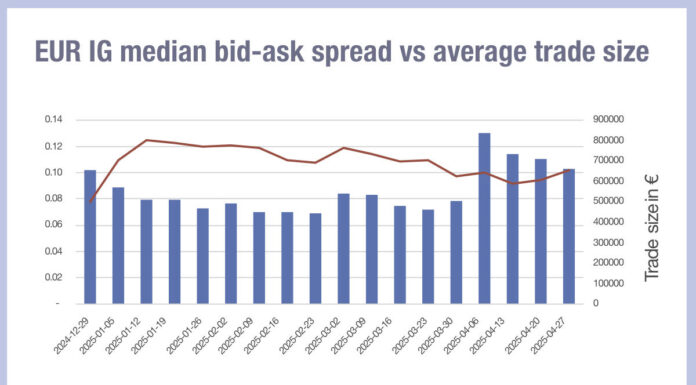

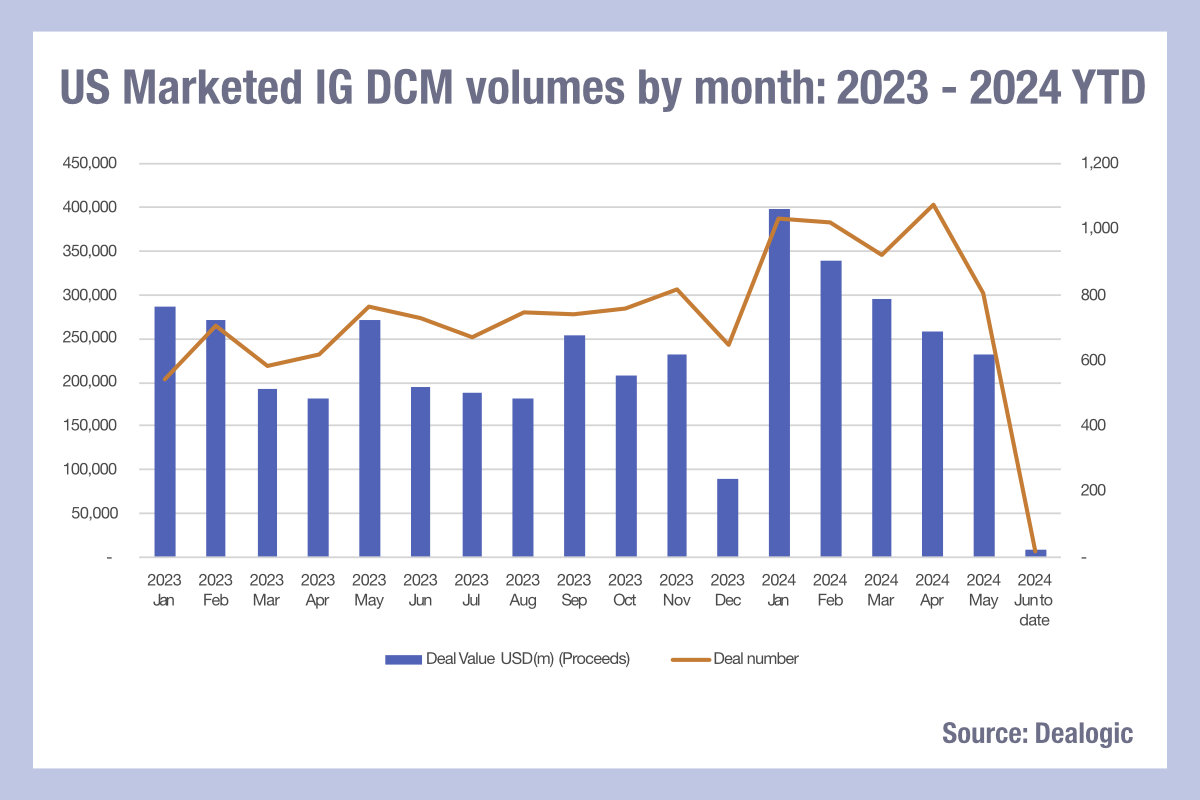

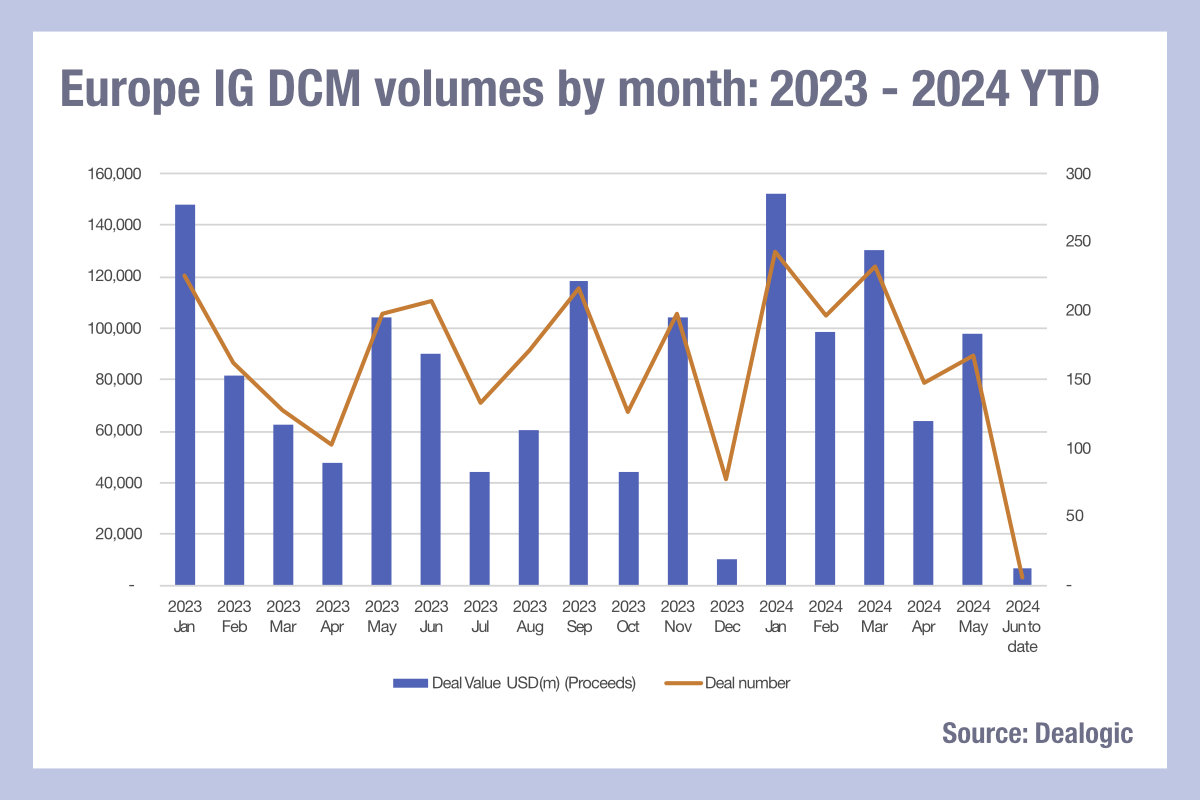

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with a decline into summer followed by a spike in September, according to Dealogic data.

Geographically, and split by bond quality, there are notable difference in pattern. For investment grade bonds, both Europe and the US markets track closely with the US having far higher deal numbers and deal value.

European IG markets are characterised by greater volatility of deal numbers and sizes, frequently doubling/halving from one month to the next. Given the deal calendar and ADVICE for IG debt is likely to track across global investors far more than for HY debt, it is perhaps not surprising to see the same overall pattern both US and European bond markets.

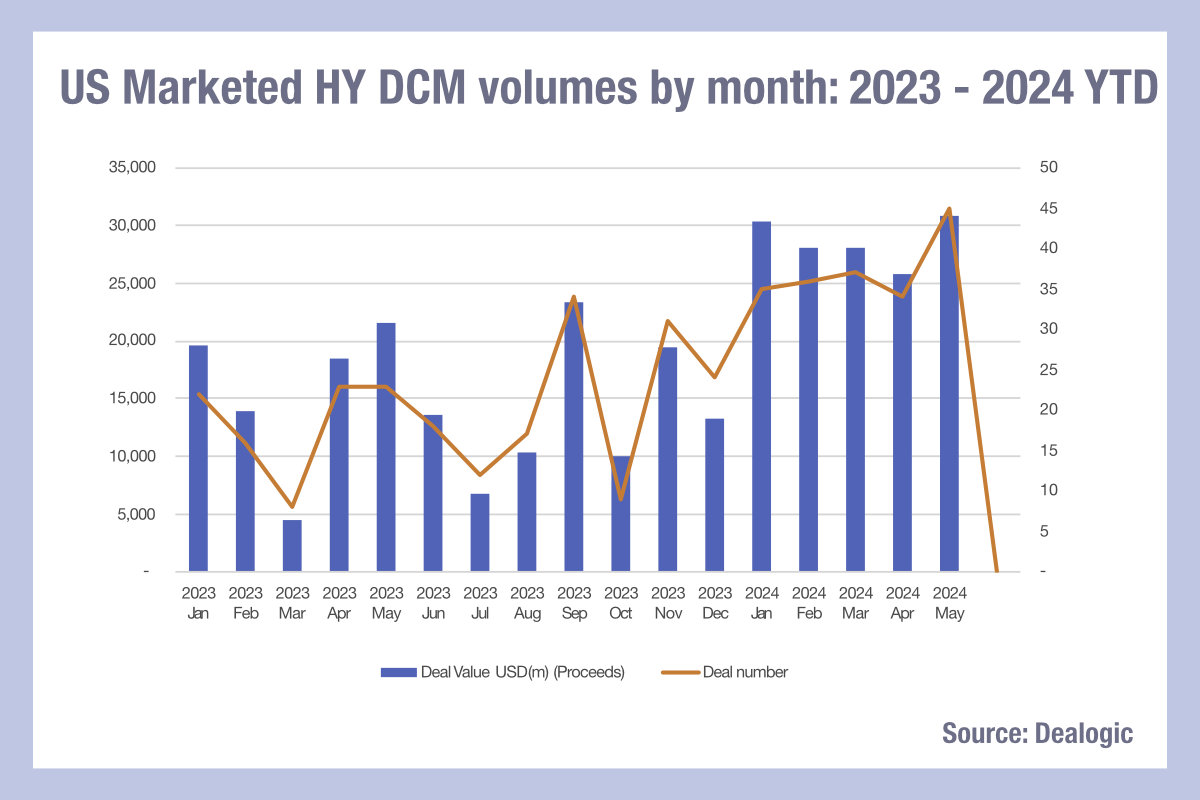

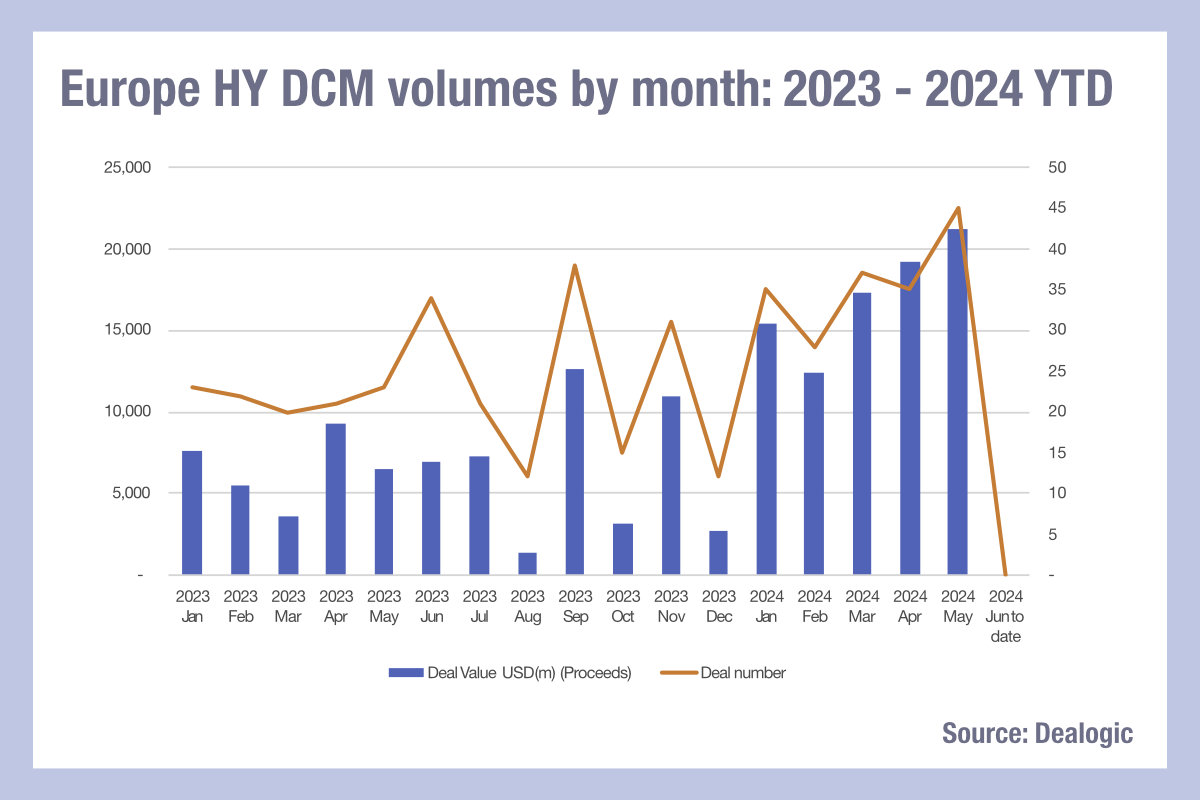

Looking across at HY issuance, a different picture emerges. High yield issuers were far less active in 2023, and have gradually increased issuance since January of that year.

In European markets, this ramp-like increase has been most evident; the average monthly issuance in 2023 was less than €6.5 billion and in 2024 it has been over €17 billion, nearly three times higher, and growing rapidly from February into May.

North America has seen HY issuance double from US$14.5 billion to US$28.5 billion, still reflecting considerable growth over 2023. If this is all refinancing, as some sources suggest, it creates a question around issuer confidence in lower rates in both US and European markets.

With higher refinancing costs, firms with weaker credit ratings will also struggle to invest in their businesses for further growth, creating economic pressure on their businesses.

©Markets Media Europe 2024

©Markets Media Europe 2025