Buy-side traders have long decried the lack of executable price in bond markets. For the best part of a decade the electrification of these markets has come with scepticism about the prices shown on screens.

Now the International Capital Markets Association (ICMA) has issued its ‘Industry guide to definitions and best practice for bond pricing distribution’ to tackle these longstanding concerns amongst traders.

Inconsistency in the firmness of prices provided by sell-side firms to buy-side firms has added to existing problems around price formation on buy-side trading desks. With no central tape of trades published after the fact in Europe, the only price that a trader can definitely rely on is one provided by a dealer, either directly or via an electronic platform.

Yet dealers do not always stand firmly behind the prices they show to the buy side. Part of this has been led by a lack of consistent terminology, allowing prices which were not firm to be offered via language suggesting they were.

In bond markets being ‘axed’ a term stemming from having an ‘axe to grind’ is normally used to a describe sell-side interest in buying or selling a bond. However, these directional indications of interest are a market convention which has never been standardised.

“Over time dealers have drifted towards flagging things as axed when they aren’t, because they are trying to show they have an interest in that bond but they can’t quite grade it the way they want to, i.e. they are working an order for a client or they were working an order for a client two days ago,” said Ricky Goddard, head of EMEA credit trading at Schroders, speaking in an accompanying ICMA podcast. “That type of information is very helpful to us.”

If prices are flagged as an indication of interest or being subject to a call, that sets more realistic expectations for the trader and they are less likely to be misled about where the pricing and liquidity are for a given bond.

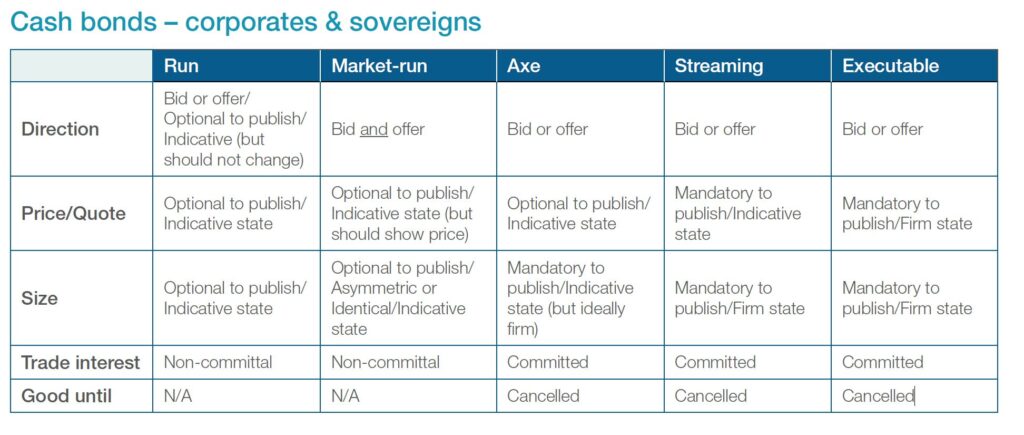

The ICMA guidelines have resolved this by providing clear definitions for the terms, ‘Run’, ‘Market-run’, ‘Axe’, ‘Streaming’ and ‘Executable’ which make it clear whether direction, size and price should be shown, and whether the price was firm or indicative.

“The Electronic Trading Council (ETC) subgroup meetings we had for this guide were extremely well attended; at one meeting we had 97 people. We had cross industry ICMA member support for this initiative. The buy-side firms were the primary drivers,” said Elizabeth Brooks Callaghan, director for Secondary Markets at ICMA. “They wanted less confusion and mixed messaging, and basically more certainty from their sell-sides.”

Other firms and market operators were also keen to see change and this gave impetus to the project’s success.

“Interestingly, the fact we had sign-off from all the major trading venues and axe bulletin boards, who all have to kick-off technology change projects in order to implement this guide to best practice, reflects the importance and value of this initiative,” she says. “When you have clear definitions, which can be flagged, your pricing is more accurate. These pricing interests mean something – which substantially improves electronic trading.”

The process was not easy, however it allowed market participants to challenge ideas which had become accepted but which were not based on any common understanding.

“We had some really good soul searching during this process,” says Callaghan. “Most notably around the term ‘two way axe’. One member said that term was pure nonsense. It took a while, but everyone came to agree with that member and the term, ‘Market-run’, which indicates a working market (indicatively), replaced ‘two-way axe.’”

Goddard notes that the risks of misunderstanding not only affected buy-side firms in their capacity to be sure of where a bond was trading and at what level, but also for the sell-side as if they take a trade that every other dealer has heard about, they will find it expensive to trade out fo a position.

“One of the big problems we have had in the credit markets for a long time, is how to keep axe information up to date and to keep it accurate so that at point of trade, [so the trader] knows with certainty who they can speak to, who has the axe, who potentially has an order or an IOI and to try and minimise the amount of information that slips out into the market,” he says. “The last thing [they] want to do is ask three dealers who wants to do the trade on a potential trade. If I can speak to one or two dealers to get a trade done at the right level clearly that is beneficial to me but also to that dealer.”

Although the ICMA does not have enforcement powers, the existence of these guidelines should create a standardised reference point for what a run or axe means.

“It is a guide to best practice,” says Callaghan. “We will be putting a reference to this guide to definitions and best practice for bond pricing distribution into our rules and recommendations. Firms can and often do reference ICMA’s secondary market rules and recommendations when trading with fellow ICMA members.”

©Markets Media Europe 2025