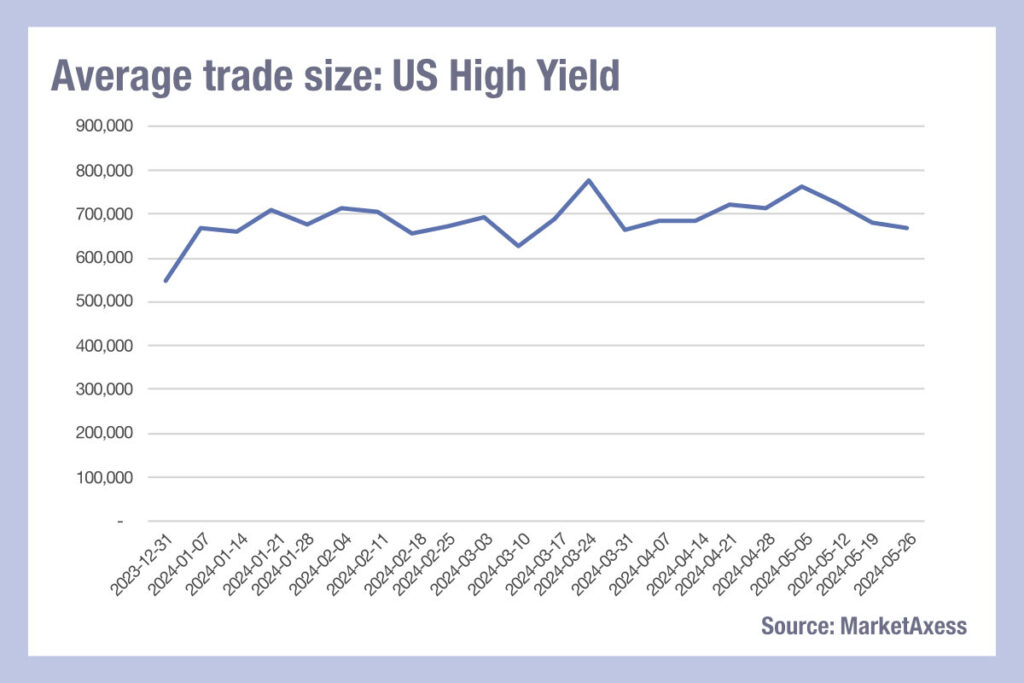

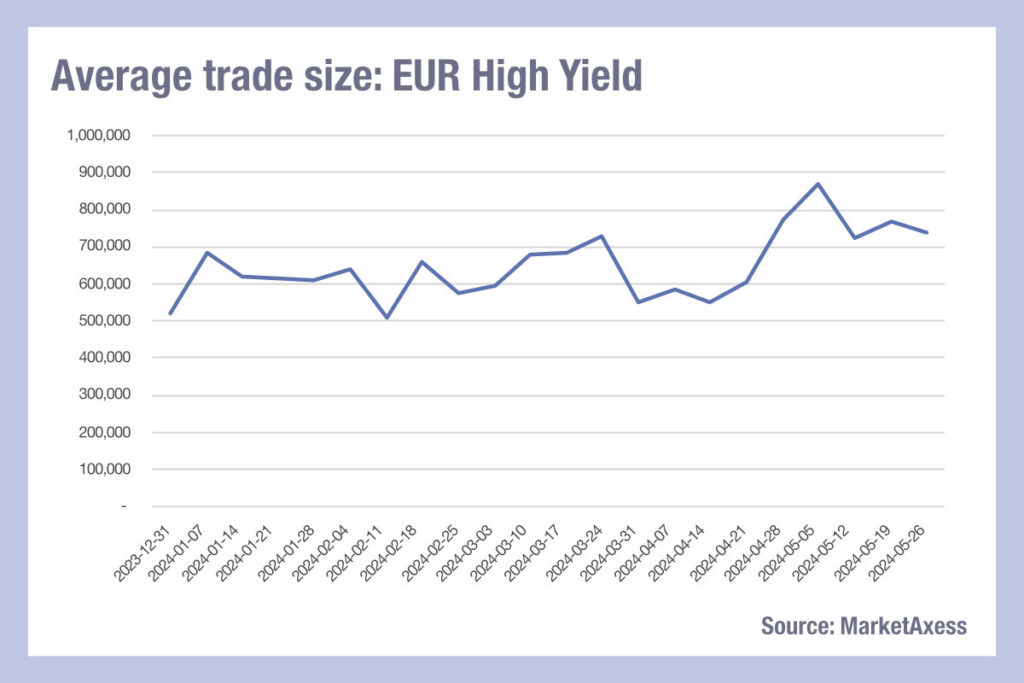

High yield trade sizes are continuing to rise in 2024, and its bonds continue to show signs of increasingly manual trading. As bond markets are following a general trend of increased electronification, and trade sizes are correspondingly decreasing, the trend towards larger sized trades in HY markets this year appears to suggest they did not get the memo about market evolution.

Looking at data from MarketAxess TraX, which follows activity across multiple markets, in the US markets we see HY trade sizes have reached an average of US$760k to US$770k in some weeks, from just below US$550k in the first week of the year, with a low January and February tracking up to a higher April and May.

In European HY trading, average trade sizes have also grown, with April and May exceeding Jan and February, in contrast to investment grade, where April and May were lower than January and February.

In European HY trading, average trade sizes have also grown, with April and May exceeding Jan and February, in contrast to investment grade, where April and May were lower than January and February.

Several possibilities exist for this difference. The first is that dealers are becoming more able to deploy balance sheet to support risk trading in these assets. That would account for the continued drop in bid-ask spreads that have been witnessed in HY as well as other fixed income asset classes over the past year.

Several possibilities exist for this difference. The first is that dealers are becoming more able to deploy balance sheet to support risk trading in these assets. That would account for the continued drop in bid-ask spreads that have been witnessed in HY as well as other fixed income asset classes over the past year.

Another is the decline of auto-trading in favour of portfolio trading. Anecdotally, we have heard that many buy-side firms are reducing the extent to which they use automated execution, while increasing the size and volume of portfolio trading. This is reflecting the ability of platforms to support an intermediated PT capacity which gives dealers flexibility around execution and therefore more comfort in stepping forward.

Maturity in trading high yield may depend on that flexibility, which allows for larger-sized trades, with more line items, to be priced collectively by dealers. That balancing of liquid and illiquid bonds in a single trade reduces the bar-belling of risk exposure and improves the tradability of a portfolio’s contents. A final point is that the structure of the market has an effect; shorter-dated high yield paper has been issued recently, and traders note that this can often trade in larger size.

At the same time, credit funds are proliferating in a higher rate environment, the high level of issuance over the past year has led to a lot of smaller rebalancing trades, while HY reflects refinancing, according to sources, which is typically shorter dated and larger in size, creating a bifurcation between the IG and high yield markets.

©Markets Media Europe 2024

©Markets Media Europe 2025