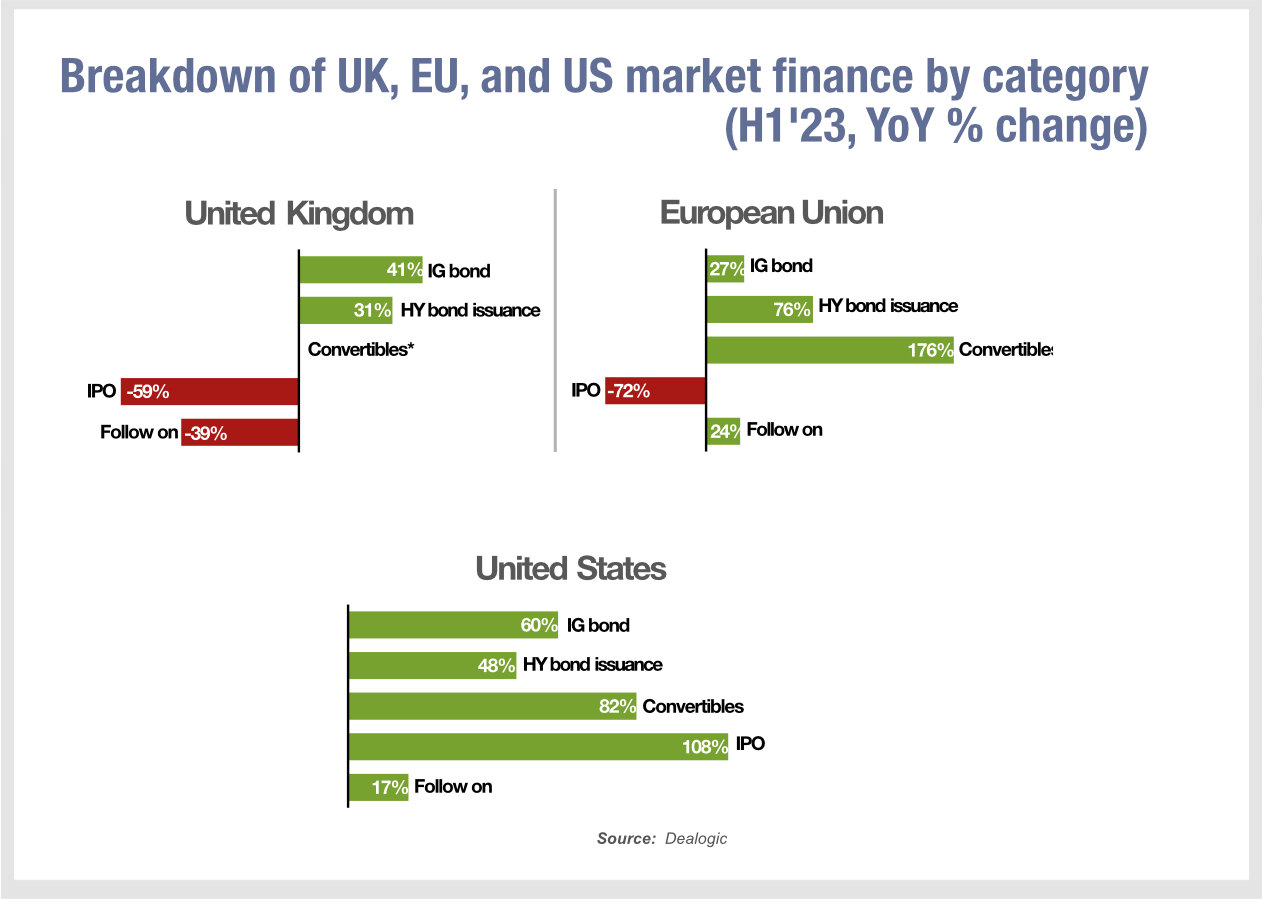

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the last three years on average, UK corporates have raised approximately a quarter of their total new funding via public markets, which is a similar percentage to the United States, but a far greater proportion of this reflects debt issuance than in the US or in mainland Europe.

While the report notes that the other 75% of funding is through banks, this means the UK firm use both equity and debt capital markets to a greater share of funding than in other European countries. AFME’s analysis indicates that the three-year average Market Finance Indicator in France and the Netherlands are around a third lower than the UK and Germany two-thirds lower, which at 9.4% is closer to the European Union average.

For equity markets, the UK is far less active. As a consequence, UK corporates are more exposed to the vagaries of bond markets that companies in other countries. Of course, UK domiciled companies are also not massively represented on the UK stock market, so the level of UK bond issuance is likely to suggest an even greater skew to debt that the AFME figures suggest.

Not only will UK companies potentially be more exposed to rate changes than in other countries, they may also suffer more significantly when secondary market liquidity is worsened, which typically increases borrowing costs.

As one corporate treasurer noted to me recently, firms are increasingly keen to engage with the investors who are acquiring their debt in the primary and secondary markets, to understand why investors hold their debt, and thereby optimise the borrower/lender relationship as they also do for bank issued loans.

©Markets Media Europe 2024

©Markets Media Europe 2025