Traders are reporting the positive effects of innovation upon market liquidity but central banks hold all the cards.

Traders are reporting the positive effects of innovation upon market liquidity but central banks hold all the cards.

The association between the Covid 19 pandemic and the market sell-off in March last year is so close, one could forget that several factors including a price war over oil, led to sell-side firms reining back their risk position, to the extent many did not even trade the world’s largest risk-free asset, US Treasuries, at the height of the crisis.

As cautious optimism about the Covid vaccination grows, it would be complacent to assume the risk of another event has moved beyond reach. Trading volumes have been variable this year, starting higher than 2020’s first quarter – despite the absence of that year’s big sell-off – before declining somewhat. Yet traders report liquidity has been fairly consistent in the markets.

There has been no significant change reported in traditional sell-side market making – one European buy-side trader speaking on background observed that all dealers seem to be making markets, although the pool of bonds on offer has shrunk a little bit. This small decline been countered somewhat by an expanding list of securities being catered for by electronic liquidity providers such as Citadel, Flow Traders and Jane Street.

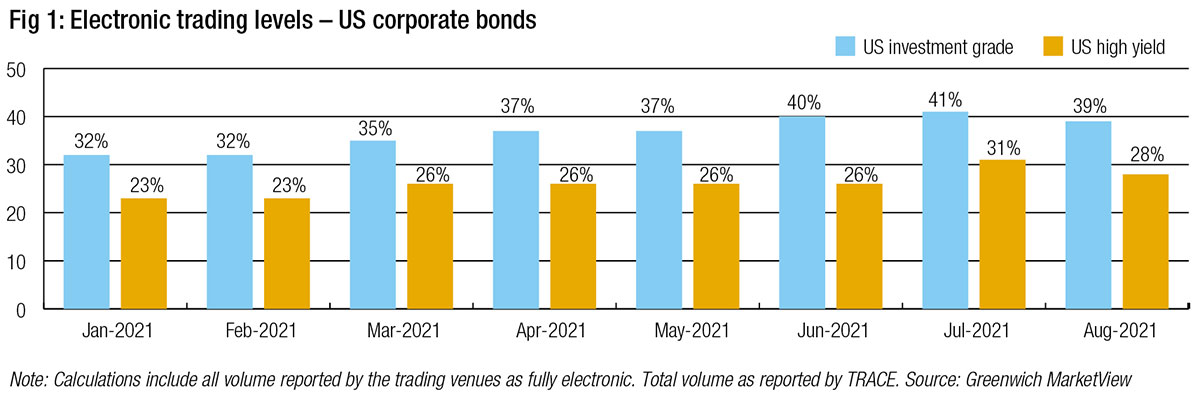

In the US, markets are also looking strong, traders observe, with a growth in electronic trading, according to Greenwich Associates’ analysis of data on TRACE (see Fig 1), the post-trade bond reporting tape.

“As a macro trend we have seen good supply this year, it really does have a material impact on overall liquidity in the market, especially in euro and US corporate heavy year supply,” says Trent Houston, fixed income product strategist at Jane Street. “That drives a decent amount of trading, so in the first half of the year in particular we seen this high yield in the US got off to a record start, IG was running at a very hot pace, you saw that influx of new issue that helped.”

“As a macro trend we have seen good supply this year, it really does have a material impact on overall liquidity in the market, especially in euro and US corporate heavy year supply,” says Trent Houston, fixed income product strategist at Jane Street. “That drives a decent amount of trading, so in the first half of the year in particular we seen this high yield in the US got off to a record start, IG was running at a very hot pace, you saw that influx of new issue that helped.”

The suggestion is that the many innovations developed between trading venues, sell-side firms and technology providers are bearing fruit on both sides of the Atlantic.

“As a whole, the long term trends certainly speak to the various new and evolving liquidity channels that participants and market makers like ourselves access,” says Houston.

“The US is a very good market not only in terms of investment grade (IG) credit, but also of high yield,” says Daniel Leon, global head of trading at HSBC Asset Management. “It’s a market that goes further down the liquidity curve. The interesting point is that it’s share of electronic volume is increasing but slower than Europe. I do like this market, it’s really technical, it’s very inventory-driven and I would say that’s why it’s less electronic.”

“The US is a very good market not only in terms of investment grade (IG) credit, but also of high yield,” says Daniel Leon, global head of trading at HSBC Asset Management. “It’s a market that goes further down the liquidity curve. The interesting point is that it’s share of electronic volume is increasing but slower than Europe. I do like this market, it’s really technical, it’s very inventory-driven and I would say that’s why it’s less electronic.”

“The ability to trade has been fine,” says Stuart Campbell, head of trading at BlueBay Asset Management.

Better opportunity

There has been a clear increase in the use of non-traditional protocols, some of these more novel than others.

“Probably the single biggest change for me, following the blow up last March, was that we used that event as a launching platform to try doing portfolio trades, and we have been doing quite a few of them since then,” says Campbell. “That’s probably one of the single biggest changes and the single biggest additive structure in the market that helps me manage liquidity.”

“Probably the single biggest change for me, following the blow up last March, was that we used that event as a launching platform to try doing portfolio trades, and we have been doing quite a few of them since then,” says Campbell. “That’s probably one of the single biggest changes and the single biggest additive structure in the market that helps me manage liquidity.”

He also notes that all-to-all trading is going from strength to strength. “It might have been 2% of peoples flow a couple of years ago, maybe that’s now up to 5-8%,” he says.

Leon says, “I think access to other client flows is useful, that being said, as long as there is no consensus on the price of a bond, these protocols are not going to be a major success or source of liquidity. While on the equity side they are important, I don’t see that happening in fixed income until we have a mid-point price.”

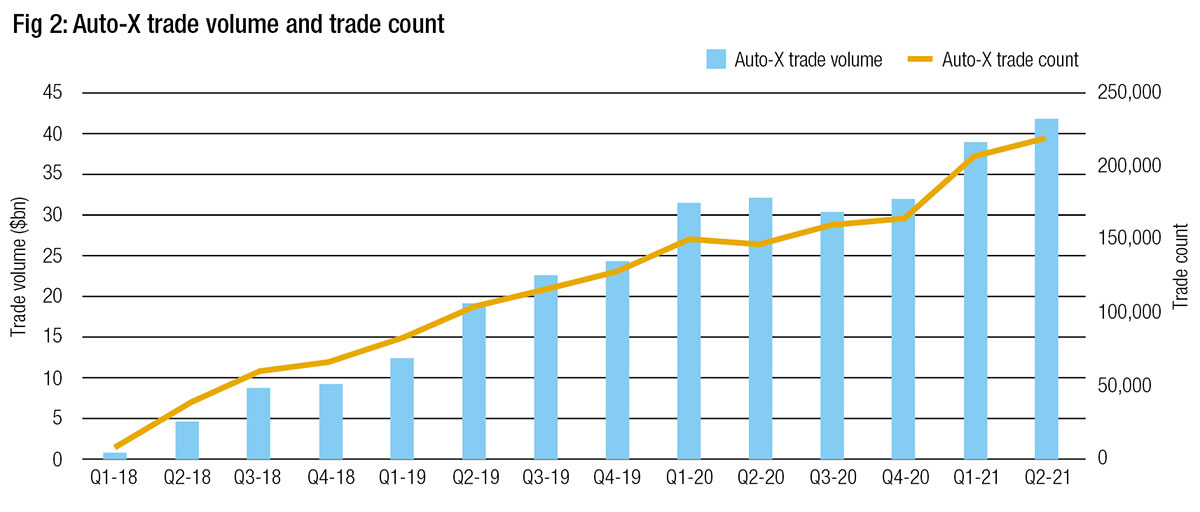

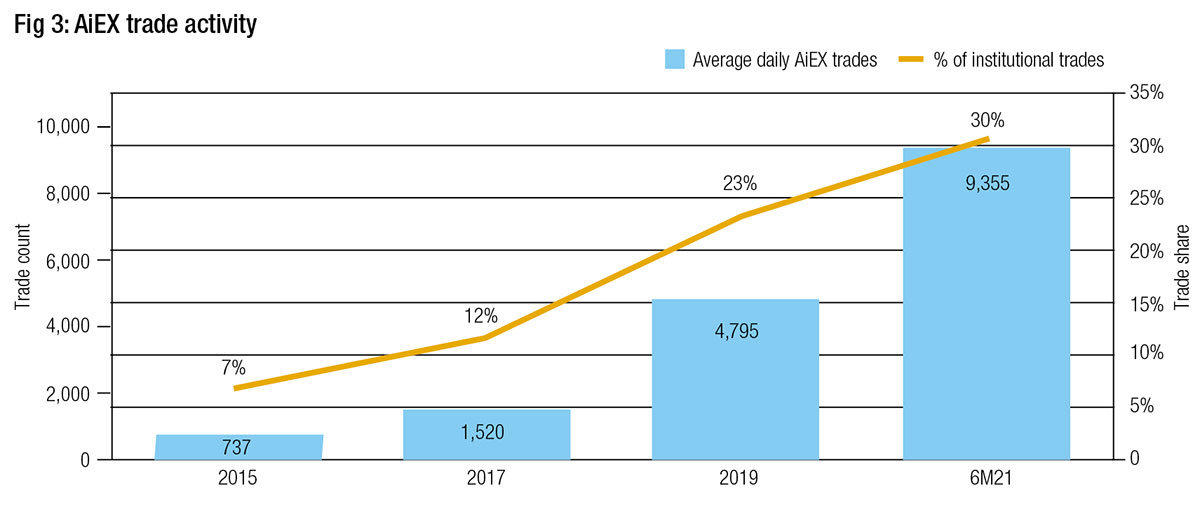

Automated trading is also growing, reducing the burden on buy-side desks to process low touch trades that are small margin for brokers and have a clear execution process for the investment manager. Both MarketAxess (Fig 2) and Tradeweb (Fig 3) report significant growth in automated trading over the past year.

However, the protocols themselves are undermined by the lack of centralised structure in the market which reduces transparency of liquidity and price formation.

However, the protocols themselves are undermined by the lack of centralised structure in the market which reduces transparency of liquidity and price formation.

“My experience is when we have two buy side traders on both sides, it is difficult for them to agree on what is a real mid.; that being said it’s something I would support, I think it’s the structure with the fixed income market that prevents it from reaching its potential,” says Leon. “Price discovery is what people are trying to establish through the consolidated tapes, but it’s not there yet.”

Campbell notes that portfolio trading has limitations around what will make it a success.

“The conditions have got to be right, it’s not going to be the right trade to do every time. But knowing that you can go to your risk manager and say, we have got daily liquidity funds and I can sell a vertical slice for this to fund, 30 per cent of it can go with a guaranteed price, that is just music to their ears.”

No pressure

While these market mechanisms have been improving, their effectiveness is really determined by sell-side appetite.

“An electronic market in the bond world is only as good as the liquidity provider behind that market,” notes Leon.

What determines bank engagement with the market are regulators and central banks. Banks have made the case that they cannot provide liquidity when it incurs a significant cost to their balance sheet, via the Basel capital rules, including the supplementary leverage ratio (SLR).

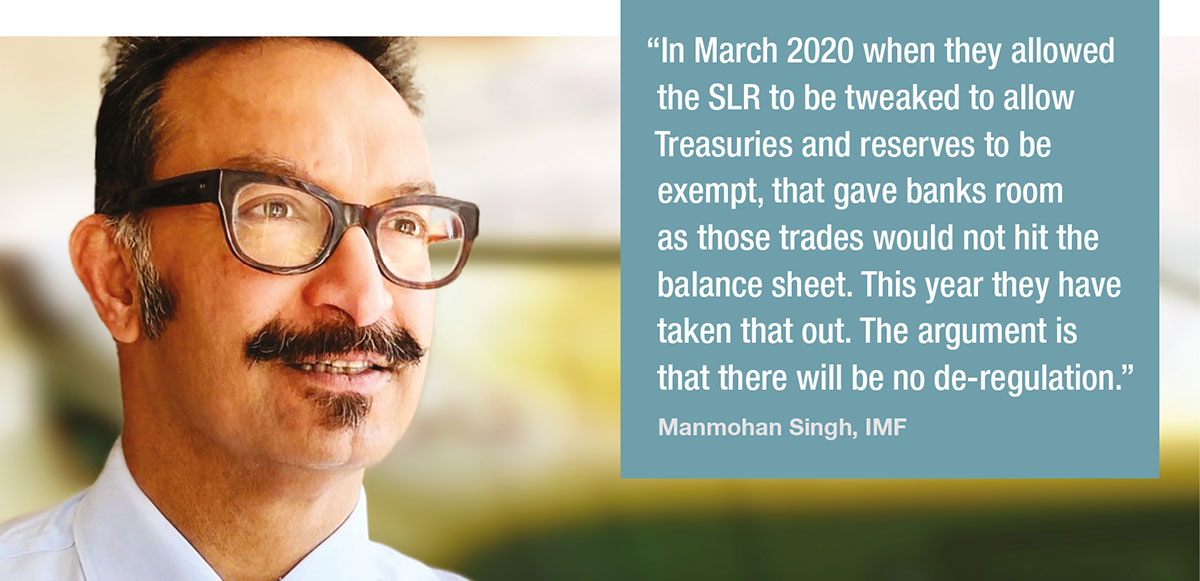

“In March 2020 when they allowed the SLR to be tweaked to allow Treasuries and reserves to be exempt, that gave banks room as those trades would not hit the balance sheet. This year they have taken that out. The argument is that there will be no de-regulation,” says Manmohan Singh, Senior Financial Economist at International Monetary Fund (IMF).

“In March 2020 when they allowed the SLR to be tweaked to allow Treasuries and reserves to be exempt, that gave banks room as those trades would not hit the balance sheet. This year they have taken that out. The argument is that there will be no de-regulation,” says Manmohan Singh, Senior Financial Economist at International Monetary Fund (IMF).

Instead the central banks have said they will stand in to provide liquidity in bond markets, and in the US steps are being taken to ensure that liquidity in the US Treasury market does not dry up.

“The Fed’s standby repo facility allows you to get liquidity. You can transfer good collateral like Treasuries and MBSs and get money,” says Singh. “This indicates they will not let the banks leverage ratio soften.”

The consequence of features like this, is that there is great uncertainty as to how strong the market is without central bank assistance.

“We still don’t know whether we will have a market that can cope on its own, because we went through the last crisis thanks to the support of the big central banks,” says Leon. “They helped us through this and I they did very well so that should be taken as positive news. But nevertheless, the fixed income market has not been tested in itself. When we find axes we can trade in good conditions. We feel we are doing okay, but when I spoke with a trading team in Asia who recently faced quite a bit of volatility in the bond markets, it’s clear they were helped by having long-term relationships with banks which helped them.”

©Markets Media Europe 2021

©Markets Media Europe 2025