By Iseult E.A. Conlin, CFA., Managing Director, U.S. Cash Credit, Tradeweb.

Digital transformation is happening in industries all over the world. Whether it’s video streaming services disintermediating cable, retail banking apps competing with branches or digital payments replacing cash, many leading industries have adopted a pandemic-fueled disruption narrative where digital solutions are becoming the new norm.

Bond markets are no different. News outlets have pointed to data from Coalition Greenwich, which shows that electronic trading in the U.S. corporate bond market has grown by more than 100% over the past three years. Tradeweb’s credit trading volumes are leading this trend, setting new market share records every year for the past three years.

But these big headline numbers may not always show the whole picture. To really understand the larger trend of digitization it’s important to look closely at how innovative technologies are shifting behaviors within credit markets.

Watching the Trends

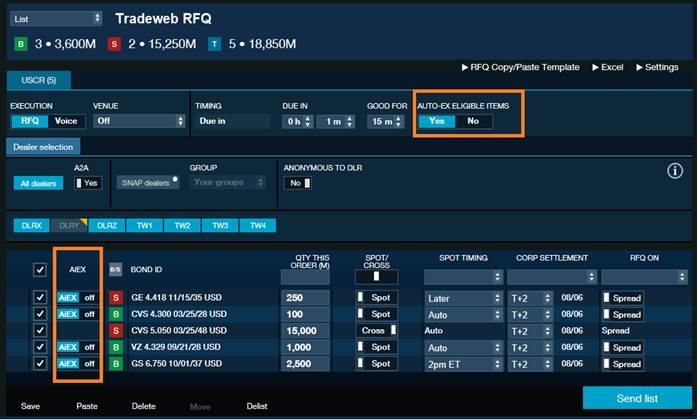

Digitization, or what is referred to as “electronification” in the corporate bond market, is having a larger impact on credit market structure now than what we may have seen a decade ago. For relatively small, highly-liquid trades, we’re seeing a growing trend toward automation using our Automated Intelligent Execution (AiEX) tool. Last year, we introduced a request-for-quote (RFQ) list ticket with both manual and AiEX-eligible items, meaning some items will trade manually while others are tagged for optional auto-execution if the trader decides to utilize it at the item or ticket level. This innovative functionality offers a more efficient way to RFQwhile keeping the trader in full control.

RFQ with AiEX eligible items

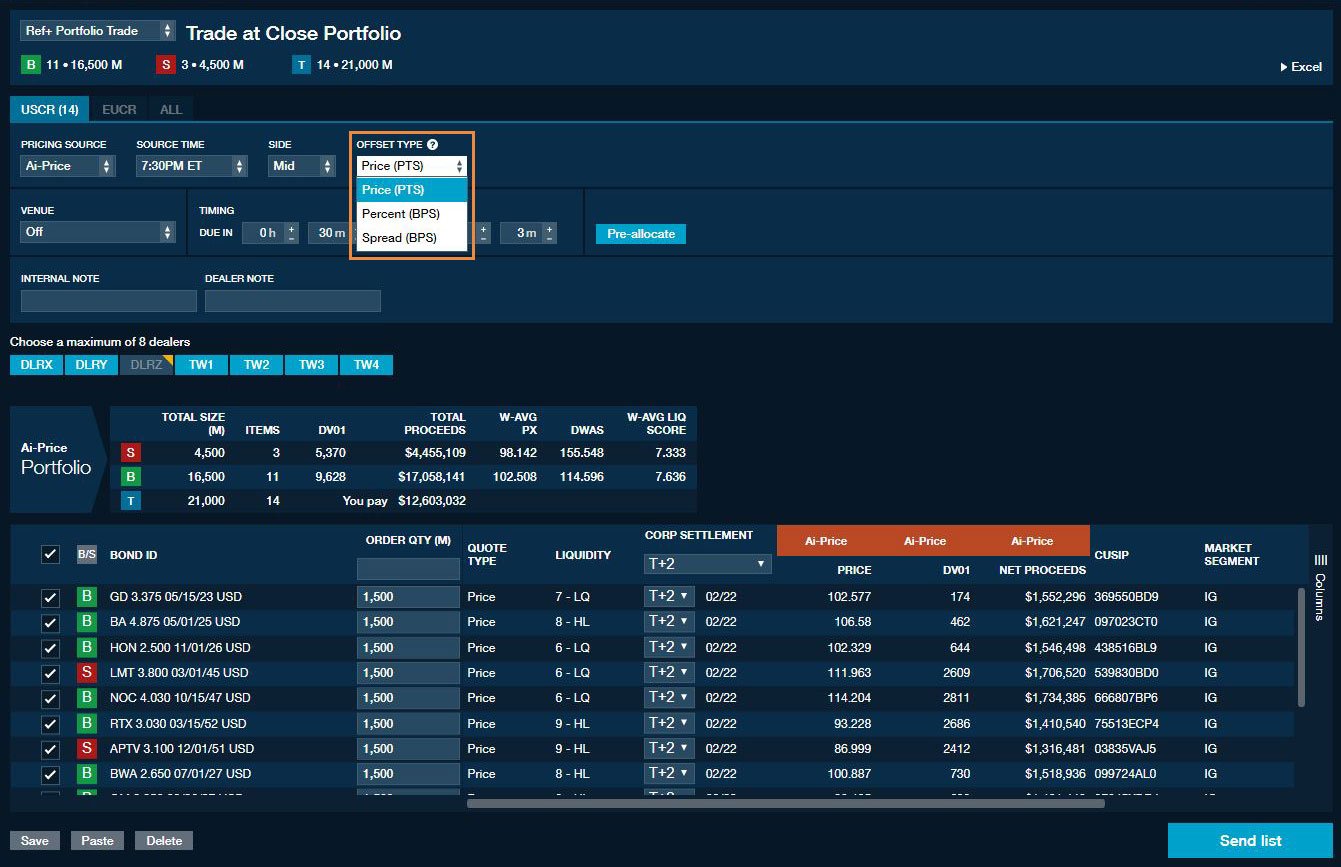

At the other end of the electronic spectrum, we’re seeing an increase in adoption for much larger and complex trades that may include less liquid bonds. In this case, traders are using our Portfolio Trading protocol which allows them to package multiple bonds into a single basket of buys and sells, negotiate a portfolio level price, and execute the trade in a single electronic transaction. Portfolio trading allows institutional traders to quickly execute upwards of several hundred or thousands of line items – which historically would have taken a day or two of passing spreadsheets back-and-forth to resolve.

Portfolio Trading against a reference price

Together, this combination of increased efficiency and the ability to create instant liquidity at significantly high hit rates is expanding the universe of trades that can be done electronically.

Breaking Through

As we continue to explore these trends further, it is clear that we are coming up on a new era of electronic credit trading. If this pace of digital adoption continues, we expect electronic trading to play an increasingly dominant role in credit markets.

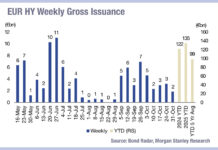

The fact of the matter is, credit markets have been evolving gradually for the better part of a decade but there will be no single moment when everything suddenly changes. What we are seeing is steady increases in technology adoption and clients benefitting from an electronic trading workflow. While the number of institutions trading credit electronically and adopting RFQs with AiEX and portfolio trading protocols accelerated rapidly over the last two years, for example, there are still many newcomers ramping up now to move significant volume electronically. We’ve also seen some regional differences in adoption rates for different tools and capabilities. Tradeweb’s AllTrade network, for example, rolled out all-to-all trading first in the U.S. and is now gaining a stronger following in Europe. On the flip-side, Dealer Sweep sessions, which allow users to tap into the residual liquidity originating within the wholesale market, had its proof of concept in Europe and is now building steam in the U.S.

Regional microtrends and varying client preferences and behaviors like these are what’s really shaping the credit markets today. It is not about sudden transformation, it is about equipping more participants with more tools to access liquidity, accurate pricing, and streamlined workflows.

Is this the new era for credit trading? Yes, we think so. However, as we ask ourselves that question year- after- year, the answer will continue being yes. The truth is our clients dictate the pace of change and working alongside them drives our innovation each day. Tradeweb is a company built on breakthroughs—consistent and meaningful solutions created for clients’ real-world needs and challenges.

Related Content

©Markets Media Europe 2025