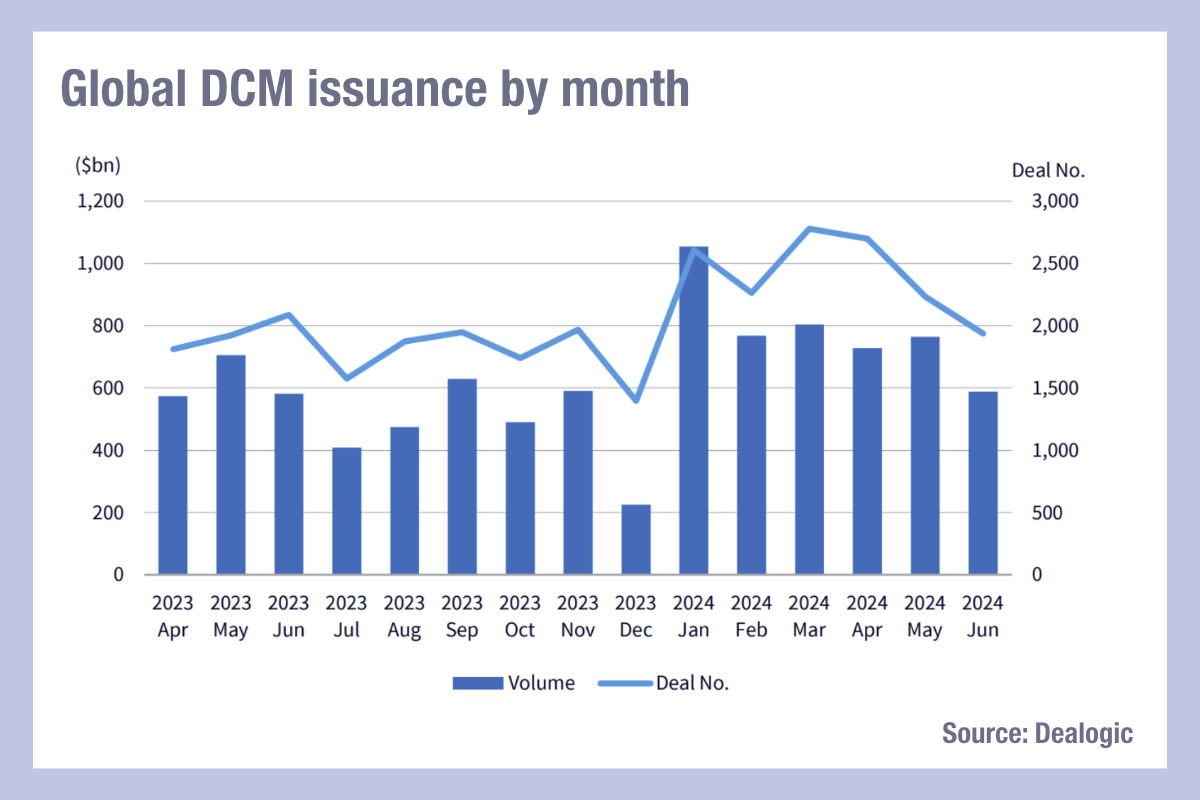

The debt markets have been booming globally in the first half of 2024, according to Dealogic data, with Middle East and Africa seeing issuance grow 48% for that period year-on-year (YoY) to US$97 billion, Latin America and Caribbean growing 42% YoY, and US marketed bonds and loans tipping 32% YoY to hit US$2 trillion.

Canada is up 28% and Asia (ex-Japan) has grown 26%, reaching US$118 billion and US$811 billion respectively.

Although Europe only grew 17% it has still seen US$1.6 trillion in debt issuance which makes it the second largest primary market, while Australasia raised US$139 billion for a 13% lift on the year before.

“Global DCM revenue paid to underwriters this year totalled US$14.6 billion; US$7.3 billion was paid by American issuers, US$4.5 billion by EMEA, and US$2.9 billion by Asian firms,” the report noted. “Corporate issuance totalled US$1586.1 billion, with US$1370.4 billion from investment-grade issuers and US$215.7 billion from non-IG ones. Cross-border deals from EMEA issuers totalled US$1591.5 billion, whereas issuers from the Americas sold US$1395.3 billion of bonds and APAC US$309.3 billion.”

The big US banks are still taking the lions share of revenue from these deals globally, with JP Morgan, BofA Securities, Citi, Morgan Stanley and Goldman Sachs taking the top five slots for deal volume, followed by BNP Paribas, Barclays and Deutsche Bank, then Wells Fargo and HSBC.

This activity level will be supplying bond funds with a significant amount of investible assets but ongoing concerns about ‘tourist’ investors, those dipping into bond markets, are ongoing as they accept worse deal terms from syndicate banks, eliminating the issuance premia on offer.

At that point issuance can become a drag with deals falling through as that potential value is lost and time spent is wasted.

A more electronic process, that sponges less time, is still being looked for amongst buy-side traders.

©Markets Media Europe 2024

©Markets Media Europe 2025