There has been a noted proportional increase in electronification of US credit trading, as tracked by Coalition Greenwich. However, metrics around European trading found via MarketAxess’s CP+ pricing service and TraX market activity service suggest it may now be bouncing back.

At the Fixed Income Leaders’ Summit last week, delegates observed that despite the apparent surge in US IG e-trading, and the absence of a corroborated jump in European activity, the absence of a single benchmark for European trading could mean that estimates were simply not capturing these events.

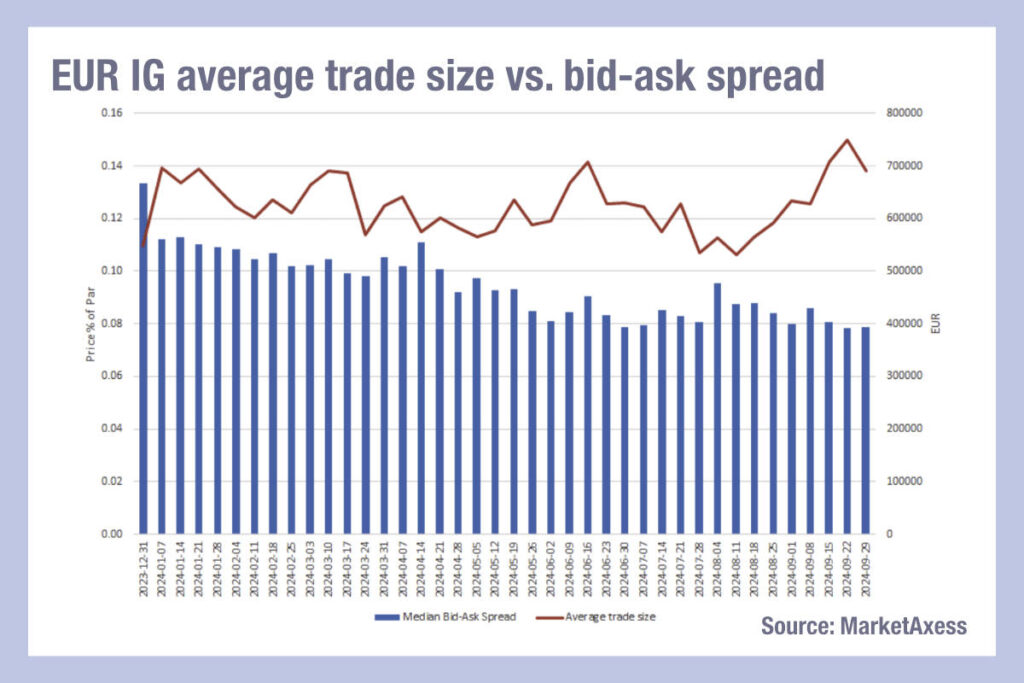

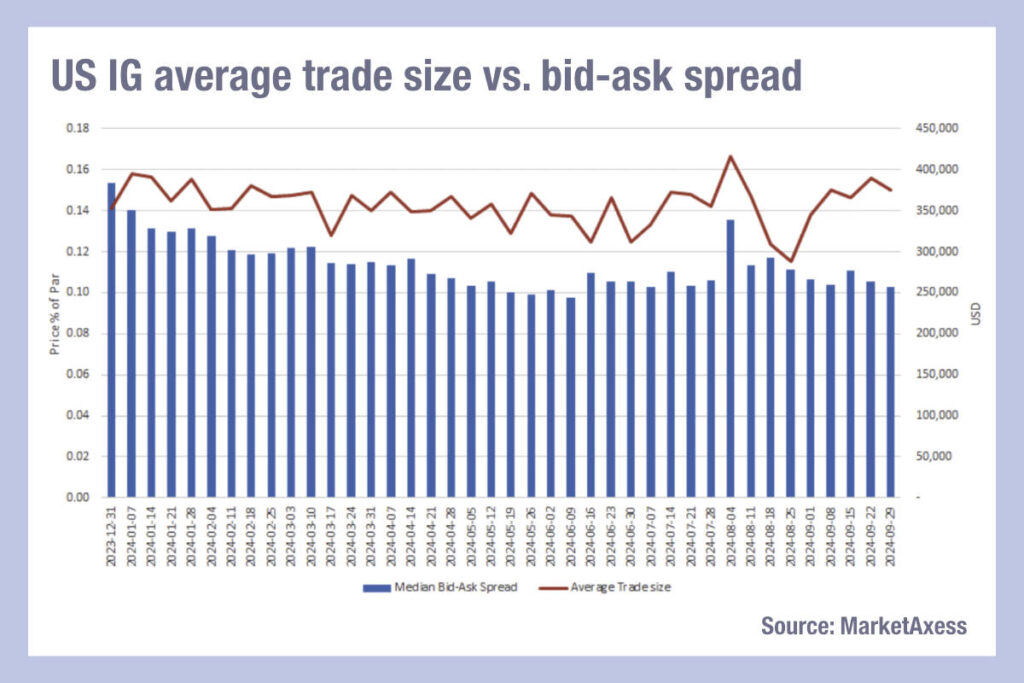

Europe has seen IG average bid-ask spreads tighten more relative to the average trade size over the past twelve months, proportional to the same change in the US investment grade market this year.

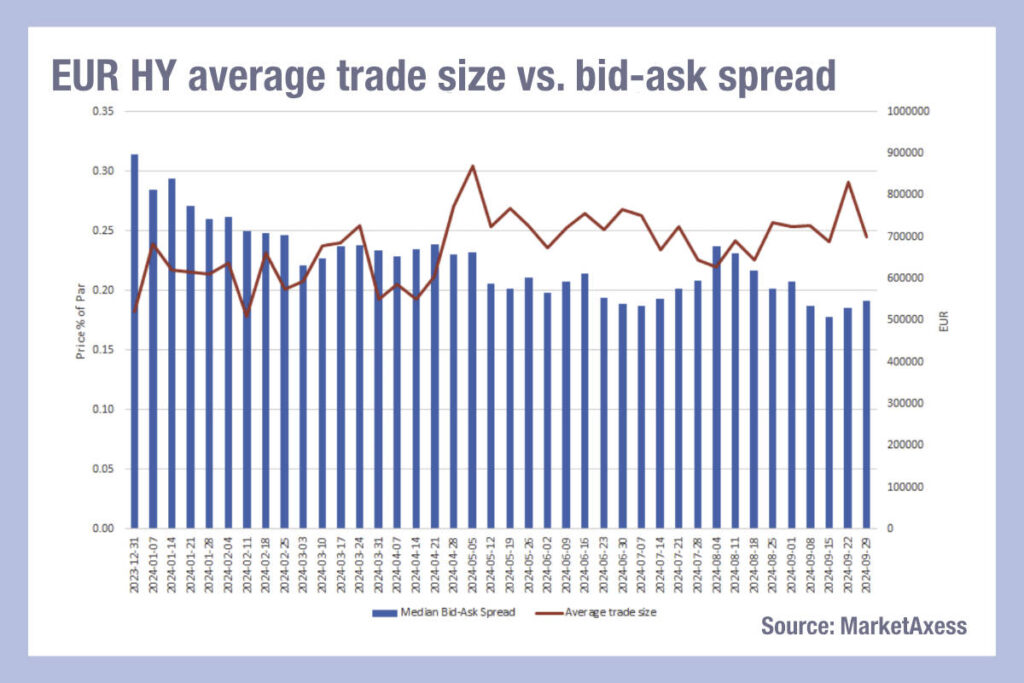

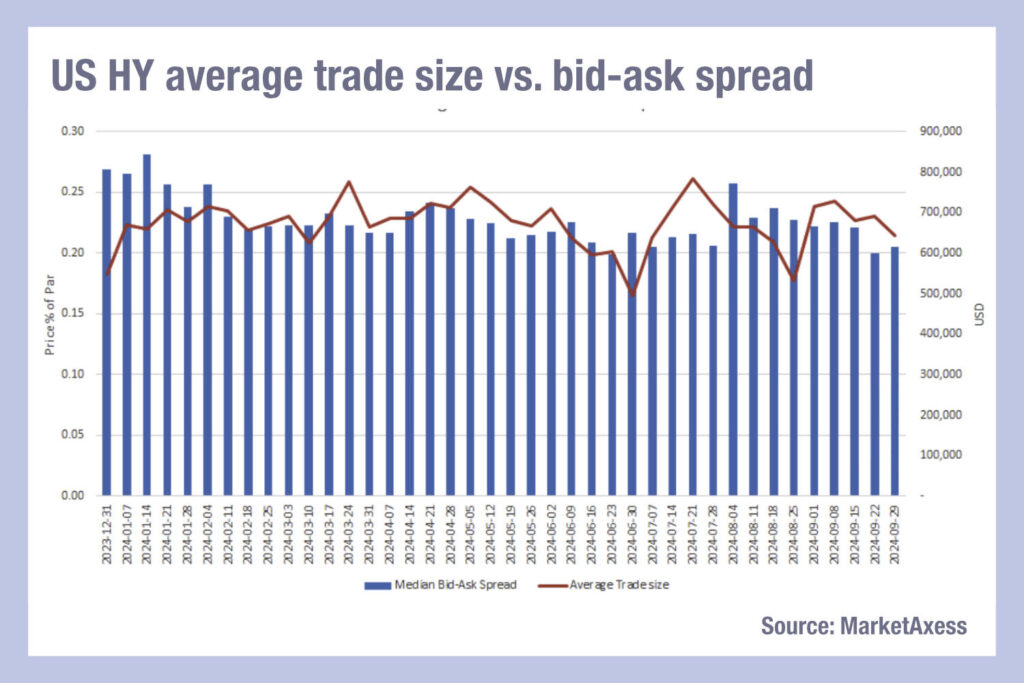

In high yield markets, Europe has likewise seen a tightening of bid-ask spread, relative to the average trade size, in a significant way. US markets have again not seen a corresponding relationship.

Does this support the hypothesis that electronic trading in Europe is on the up, relative to US markets? It could, but that is not certain.

Average trade sizes have varied week-on-week in all markets, but none have clearly declined year to date – both European IG and HY markets have seen an increase in average trade sizes since the summer, yet bid-ask spreads have continued to tighten – a little and a lot respectively.

Typically, e-trading leads to smaller trade sizes, as well as declining bid-ask spreads, which reflects the trading of smaller orders which can be processed at lower cost, as low-touch orders.

Although we are not seeing that pattern here, it is also possible that the larger average trade sizes are presenting portfolio trades, which can enables banks to price baskets of risk more effectively than they can line-by-line. This can be conducted bilaterally or via a platform, and so may well reflect greater e-trading.

Either way, it is clear that understanding the best way to trade can potentially result in lower net costs for a trade if traders have access to strong pre-trade information, and this can also provide a strong guide on trends for pricing and risk sizes being traded, even in markets without a consolidated tape.

©Markets Media Europe 2024

©Markets Media Europe 2025