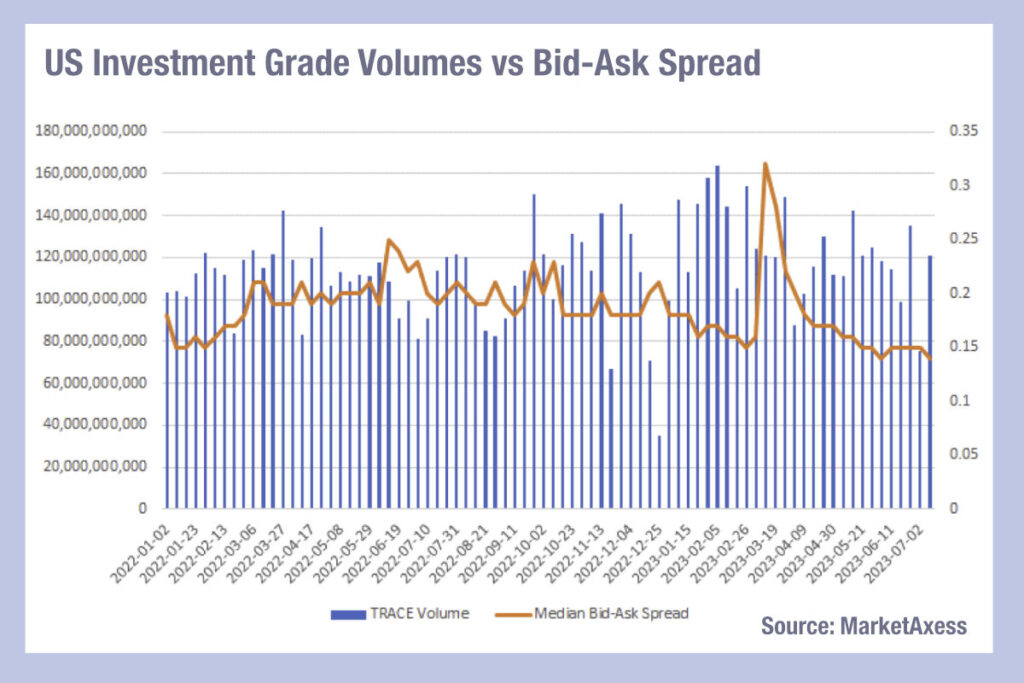

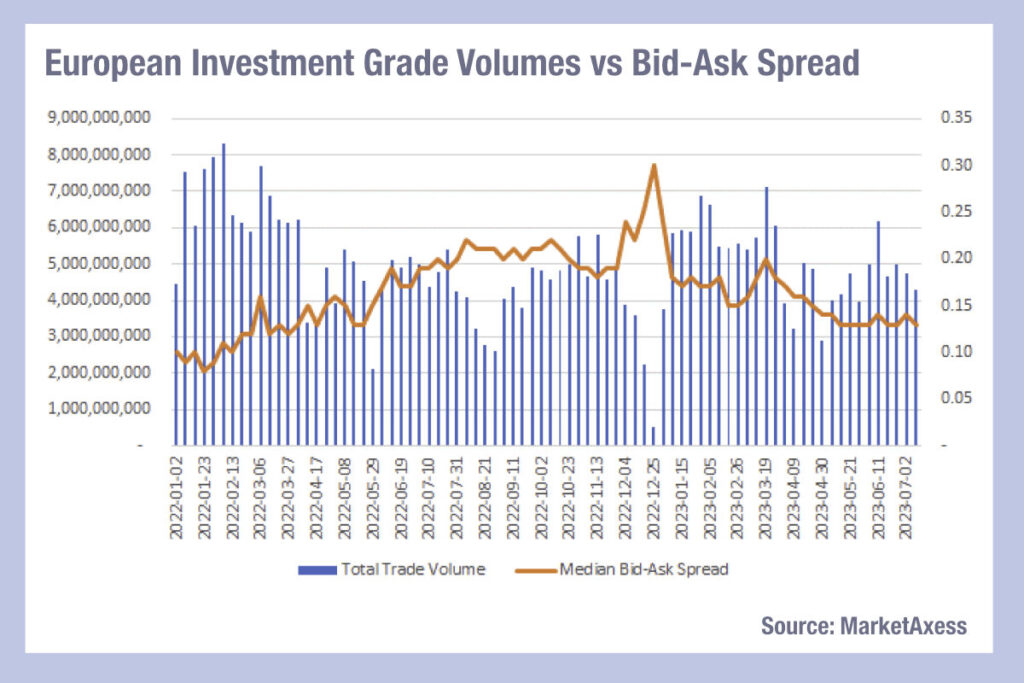

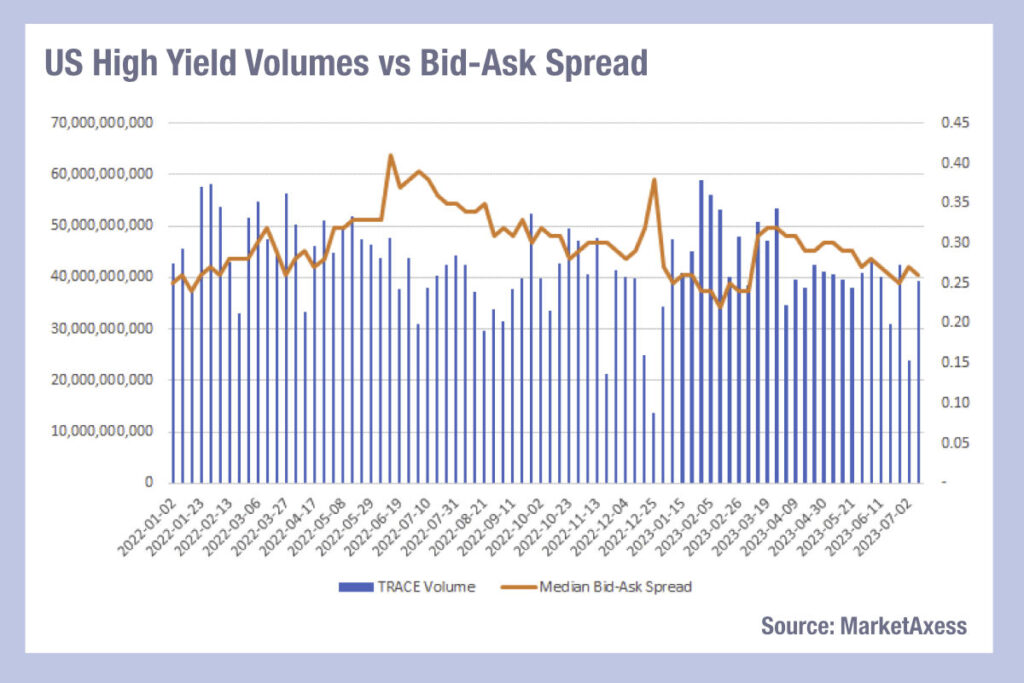

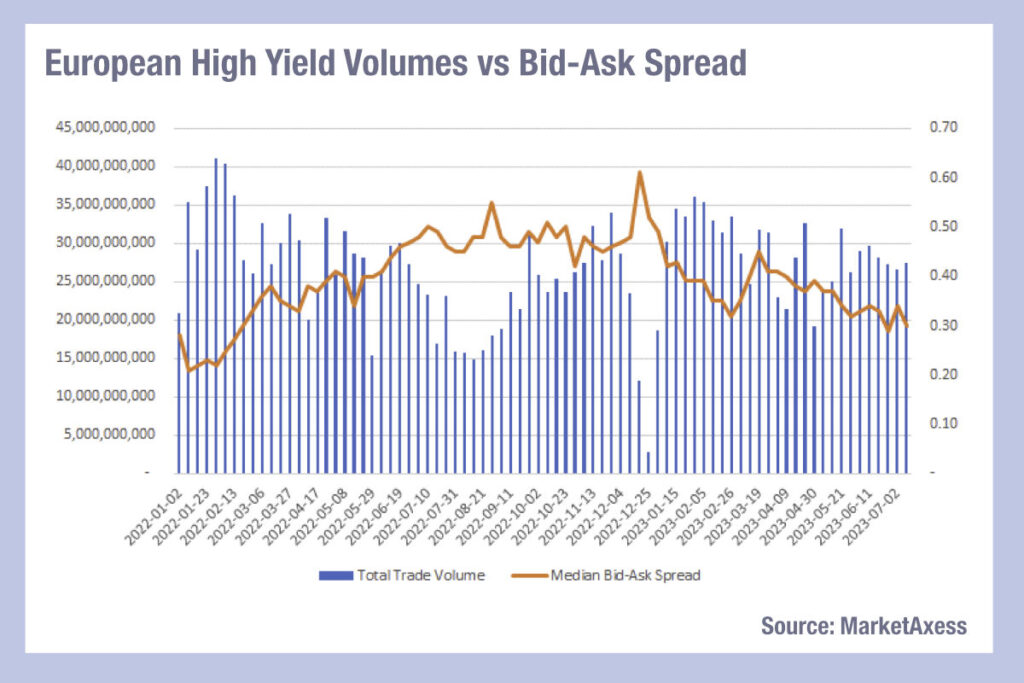

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and Europe, except in US high yield (HY), according to data from MarketAxess Trax, which reports on trading activity across multiple markets.

Within investment grade bond trading, US markets have seen a net decline in bid-ask spreads since February, albeit with a massive spike around the Silicon Valley Bank and Credit Suisse debacles in March. At less than 0.15 basis points (bps) bid-ask spreads are at their lowest point since the start of 2022. Trading volumes are very jittery, relative to the start of 2022, jumping between US$80 billion to US$120 billion from one week to the next.

European investment grade (IG) bid-ask spreads have not recovered to early 2022 levels yet, sitting around the 0.13/0.14 basis point level, up from the sub 0.1 bps levels in January 2022. Nevertheless, they have also fallen considerably since the end of 2022 when they spiked to nearly double their current level and volumes tanked, and their more elevated position they had occupied since June 2022. Volumes have stabilised considerably since last year, into summer.

HY markets represent a far lower volume of trading activity than IG and in the US HY trading volumes have also been more erratic, moving between highs of US$59 billion and lows of US$23 billion. Bid-ask spreads around 0.26/7 are close to early 2022 levels, but after jumping in March 2023 they are still relatively elevated to volumes – which rapidly dropped off after March, implying liquidity is more expensive.

In Europe, as with IG trading, bid-ask spreads are higher than at the beginning of 2022 and volumes are lower but have stabilised. The terrible volume levels in summer 2022 and a the end of the year have both recovered and levelled off, implying the cost of liquidity has fallen since the start of the year.

©Markets Media Europe 2023

©Markets Media Europe 2025