When trading teams are fully stretched it is hard for them to support innovation and change, yet Dan Barnes finds that the two things are not mutually exclusive.

In 2022 bond markets have been shaken by war, disease and natural disaster. Risks that have proven hard for portfolio managers to model, including food and commodity crises, rampant inflation and political risk, have created scenarios which look terrible for debt investors.

“[The] 3rd Great Bond Bear Market [is] thus far a doozy,” warned Bank of America’s chief investment strategist, Michael Hartnett, in a note on 22 September. “2022 global government bond losses on course for worse [sic] since 1949 (Marshall Plan), 1931 (Credit-Anstalt), 1920 (Treaty of Versailles); bond crash threatens credit events and liquidation of world’s most crowded trades.”

For the buy side traders seeking to manage flows for their portfolio managers, and sell-side traders trying to make prices, executing deals in the market is incredibly challenging. It is hard to find accurate pre-trade pricing, it is hard to find liquidity either dealer-to-client (D2C) or on the interdealer markets and in some cases market makers are declining to offer prices on trades.

David Nicol, CEO of LedgerEdge, which provides a bond-trading ecosystem built on distributed ledger technology, says, “The current economic conditions and interest rate environment, matched with existing market structure, has meant that liquidity in corporate bonds is decreasing, not increasing. Investors are offloading stocks and bonds but there are big bond exchange traded fund (ETF) inflows.”

He adds, “What we’ve seen is that asset managers are buying ETFs until they can access the underlying market more efficiently and more effectively. Asset managers want to represent a certain risk bucket they have to do a lot of bond substitutions to find the right mix of assets. There is consensus on the risk transfer model in the corporate bond market not really working right now.”

“It’s a risk-off environment with raising rates,” says Scott Eaton, CEO of Nivaura. “I hope the flip side is that it introduces a bit more urgency on the efficiency benefits.”

Three big structural changes have worked against liquidity. Firstly, the universe of available bonds has expanded making it more complex to gather data on any single instrument. Secondly, the increased regulatory cost for banks to carry risk on their books has made them more reluctant to hold bonds to trade with clients. That has increased the cost of finding liquidity for the buy side. The third change has been the ‘juniorisation’ of some sales-trading functions which has seen senior traders removed thereby weakening longstanding relationships between clients and dealers.

The challenge for bond markets is to evolve the electronic offering, while coping with the daily impact of the macro environment, and a shifting market structure.

Rules-based change

As technologists seek to support more efficient ways of trading, so regulators make efforts to ensure markets are fair and effective.

For example, reviews in the US, European Union and the UK are underway to determine at what point software at a trading firm becomes a trading venue. Equally there are moves to regulate certain trading platforms which might otherwise be considered outside of the scope for rules that originally governed stock exchanges.

“We don’t see a great deal of tension between the power of technology in the market today and in the near future, and what regulators are seeking to accomplish,” says Nicol. “We’ve spent a great deal of time with regulators in multiple jurisdictions to help them understand our fundamentally more powerful way of trading using distributed ledger technology. That has been a journey of education for regulators and the market as a whole.”

If traders are the rock stars and technologists are their roadies, regulators are the health and safety team trying to make sure nobody gets hurt.

Eaton says, “Regulators don’t fit in at the top; That is where the market participants sit, trying to make prices. Regulators are the second line. These two things have to happen in order to then build the technology. Sometimes the regulator is a step behind what the market really wants and technologist have to then catch up by building a solution that bridges that gap.”

For traders, having confidence in their service providers is key, as this can make or break appetite in a given product or offering. Any risk of changing regulatory status or of being ruled non-compliant with a particular set of rules creates significant problems for a trading desk.

That said, at a high level there are certain aspirations shared by both regulators and technologists, such as increased transparency, which can create a virtuous circle when well supported.

Mark Taylor, head of fixed income product & business development at Liquidnet, says, “Where orders can be captured and processed electronically you also have increased aspirations for monitoring those, it’s no longer an impossible task. That’s driving change in the same direction.”

Eaton adds, “If we go back to 2018 and MiFID II go live, volumes were pushed on to electronic platforms. It just changed behaviour almost overnight. So it can help technology to leapfrog.”

Pressure to change

With an agreed set of broad goals, the real challenge is to find the resources and motivation to focus on longer term goals when shorter term targets can soak up so much energy.

“Sell side firms still have the best data and access to the best talent in the market; they’re still effective at making markets and serving market needs,” says Nicol. “However, they do not have the backup of a large balance sheet. That’s a problem. Everyone’s looking for a solution to more efficiently and effectively find the right opportunities for relative value, for generating alpha, and to get the right exposure to the right risk. That’s where the consensus is.”

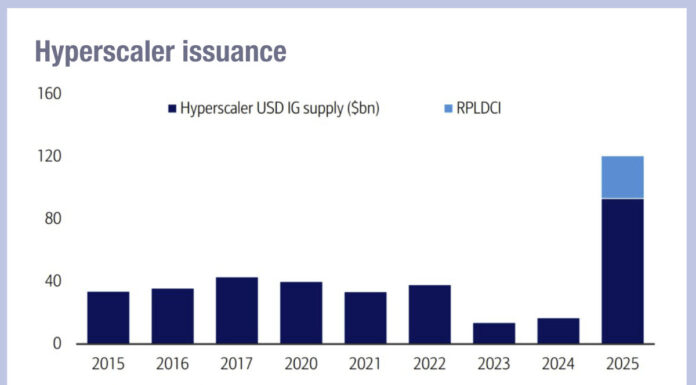

Part of this will depend upon the advantages that can be proven through greater efficiencies. Despite a drop-off in bond issuance in 2022 compared with 2021, firms are positive that the appetite for primary market automation will continue.

“Pressure may be eased for a month or two if issuance drops but long term, if you’re planning resources on a desk and you see technology able to improve your process and free up traders, I don’t think a quiet summer will make you deprioritise the need for change,” says Jonathan Gray, head of Liquidnet primary markets, EMEA.

“As soon as market conditions improve, corporations and governments will come to market to refinance so I don’t think the process will slow down too much. If anything, if issuance picks up quite heavily in September, it will refocus minds on the need for technology and advancement in this area.”

©Markets Media Europe 2025