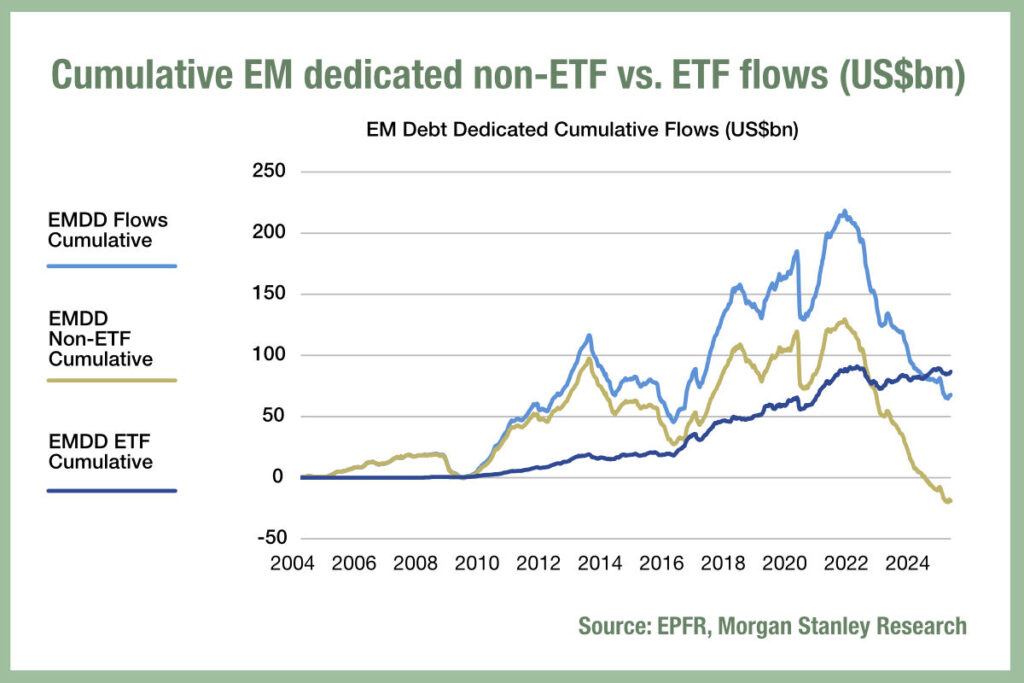

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while non-ETF funds have seen several weeks of outflows, knocking the cumulative total of inflows, year-to-date, down to US$899 million which all stemmed from the first weeks of the year.

UBS reported that emerging markets corporates had posted strong earnings growth of 16% by mid-February, giving impetus to these economies despite the uncertainty posed by staccato US foreign policy and tariffs.

The information regarding bond fund flows carries several implications for traders. Any EM bond markets seeing inflows must be represented in local currency indexes in order to support the ETFs. These typically carry low levels of concentration relative to their peers, suggesting that holdings are unlikely to be concentrated in any one country. As a results, inflows are likely to drive directional buying across the EM space broadly.

An increase in trading for passive or beta funds, whether buying or selling, needs to track index matching for a market, trade as closely to the index pricing point as possible. It will also typically involve a larger number of line items than an active fund might need to trade to balance inflows. While an active manager can take positions in an EM market with a small number of bonds, beta fund managers need to represent the broader balance of asset tracked by the index.

To go long Mexico and short Chile, for example, an active PM might use between two to four bonds, choose their point on the curve and set up the trade, while a beta or passive fund manager would typically be spread more across the curve, with the same trade taking double digit line items to put on. When balancing inflows again the range of lines items will likely increase to reflect the weighting across the index.

That said, the way to trade into an emerging market is typically affected more by the idiosyncrasies of the market and current liquidity profile.

A major challenge can be the ability to access a broad number of liquidity providers in order to get liquidity at the right price. An EM broker list can require specialists in particular markets in order to effectively access pricing or even to get bids in illiquid bonds.

With less flexibility to move away from the index tracking point, these beta fund managers will need to optimise the trading protocol that best fits delivering the right price for the trade over other best execution elements such as timing, order completeness, or speed of trading.

As a result, while certain protocols such as portfolio trading can be used, it may be that a combination of electronic trading tools which help to optimise price such as all-to-all trading and automated, rules-based execution can deliver an optimal outcome by bridging a wider set of counterparties with a greater emphasis on price improvement.

©Markets Media Europe 2025