Securities Financing Transactions Regulation (SFTR)

Q&A with Tom Harry, Regulatory Specialist, MTS

Q&A with Tom Harry, Regulatory Specialist, MTS

How well prepared are institutions for the impending requirements of SFTR?

Most repo market participants are aware of the new European Securities Financing Transactions Regulation (SFTR), but not everyone is clear on exactly what the so called ‘MiFID II for repo’ means for their business.

SFTR came into force in January 2016 as an EU Regulation with the aim of increasing the transparency of securities financing transactions, such as classic repo, triparty and sec lending. The scope of SFTR is wide. It encompasses, with limited exceptions, European Economic Area (EEA) firms, their branches and even EEA branches of non-EEA firms that engage in repo trading.

The European Commission has recently endorsed the technical standards drafted by ESMA and therefore the countdown to SFTR reporting has begun, with the first wave of reporting expected for banks and investment firms in 2020, followed by CCPs, asset managers, insurers, pensions funds and eventually non-financial companies. UK-based firms will also have to consider potential Brexit impacts.

This means the time has come for both the buy-side and the sell-side to take a close look at their repo businesses and to sketch out their roadmap to meeting these new reporting requirements.

What challenges do you anticipate for market participants given the way the repo market currently operates?

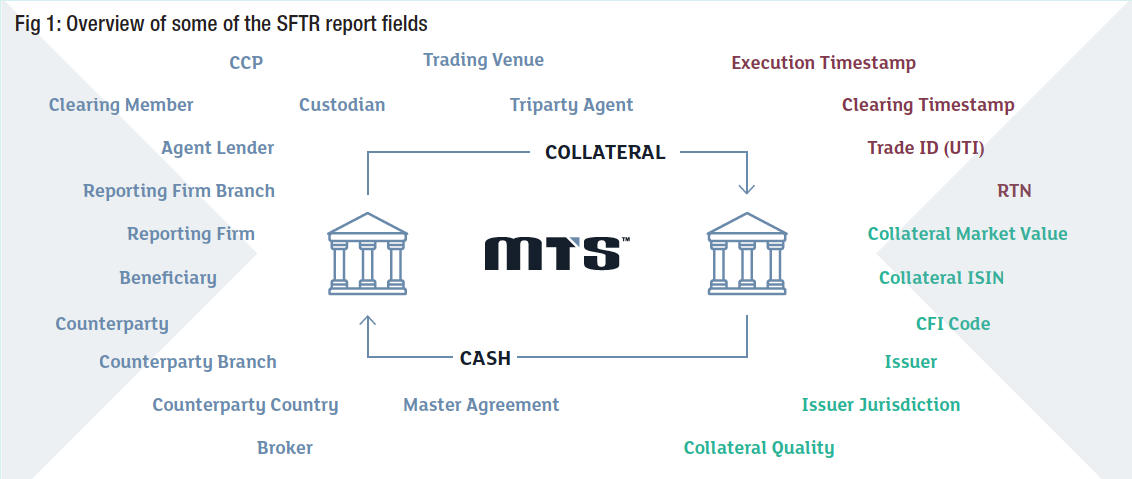

SFTR will require firms to report repo trades, lifecycle events and collateral reuse to a Trade Repository, such as UnaVista, by T+1. Both sides to a trade will face about 110 reportable fields for repo. The European Securities and Markets Authority (ESMA) has also stipulated that many of these fields will have to match. This presents a huge challenge to repo market participants whose trading activity is currently fragmented across phone, email, chat systems and electronic platforms, particularly in the dealer-to-client space.

The reportable fields extend well beyond trade economics. Significant effort will be required to create and to maintain extensive counterparty, collateral and even stakeholder reference data. Attempting to capture the data required for this many fields and to submit accurate and complete reports by close of business the following day will present a real challenge for firms, across multiple workflows with little or no standardisation.

As with EMIR for over the counter derivatives, reporting firms will have to invest time and resources to address “reporting breaks” should the two sets of data sent to the trade repositories not match. This can be a hugely time-consuming task that distracts individuals away from trading, ultimately impacting their performance and profitability.

Beyond the content of the reports, firms will have to consider who will do the reporting. SFTR is a double-sided reporting regime where delegated reporting is allowed, and in some cases mandated. From a buy-side perspective the question is whether you are prepared to report yourself or if you would prefer to delegate the reporting to your dealers – with the risk that they may not be prepared to report for you. From a sell-side perspective, meanwhile, the issue is the potential cost of building the ability to report on behalf of clients and hiring the teams to support this activity when their trading is fragmented across so many different communication channels.

One additional challenge for the sell-side is that their reporting obligation will start before many of their clients need to report. This means that their clients may not be prepared to provide the sell-side with the necessary data points to submit complete reports, which increases the risk of late reporting by the sell-side.

How can these challenges be tackled?

The first step is for firms to assess when they need to report and to identify for their different workflows what data points they have and in which systems they have them. This is a challenge in itself given the number of workflows they follow and limited standardisation between them.

In this sense, SFTR presents an opportunity to the repo market to improve the efficiency of trading workflows. The use of electronic trading platforms for both ‘dealer to dealer’ and ‘dealer to client’ workflows could eliminate the need to book trades manually, freeing up the time of traders and sales people to focus on trading, as well as reducing the uplift to meet reporting requirements.

Shifting flow away from fragmented manual channels such as phone, chat and email and onto an electronic platform not only delivers the benefit of full straight through processing connectivity to trade repositories and third parties, but also ensures trade data is fully standardised and consistent across both counterparties.

How is MTS preparing for the introduction of SFTR?

MTS Repo has been working with a diverse group of industry stakeholders in the run-up to SFTR’s implementation, including clearing houses, trade repositories such as UnaVista, industry groups and other vendors and has identified solutions to support a smooth implementation process for both the buy-side and sell-side.

First, we have launched a D2C repo segment of MTS BondVision. The integrated request for quote and chat functionalities allow our clients to enhance their trading workflows, complemented by full STP and an electronic audit trail. This will also provide greater standardisation, which will reduce the uplift required to report for both the buy-side and sell-side and will allow firms to focus on trading.

Second, we are enriching the market reference data and trade tickets with additional SFTR data points. MTS can ‘pre-match’ SFTR reporting fields prior to submitting reports. This will allow firms to overcome the issue of reference databases that differ between counterparties – and even within firms – when populating their reports, especially given the need for some of these fields to match.

Third, we are continuing to work closely with UnaVista, the London Stock Exchange Group’s trade repository. This collaboration allows us to provide a one-stop solution for repo trading and reporting, with seamless front-to-back reporting of unique transaction identifiers, timestamps, ISINs and other product identifiers.

As with MiFID II, we will collaborate closely with our clients to deliver the expert guidance, innovative tools and responsive support to ensure that users of MTS Repo can continue to trade with confidence.

©Markets Media Europe 2025