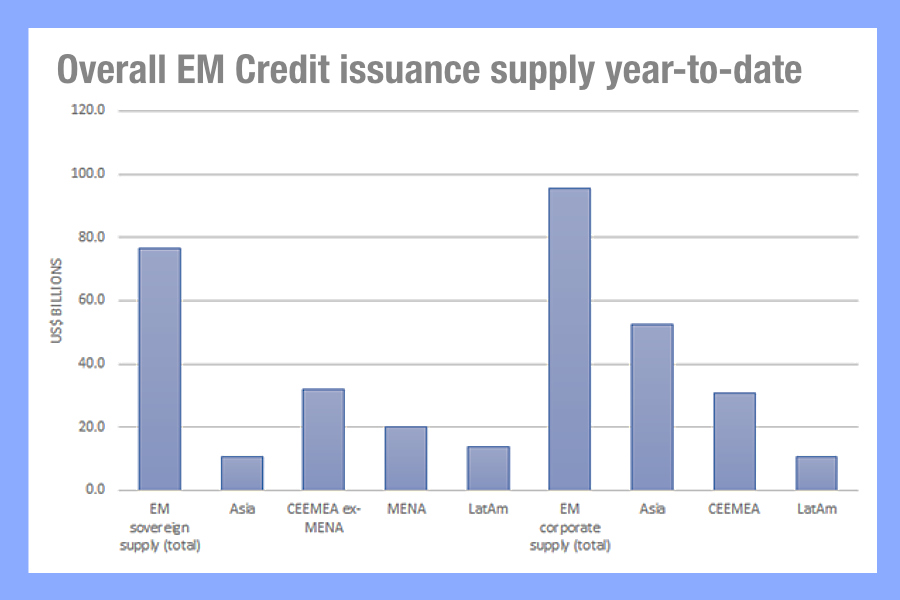

Over the past week emerging markets (EM) credit issuance saw US$7.6 billion in newly issued bonds, against US£900k the week before, while on the sovereign side issuance reached US$1.4 billion which Morgan Stanley analysts report brought the year-to-date sovereign supply to US$76.6 billion.

This is US$30.8 billion more that seen in 2022 in sovereigns, and is 80.8% of the gross supply of government bonds issued last year on a gross basis, while meeting “50.8% of our projected 2023 supply” according to the MS team.

Following a tough year for EM investors in 2022, the supply of new debt will be welcome, with Mexico being a major issuers year to date, and potentially later in the year, with other Latin American countries including Chile, Peru and Uruguay also expected to be issuers for investment grade (IG) debt. Qatar may also offer IG to the market and potential high yield (HY) issuers include Oman, Turkey and Uzbekistan.

So far US$12.1 billion has flowed into EM debt this year, with the majority of hard currency investment being via active, global mandates. As new issues support price formation and liquidity, matched with the cash inflows this suggests a more positive liquidity picture than was seen in 2022, when the sector was struck by the war in Ukraine and foreign exchange controls.

©Markets Media Europe 2023

©Markets Media Europe 2025