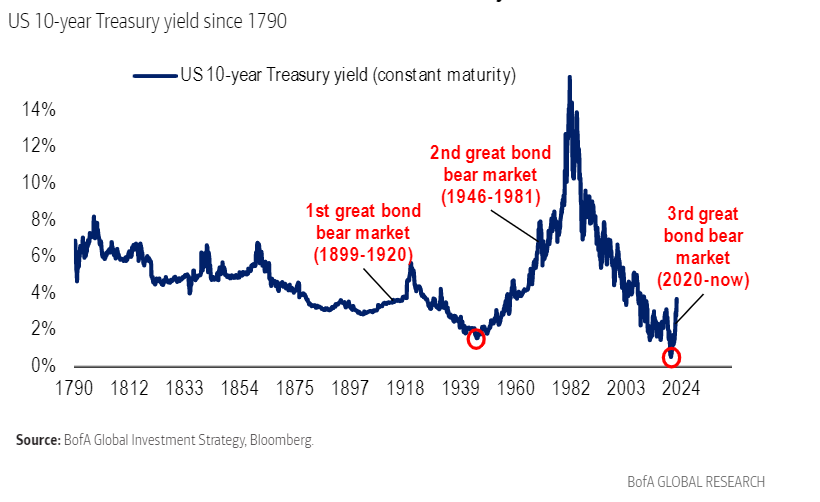

The bond market is bearish at a historical level according to analysis by BofA Securities, with high yield down -16.7%, investment grade down -19.3%, and government bonds having fallen -20.1% year to date, with “bond losses worse since 1920”.

“[The] 3rd Great Bond Bear Market [is] thus far a doozy,” warned Bank of America’s chief investment strategist, Michael Hartnett, in a note on 22 September. “2022 global government bond losses on course for worse [sic] since 1949 (Marshall Plan), 1931 (Credit-Anstalt), 1920 (Treaty of Versailles); bond crash threatens credit events and liquidation of world’s most crowded trades.”

The scene is set for one or more credit events, and the unwinding of major long positions. With governments struggling to balance their books in developing markets, in turn creating currency turmoil, there is enough to shake up frail corporates with the wrong kind of foreign exchange exposure, oversized debt positions and an inability to refinance on viable terms.

Traders have limited ability to influence their portfolio manager’s positions at this point, but getting out of those positions as and when needed will require very strong access to dealer balance sheet – which has been notably absent so far in 2022 – and alternative liquidity sources such as all-to-all trading and alternative counterparties.

©Markets Media Europe 2025