How technology is enabling data-driven execution and analytics.

In recent years, the electronification of fixed income (FI) markets has been followed by the development of technology and analytics in support of buy-side trading desks. New generation FI EMSs and analytics products offer features such as pre-trade market data aggregation and data-based order routing for all buy-side firms.

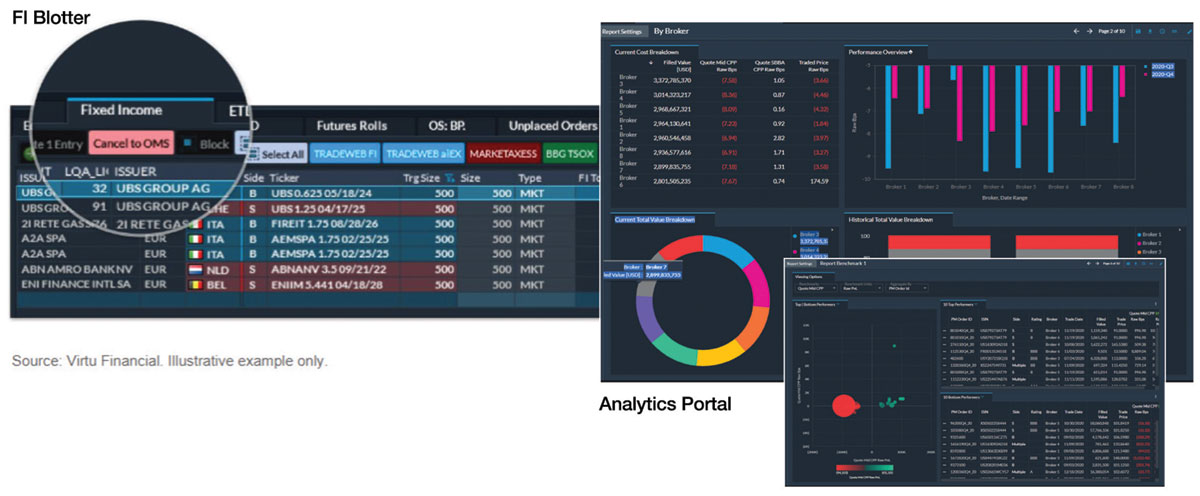

We examine how these emerging tools are used today by taking a closer look at Virtu’s FI offering across data products, analytics and workflow technology. Among the defining features of these products is the portability of the content – firms can aggregate data from different sources and technology providers in a customised manner to seamlessly integrate the data and analytics into their unique trading workflows.

Data products: supporting fixed income investment decisions

“FI market data is disparate, restricted and expensive,” says Kevin O’Connor, Global Head of Trading Analytics. “Virtu’s FI product suite gives clients the flexibility of using various data sources and the ability to deploy that data and analytics either to Virtu’s platform or to other platforms via our Open Technology API framework. Portability of data and analytics is the right model for the FI market and the best way for us to support the needs of our clients.”

“FI market data is disparate, restricted and expensive,” says Kevin O’Connor, Global Head of Trading Analytics. “Virtu’s FI product suite gives clients the flexibility of using various data sources and the ability to deploy that data and analytics either to Virtu’s platform or to other platforms via our Open Technology API framework. Portability of data and analytics is the right model for the FI market and the best way for us to support the needs of our clients.”

An example of Virtu’s commitment to FI analytics is Virtu’s ETF estimated NAV (eNAV) analytics tool offered in partnership with MarketAxess. ETF valuations are provided with real-time transparency via the calculation of bid and ask prices based on their underlying components and proxies to estimate the net asset value (NAV). As a complement, MarketAxess Composite+ offers two-sided market data from both public and proprietary sources for more than 32K instruments across the globe1. Virtu’s eNAV can help its users support a variety of FI-related trading functions, including pre-trade price discovery and execution consultation, liquidity provision, post-trade transaction cost analysis, auto-execution and crossing. Coverage currently includes US-listed ETFs with domestic and international equity, commodity and fixed income holdings.

Virtu Analytics’ Open Technology is a REST API framework that provides subscribers with access to trade data, market and reference data, as well as model cost estimations and various other data products. The Open Technology platform initially provided access to Virtu Analytics data for both third-party and in-house analysis but has also become a source for market data and reference pricing. This flexibility allows users to develop their own custom solutions for multi-asset class analysis and trading workflows.

Trading analytics: guiding trading decisions and measuring execution quality

Because of the OTC nature of the market and the large number of less-liquid instruments, FI analysis faces the challenge of fragmented and incomplete market data. Buy-side firms can overcome these limitations by either using market data and evaluating pricing across multiple providers or by using model-based approaches to estimate costs and analyse liquidity.

Because of the OTC nature of the market and the large number of less-liquid instruments, FI analysis faces the challenge of fragmented and incomplete market data. Buy-side firms can overcome these limitations by either using market data and evaluating pricing across multiple providers or by using model-based approaches to estimate costs and analyse liquidity.

“Virtu’ Analytics’ FI TCA combines metrics from third-party providers such as MarketAxess or Refinitiv with Virtu Analytics’ own FI metrics,” says Ruben Costa-Santos, Multi-asset Products, Virtu Analytics. “This approach enables data aggregation flexibility that was previously available only to large buy-side firms with extensive internal resources.”

To help inform their FI execution quality, Virtu FI TCA clients can use multiple data sources and pricing methodologies. Depending on the execution style and security under consideration, these benchmarks can be considered individually or combined into a single metric of quality of execution.

Virtu’s pre-trade cost model, FI ACE, is designed to incorporate the relevant bond characteristics to produce average estimates of expected costs and liquidity even when recent market data is limited. Virtu’s FI ACE model now covers over 100K2 securities including both global corporate and sovereign debt. The model is calibrated using extensive venue market data and against the Virtu Peer Group of anonymised trades from its FI TCA clients.

Virtu’s pre-trade models are widely used in portfolio construction and liquidity analyses, pre-trade execution strategy selection, and supporting post-trade TCA by adjusting for trade difficulty due to trade size, instrument liquidity and market conditions.

Execution workflow technology: integrating data and analytics

According to Michael Loggia, Global Head of Workflow Technology, Virtu Financial, “We’ve seen FI trading accelerate its migration towards an EMS approach in part due to the benefits of data and analytics integration combined with access to workflow automation. To optimise infrastructure costs, buy-side firms need multi-asset class consistency across execution and data management like that provided by Triton EMS.”

According to Michael Loggia, Global Head of Workflow Technology, Virtu Financial, “We’ve seen FI trading accelerate its migration towards an EMS approach in part due to the benefits of data and analytics integration combined with access to workflow automation. To optimise infrastructure costs, buy-side firms need multi-asset class consistency across execution and data management like that provided by Triton EMS.”

Triton is Virtu’s market-leading3, broker-neutral, multi-asset class EMS used by 40% of top 10 asset managers4. Triton integrates equities, FI, futures, and FX trading into a single interface and is closely integrated with Virtu Analytics’ multi-asset TCA for pre-trade strategy selection and post-trade performance management.

Triton offers support for all major FI trading platforms along with ancillary components such as FI analytics, market data integration and post-trade services such as FIX-based allocations – all of which can be combined to fit the specific needs of each client.

Virtu’s offerings help buy-side firms manage the proliferation of FI trading tools and integrate with existing infrastructure. In Virtu FI, clients can choose to use Virtu Analytics, Triton EMS, and post-trade services as a fully integrated trading solution or select individual components that can be integrated within a clients’ existing trading ecosystem.

Ask us how Virtu’s solutions can help your FI needs. Contact us today to begin the discussion.

- MarketAxess Holdings Inc. of May 31, 2022.

- As of March 31, 2022.

- #1 Overall Outperformer (2021), #1 Best Platform Adaptability (2021), #1 Overall Outperformer (2020), #1 Best Customer Support (2020) The TRADE’s 2021 and 2020 Execution Management Survey of Buy-Side Users.

- Ranking of top 10 global asset managers, top 400 global asset managers by IPE, 2020.

Triton EMS, Virtu Analytics, and Virtu eNAV are offered by Virtu Financial, Inc. (“Virtu”) though its worldwide subsidiaries including Virtu ITG Solutions Network LLC (“Solutions”) and Virtu ITG Ventures Limited (“Ventures”). Solutions and Ventures do not engage in regulated activities. MarketAxess Holdings Inc. and Refinitiv US LLC are legal entities that are separate and unaffiliated with Virtu Financial.

©Markets Media Europe 2025