Ten ticks’ depth of order book collapsed as liquidity providers fled unprecedented volatility, analysis from The DESK shows.

After an initial flight to safety on 2 April, liquidity evaporated from the depth of order book in long bond futures (ZB) traded on CBOT.

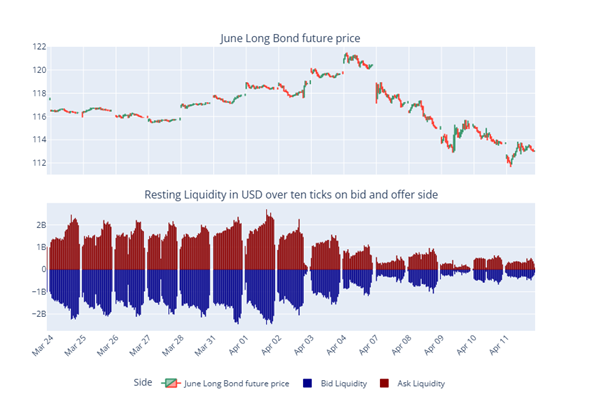

Detailed measurements averaged over 15-minute period between 24 March and 11 April show that during normal trading hours, from 9 am to 5 pm ET, liquidity resting across the first ten ticks on the bid and offer of the CBOT lit order book evaporated in the following days.

Using Level 2 order book data, this liquidity is expressed in the number of limit order contracts placed on the bid and offer side within the first ten ticks from the market price. Multiplied by the contract value and price, this gives a dollar amount for available long bond futures liquidity.

Robust liquidity up to 2 April close

From 24 March to 28 March, liquidity on the bid and ask on cash equity open was between approximately US$1 billion and US$2 billion on the close. In contract terms, this represents between 10,000 and 20,000 limit order contracts resting passively in the CBOT book.

As opposed to S&P futures, which had already experienced a decline pre-2 April, long bond futures’ liquidity declined aggressively after the initial rally on so-called ‘liberation day’, showing a decline between US$500 million to US$1 billion by the end of trading the next day.

(read more: https://www.globaltrading.net/wp-admin/post.php?post=38057&action=edit)

A collapse the following trading days

As the term premium in US bonds ramped back up the following days, evidenced by the disproportionate decline in long bond prices relative to the rest of the curve, the long bond futures market grew extremely thin.

This led to a substantial decline in passive liquidity as measured by limit order book depth.

On 7 April, during the 15 minutes after the CBOT open, resting liquidity on the first ten ticks on the bid and ask was only around US$500 million.

A poorly received US$58 billion 3-year note auction on 8 April, where dealers had to step in for 20.7% of the auction in the worst result since December 2023, further spooked the market.

By 9 April, liquidity had all but collapsed to between US$250 million and US$300 million.

The US administration U-turned on tariffs later that day.

When contacted by The DESK for comment on the findings, CME stated: “Our markets are operating with exceptional resilience in a period of tremendous uncertainty and record volumes.”

©Markets Media Europe 2025