US credit markets are seeing a divergence in bid-ask spreads and trade sizes between high yield and investment grade bonds, according to data from MarketAxess’s TraX, which tracks activity across multiple bond markets, and its CP+ pricing data.

This comes as concerns about recession in the US economy are rising, based on the suddenness and size of the imposition of trade tariffs.

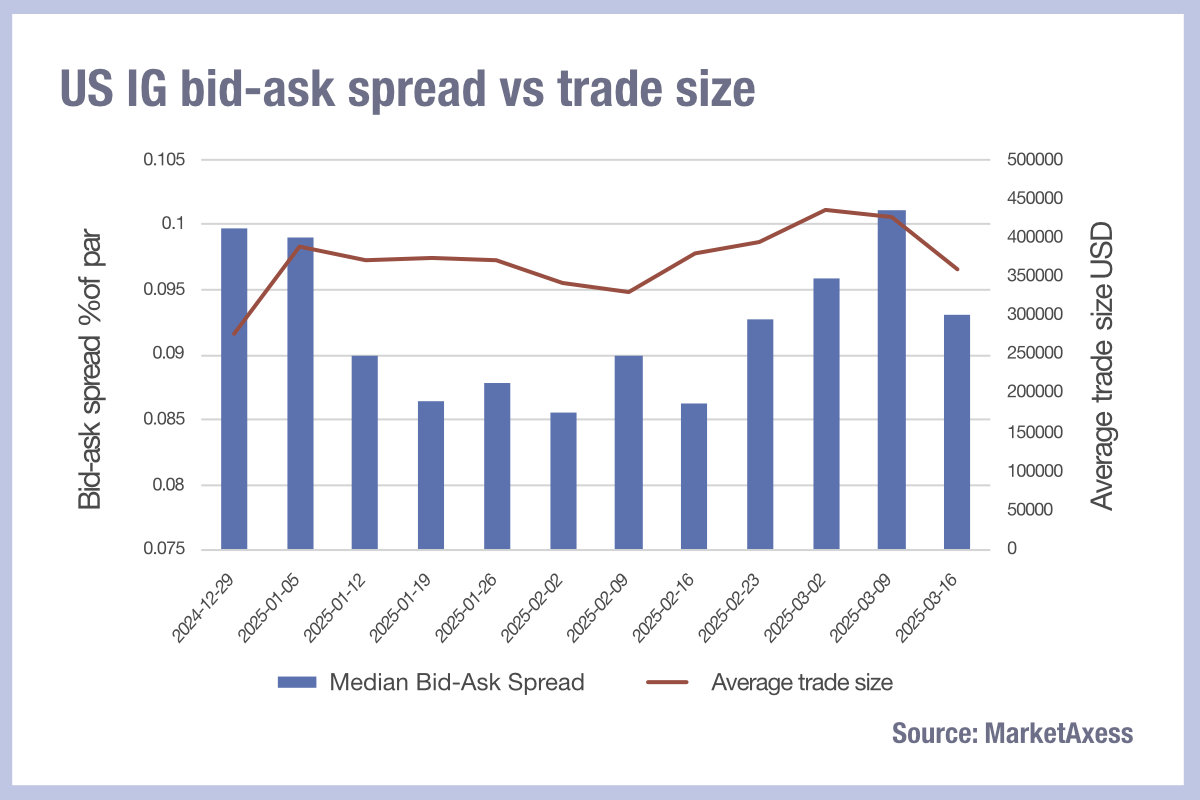

In US investment grade trading, the median bid-ask spread began the year by gradually reducing and then plateauing out at between mid-January and mid-February before rising in late February. In mid-March this suddenly dropped. Trade sizes had initially risen, also plateaued mid-January to mid-February and then followed the same pattern, rising in March and then falling.

The correlation here speaks to the effectiveness of electronification delivering trading efficiency. With bid-ask spreads as a proxy for trading costs, the smaller average trade sizes reflect the highly electronified trades that have limited market impact and are easily matched.

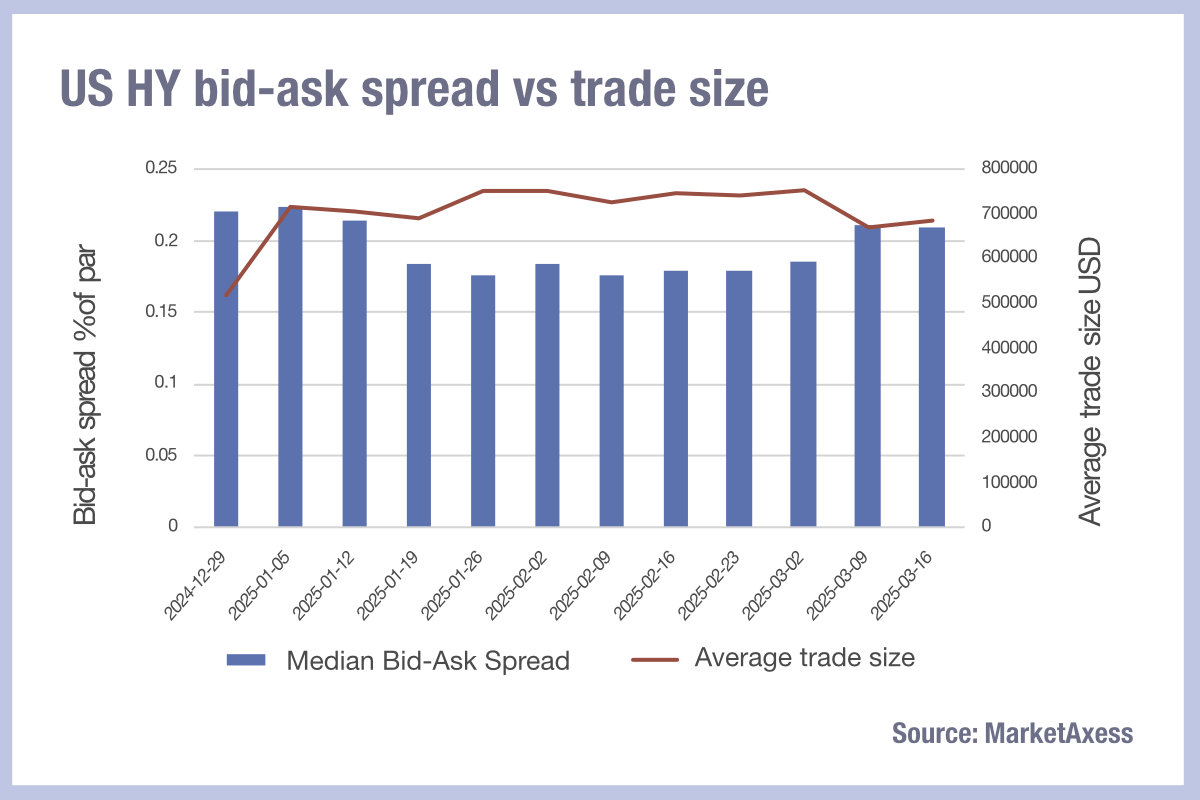

In high yield markets, a similar trail of both order sizes and bid-ask spreads is seen, but with a notable exception. Average trade sizes began to rise again in mid-March, and bid-ask spreads declined, but only just.

One reason for the difference, given that both set of bonds are relatively well indexed and therefore supported by both electronic and traditional market makers, could be the difference in credit risk and the cost for larger sized risk trades.

Being the debt of less credit worthy borrowers, high yield bonds carry increased risk and therefore capital cost for dealers. The larger average trade sizes seen in HY will include more block trades which are executed using dealer balance sheet. This necessitates a larger explicit cost to trade, with the execution objective for buy-side traders being reduced information leakage and completion of orders.

With concerns about recession rising, it may be that banks are increasing the bid-ask spread to account for greater concerns about credit worthiness, triggering this divergence.

©Markets Media Europe 2025