Shifting odd lot dynamics throw a spotlight on ICE’s Size-Adjusted Pricing

A dramatic jump in small trade volumes, driven by increased retail and electronic activity, has underscored the need for accurate pricing of non-institutional-sized trades. The expanded role of small trades means their pricing also carries greater consequence in terms of accurate risk transfer. The DESK spoke with Tim Monahan, senior director of product management at ICE, to discuss the importance of precise pricing to market confidence, compliance, and reducing tail risk that a given trade is mispriced.

The DESK: How do you calibrate size adjusted pricing?

Tim Monahan: We have two models. The first model that rolled out in 2015 was a trade-based model. For asset classes like corporate bonds and municipal bonds, with publicly disseminated trade data, we were fortunate to have an intraday reference in Continuous Evaluated Pricing (CEP), allowing us to measure the distance of every single trade versus our intraday, continuous, evaluated price. That comparison with a very relevant, high quality evaluated price was at first back-testing, to ensure that our CEP was in line with the point at which the next round-lot trade took place.

We also identified a consistent trading pattern that existed for smaller trade activity. That trading pattern was evident when we took the fixed income universe and organised it into cohorts, by asset quality like IG vs HY, tenor, as well as the size of transactions, and direction. We were then able to identify the pattern.

We expanded from munis and credit to virtually all of fixed income, including mortgages and structured products. We did that by leveraging what we learned from the first distribution model we built and extended it to assets that do not have publicly disseminated trades. We use three major components of those asset classes.

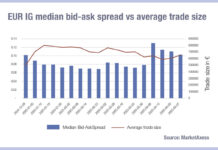

We look at the bid-offer spread of the instrument, the yield of the instrument, and the liquidity profile of the instrument. We have liquidity scores for every bond allowing us to apply our own data to identify the liquidity profile of the instrument. We obviously also generate the bid offer spread and the yield so depending on the width of the bid offer spread, the yield of the asset and the liquidity profile, we can estimate whether the price should be wider or tighter compared to the originally covered asset classes that we built the model on.

How do those different relationships change and do they change much over time?

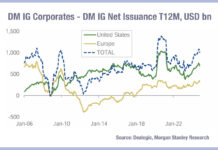

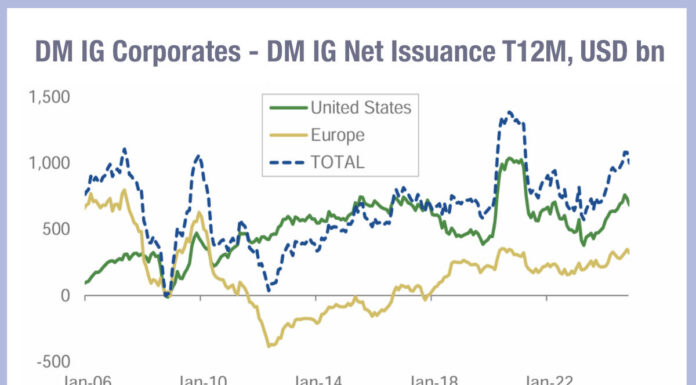

They don’t change dramatically day by day, but an evolution is happening in fixed income markets that’s crystal clear in the data we provide in our size adjusted pricing white paper. We’re seeing a similar trend across asset classes for smaller, odd lot and micro-lot size adjustments, which in general, are collapsing closer to the institutional price. There is still a clear space between the institutional price and the size adjusted price. We feel that collapse has to do with the evolution of fixed income trading, such as increased electronic trading, the explosion of exchange traded funds (ETFs) and better data. The net result is a consolidation of the size adjusted price. There is, however, still a separate and distinct micro lot, size adjusted price.

We count the number of trades across different trade size buckets, and we’re seeing a dramatic increase in the number of smaller trades, whereas the number of larger trades has remained consistent over several years’ worth of data.

So, access to liquidity is being spread across smaller trade sizes?

Yes, in combination of new technology, trading platforms and protocols this has all led to a shift in the ecosystem, and it’s a mature part of the sell side community. The institutional dealer community is now ready, willing, and prepared to execute on a wide range of assets on a smaller size.

Liquidity providers support smaller packages of risk and they’re not carrying risk in the traditional sense. Those playing in the exchange traded funds market are providing a much more varied range of liquidity provision than we have historically seen.

Why do people care about size adjusted pricing?

Firms who traditionally buy in an institutional size, and then allocate across their funds might end up with a micro lot position in some of their funds, because of that allocation, and if there is an event that takes place within those funds, they may not be able to cross that asset from one fund to another.

Applying an institutional price to a micro lot in that fund may work fine when you can undo the allocation and roll it up into a block trade. If you can’t put it back into a round lot trade, then you may have to size adjust your pricing to accommodate for the micro lot that exists in that fund. If you have a liquidity event in that fund, without the size, you have no way of defending the price being used for that micro lot.

Why are they not tackling this independently?

It is a very expensive, complicated, time-consuming endeavour to build a model that computes size adjusted pricing. Asset managers are not necessarily in the business of building models for adjusted pricing. Our business of building content and data sets to produce this type of intelligence means we have the data, resources, content, and expertise to build that model. Clients, on the other hand, specialize in managing risk and running certain strategies to best serve the investor so they may not be in a position to build these types of models. We hope clients take advantage of our model because it’s clear they have various regulatory and fiduciary responsibilities to deal with on this front.

Which types of asset managers or funds are more concerned about this?

Any firm that has multiple funds or strategies across multiple asset classes that find themselves holding odd lot and micro lot positions across various funds has to be very concerned about this. Our size adjusted pricing service started by serving the separately managed account (SMA) community, because virtually all of the execution flow is done at sub-institutional trade sizes, the vast majority is done at micro lot sizes.

How do your clients consume the service?

We have an on-demand web service API which allows the client to make a request to input the size, direction and percentile, in return the client gets a size adjusted price. Our service is designed not only to give the median – because we build a distribution, so the client can decide which size adjusted price to leverage which may vary based on the market or the liquidity profile of the bond. Based on our experience clients seem to be requesting the 50th, 25th and 10th percentile size adjusted price. This gives them a range which provides a flexible solution for a wide range of fixed income assets.

©Markets Media Europe 2025