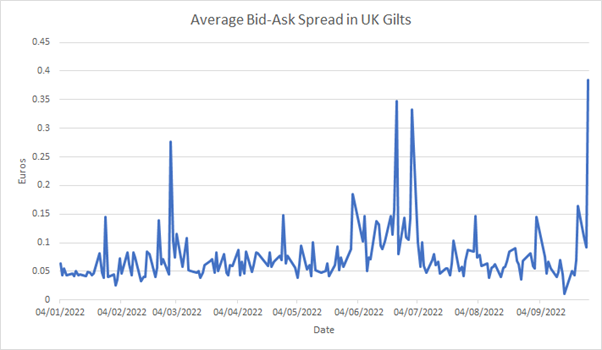

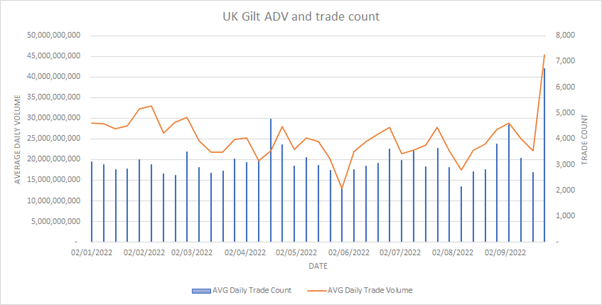

Both volume and bid-ask spreads have blown out in the UK government bond (Gilt) market, as seen in the latest TraX data from MarketAxess, which aggregates bond market activity executed by European banks, asset managers and trading firms, and then is validated in near real-time through a post-trade regulatory reporting and trade confirmation engine.

While no official source for secondary European bond market trading exists, such as the US TRACE system, TraX data represents the bulk of European activity across both voice and electronic trading, with MarketAxess estimating that activity reported to TraX accounts for 75% of European credit trading volume and 60% of emerging market bond volume from European participants.

Bid-ask spreads are an indication of the cost of liquidity in the market, while volume reflects liquidity to an extent, however higher volumes with increased bid-ask spread indicate a lot of trades happening at a higher cost to the buy side.

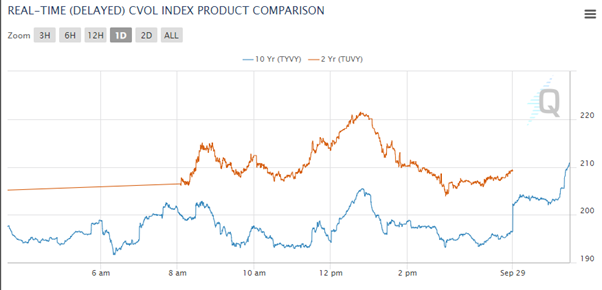

In the US< CVOL Indexes, offered by CME Group, measure the expected risk or implied volatility of an underlying future based on the information contained in the prices of options on that underlying future. In general, the expectation has a 30-day forward-looking horizon. The metric is an annualised standard deviation as used in typical option pricing models.

The latest data from CME’s CVOL suggests 10-year volatility has jumped again as yields have fallen. Open interest in the 10-year futures also rose yesterday.

In the image from CVOL (below) there is currently no reading based in options market trading.

©Markets Media Europe 2025