A new article written by the regulatory team at the International Capital Markets Association (ICMA), has shed light on details in the agreed text of the revised Markets in Financial Instruments Directive/Regulation (MiFID II/MiFIR), which was signed last week but the details of which are not expected to appear for several weeks.

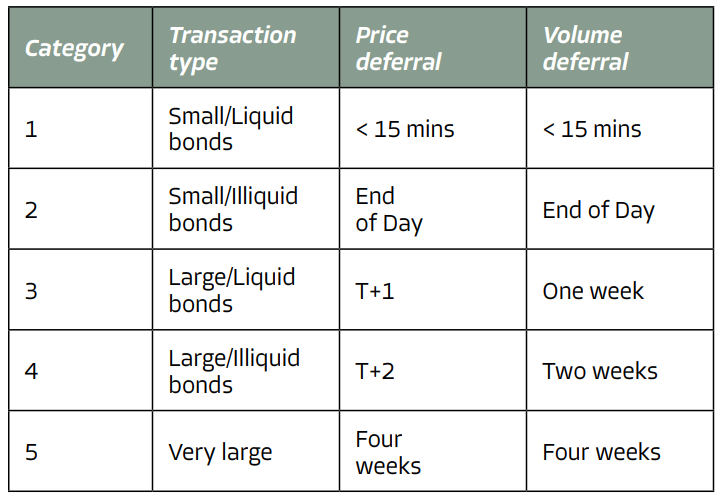

“ICMA believes that the co-legislators have settled on the following deferral framework for bonds. The five deferral categories proposed by the Council and Parliament are similar to a proposal made by ICMA, with the timelines largely consistent with the EP proposal,” wrote Andy Hill, senior director at the ICMA.

He noted that the long deferral for both price and volume disclosure for very large trades was necessary, “The reason for requesting alignment is that it is relatively easy to infer a lot of information about a bond trade from seeing the price alone, including whether it is a “risk trade” (ie a market maker has taken the trade onto its books), the direction of the trade, as well as its relative size.”

In the sovereign bond market, he noted that, “The co-legislators appear to have agreed on the European Parliament’s proposal allowing for national competent authorities (NCAs) to elect for (a) the omission of the publication of the volume of an individual transaction for an extended time period not exceeding six months; or (b) the deferral of the publication of the details of several transactions in an aggregated form for an extended time period not exceeding six months.”

While differences in regulatory regimes are largely seen as problematic, particularly where NCAs can choose if rules do or do not apply, Hill noted the agreement was preferable to the existing arrangement for an indefinite period of aggregation.

Pre-trade reporting for non-equity instruments traded on a systematic internaliser has apparently been dropped, as has a Parliamentary proposal for deferrals to be applied by the consolidated tape provider (CTP) once set up, in addition to those deferrals to be applied by authorised publication arrangements (APAs) and trading venues.

“The final text will still need to be signed off by the Council and Parliament, as well as subject to legal review and translation, before it can be published in the EU Official Journal, after which it will enter into law,” Hill noted. “ICMA would expect this process to be finalised before the end of 2023.”

The ICMA Quarterly Report is available here.

©Markets Media Europe 2023

©Markets Media Europe 2025