Guido Galassi, Head of Data & Cash Product, MTS

In volatile market conditions, more accessible and meaningful data has become critical to navigating the path to profitability in fixed income. But quality is just as important as quantity when it comes to market data – so how can participants get the insight they need to build a better picture of the market?

In volatile market conditions, more accessible and meaningful data has become critical to navigating the path to profitability in fixed income. But quality is just as important as quantity when it comes to market data – so how can participants get the insight they need to build a better picture of the market?

Since the introduction of MiFID II, there has been a huge growth in the array of different fixed income data types and sources from which to choose – and not all of it is of the best quality. Participants want to expand the range of sources of firm data to act as a benchmark for trading decisions, but to do this effectively they need trustworthy data sources that provide detailed coverage of the markets in which they trade.

Against this backdrop, the ability to access real-time and executable prices from a broad range of markets is more essential than ever, helping participants to build a better picture of price formation to inform effective trading strategies. ‘Big data’ alone is no longer enough – it must be of exceptional quality before innovative analytics tools can be applied to it to convert raw information into valuable insight. This is where MTS, part of the Euronext Group, can help.

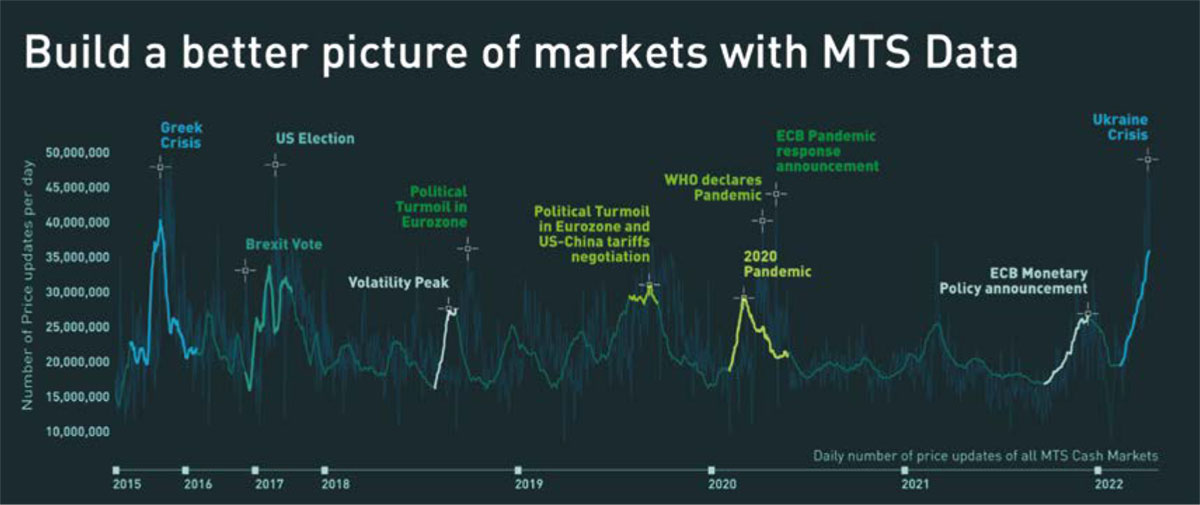

MTS Data offers market-leading data direct from the #1 interdealer EGB platform in Europe, MTS Cash order book, capturing circa 80% of electronic D2D EGB trading volumes*. Market volatility has driven a substantial increase in usage of MTS Data (see chart), as participants look for trusted, accurate information to support critical trading decisions. The last year saw a surge in requests to access high-quality data and analytics – and MTS has responded with various enhanced data products that range from historical and end of day to real-time and ultra-low latency feeds. These include:

MTS real-time data

MTS’s raw data feed provides market-leading data on EGB liquidity direct from its MTS Cash interdealer trading platform. This gives traders an advantage by offering consistent access to the most comprehensive source of EGB data, offering an invaluable and unique insight into market turnover and volatility. Moreover, MTS Cash data is based on executable prices. This allows traders to have the confidence to make decisions based on executable prices.

MTS Alpha

Subscribers to MTS Alpha can take advantage of this ultra-low latency premium data product, which is updated every c600 microseconds. MTS Alpha includes all price updates received on bonds within the Futures deliverable baskets in France, Germany, Italy and Spain. This allows traders to rapidly identify and react to liquidity and price movements in the market.

BV Composite

BV Composite is derived from our dealer-to-client (D2C) BondVision RFQ platform and is designed to provide an accurate indication of the market level for EGBs, UK Gilts, SSAs, and Covered bonds. The BV Composite is a robust composite price that can inform market trend analysis and feed into pricing engines, TCA reporting, risk management and portfolio management systems.

MTS Time Series

MTS Time Series data is taken directly from the market-leading interdealer MTS Cash and Repo order books. The data is of the highest relevance, coming only from firm, fully executable prices. The MTS Cash order book is widely considered the best price discovery in European government bonds due to its eligibility as a primary dealership platform in 16 countries across Europe. Packages include historical data and end of day. The MTS Repo Order Book is the data source for the “Repo Daily Summary” end of day package which provides trade-based funding benchmarks in a traditionally opaque market. Time Series data delivers granular data to optimise research capabilities and develop trading strategies.

Regulatory data products

MTS has developed a suite of innovative regulatory data products, including the MTS SFTR Blotter and MTS CSDR Closing Prices, to support market participants and infrastructure to fulfil their regulatory requirements.

In conclusion, as we carry on facing unexpected world events, MTS Data continues to be proven as both an accurate source of pricing and proxy of volatility that guarantees efficient trading. We look forward to continuing to innovate to support the diverse needs of different market participants during this period of evolution in our industry.

*Bradley Bailey, Josephine de Chazournes, Celent “European Fixed Income Market Sizing” (2019).

©Markets Media Europe 2025